As on April 8th, the Nifty bank index has dropped by over 38%, while the benchmark indices have fallen by 25%, YTD. The same is replicated across the global markets as US Dow Jones bank index fell by 37%, compared to the S&P 500 fall of around 14% over the same period. The MSCI world banking index has also fallen much more than the MSCI World Index, which shows that the banking sector has been impacted more than other sectors by the lockdowns around the world. Banks are a mirror on the state of the economy and the huge economic impact expected will definitely affect the Banking stocks. Such has been the damage in India that bluechips and strong balance sheet giants like HDFC Bank and Kotak Mahindra bank had fallen even as much as 40% and 35%, respectively, YTD.

The uncertainty in Investor’s mind, on the banking sector, can be broken down into 2 phases.The first is with respect to the liquidity issues, post the IL&FS and DHFL crises, which slowed down credit growth and also the uncertainty surrounding the Yes Bank saga. The 2nd phase and the more valid fear, is the one surrounding the impact of the current Covid-19 lockdown in India.

The uncertainty, post the Yes Bank issue, had much more to do with doubts and speculation that the banks would be allowed to go bust. But the RBI has, more or less, allayed fears regarding this, with a planned rescue package for the bank. Some banks faced deposit outflows because of this issue, and also due to perceived governance issues, and as a result their stock prices were impacted. But during this time, larger banks with strong balance sheets and deposit franchise were largely not impacted by this. Exposure to the telecom companies, affected by the AGR ruling, also impacted the prices.

But a much more widespread and longer effect on the banking industry is the impact of the virus lockdown on banks. The lockdown has increased fears of bad loans, rising NPAs and dismal outlook for credit growth for banks. Banks will suffer because of their lending exposure to the various sectors and to Individuals in the associated sectors through personal loans. The lockdown has shut down tourism and non-essential trade, closed offices, hotels, restaurants, and malls which means that commercial real estate has also been impacted. The high risk areas are Auto, Microfinance, Agriculutre, MSMEs and Real Estate along with unsecured personal loans, credit cards, and vehicle financing. Banks are expecting a decline in collections and at the same time an increased demand for working capital from borrowers. The rating agencies have assigned a negative outlook for the entire banking sector due to the disruptions arising from the outbreak.

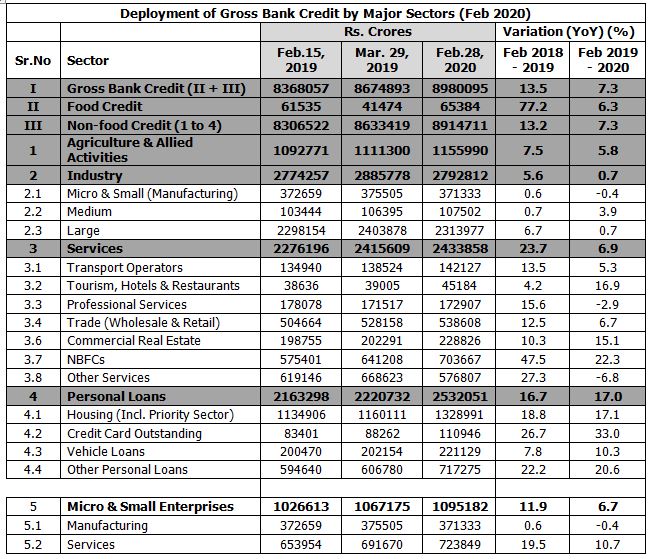

Let us look at the Sectoral Credit deployment data of 39 scheduled commercial banks, as published by the RBI on a monthly basis. This accounts for 90% of total non-food credit.

* Some line items have been removed considering their importance to this discussion

As on Feb 2020, total Non food credit grew by just 7.3% to Rs.89 trillion, YoY, as compared to 13.2% growth, a year ago. This reduced growth was mainly because of lower growth in Industrial credit and also to the Services sector. Banks were already reeling under slowed down credit growth. But even for the credit given, banks have lent more to sectors that seem to be the most vulnerable to the lockdown imposed by India, when compared to a year ago. Loans to tourism increased by 16.9% and to commercial real estate increased by 15.1%, YoY, at a time when total credit growth for the year actually fell below last year’s rate. Although these sectors form a small percentage of total credit, (in absolute terms commercial real estate lending is only 2.6% of the total credit and tourism forms only 0.5% of the total credit), Banks will be worried about their increased exposure to these highly impacted sectors and its asset quality.

Although the pace of credit growth to NBFCs have slowed down, as a percentage of total credit, NBFC exposure of bank loans have increase to 7.9%, from 6.9%, a year ago. Some of the NBFCs were already struggling with liquidity issues and this lockdown will only make it worse for them. After large corporate lending and housing loans, NBFC sector accounts for the largest percentage of bank borrowings.

With offices closed down and the above mentioned sectors amongst the biggest job creators, this will have a cascading effect on personal incomes and the individual’s ability on repaying personal loans. Personal loans accounted for 28% of total credit. RBIs moratorium on loans has given temporary relief but it needs to be seen how fast the recovery happens and the repayment capacity. Micro and Small Enterprises loans (including credit to manufacturing and services sector) accounted for 12% of the total non-food credit, and this sector is listed as one of the most vulnerable in this lockdown period.

The outbreak and the subsequent lockdown will definitely have an economic impact on companies, individuals and will no doubt hit all sectors of the economy. The slowdown in economic activity will no doubt impact the debt servicing ability of many borrowers. The moratorium on loans, announced by the RBI, will enable banks to postpone NPA recognition. But eventually, NPAs are expected to spike in the next couple of quarters.

Government might also need to make some capital infusion into PSBs. After pumping in around Rs.3.5 trillion in the last 5 years, to shore up the balance sheets of some banks, this year the banks were expected to tap the capital markets for funds. In the current situation, this looks challenging and the government might have to step in, in spite of the weak fiscal position.

To compensate for slow credit growth, banks should also refrain from evergreening, which is the process by which a delinquent loan is updated as current by re-issuing a new loan. They should also be vigilant against zombie companies, which are unable to cover debt servicing costs and which might look to utilize cheap credit. The management commentaries over the last few weeks has taken cognizance of the situation and have been heartening in the sense that they understand the seriousness of the current scenario and have practical time periods and action plan for the expected recovery when it happens. The distress on the bank portfolios will become more evident in a few months after the moratorium period is over and the repayment capacity of borrowers is tested. Banks have varying exposure to the sectors and some banks were already reeling under a bad loans surge before the Covid-19 impact. Once the dust settles, the better managed banks, with low NPAs and good margins will once again be in the investor’s radar.

Published in Financial Express.