The year till date, market has been volatile with a negative bias due to two events. Firstly, the union budget was below the market’s expectation and then the economic impact of coronavirus on world GDP growth. The negative effect of the budget was well expressed on the budget day itself. Since the effect was short-term the market started to recover but went down due to the sudden increase in the number of coronavirus cases. Both events seem to be temporary in nature and the undercurrent of the economy and market continues to be healthy in the long-term.

The Budget being below expectations does not impact the long-term trend

The market started to build-up a positive expectation from the budget since the time government started adopting a candid approach to the slowing economy and industries post its re-election. A slew of economic incentives and industrial stimulus were announced from August-2019 onwards. Market hoped that the government will utilize the budget to offer more relief to households and help specific industries to stimulate the economy. For households, goodies were expected to increase their personal income thorough cut in tax and increase in Income Tax exemptions. At the same time, market also expected that benefit will be given to equity market through relaxation in long-term capital gain tax and STT. Sops were also expected for industries which were under stress like Auto, Real Estate, Infra and Housing. Market also expected the government to increase its role in the economic growth by spending more in FY21.

But, the FM adopted a conservative approach hoping that economy will grow by a nominal rate of 10% (below average 12% for the last 10 years), supported by the fiscal and monetary measures announced in the last six months. The fiscal deficit of FY20 was increased to 3.8% only due to lack of options, given fall in the tax revenue. While for FY21 fiscal deficit target of 3.5% was below the need of the economy, also showing that the financial bandwidth of government is limited.

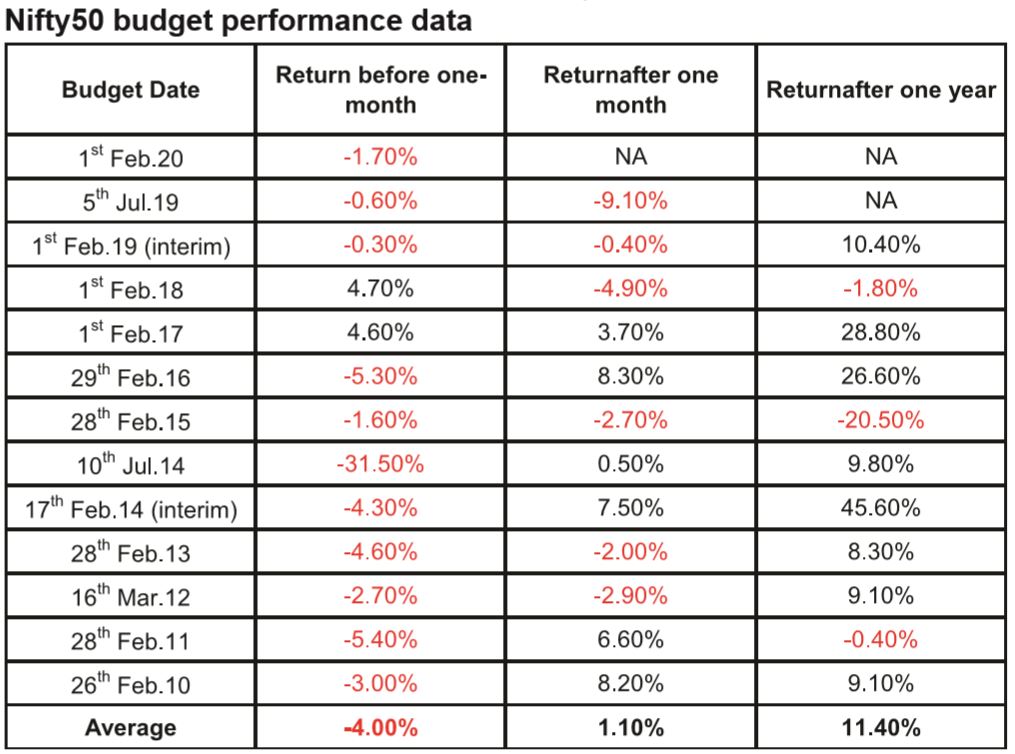

Though the budget may be below the expectation it is not going to affect the long-term trend of the market.Considering Nifty 50 as the barometer, the one-year forward return post the budget is usually positive with an average of 11.4% gain. The long-term performance of the equity market depends on the corporate earnings growth, domestic economic and industry policies, global structure and financial liquidity. Budget has not materially changed the undercurrent of the market other than the short-term volatility during pre and post-performance. Today wealth creation is intact, the main factors required to develop the economy and market are already present in the system, which is supported by the corrective and supportive actions undertaken by the government and RBI.

The positives from the budget: the government wants to reduce its role in business and focus on governance. Huge divestment plan of Rs2.1 lakh crore compared to only Rs0.20 lakh crore in FY20, shows the strong intention of the government. The government expects real GDP to grow in the range of 6% to 6.5% compared to 5% estimated in FY20. Custom duty has been increased in various products and sectors, which is positive for manufacturing and Make in India. Strong measures were announced for infrastructure, rural market (doubling farmer’s income) and aquaculture (Fisheries). Huge plan of Rs103 lakh crore infrastructure spending and doubling of farmers’ income have been announced without adequate fiscal support as required. Borrowing plans have been moderated, which is positive for bond market; interest yield can decline in the medium to long-term.

Coronavirus: a short-term blip to world economic growth

Covid-19 will have a bigger affect than the SARS of 2003, to world GDP. SARS impacted China GDP by only 1% but did not affect the world growth. After that, the share of Chinese economy has increased 4 times from 4.2% to 16.3% of world GDP. Primary consensus is that the world GDP could cut by 0.3% to 0.5% from 3.3% growth projected by IMF in CY20.

For India, China has become the largest trading partner accounting for 15% of the total trade (export + import): $ 87 billion in FY19. Majority of which goes towards import of manufactured products. Some sectors depend on the import of semi and final components or raw-material from China. Non-availability of these will have a negative impact on auto and auto ancillary, pharma, consumer durables and few chemical segments. Cost of production for such industry may increase in the short-term impacting their profitability. Loss of exports to China is limited to agriculture, auto, aquaculture and engineering sectors.

On a positive note, the number of new covid-19 cases in China is reducing and hospital discharges are increasing. Experts think that this epidemic will reduce as temperatures rise in China in the coming months. The economic effect will be limited to Q1CY20. The long-term benefit for emerging economies is that the world wants to diversify their high trading exposure with China. India has been developing as a strong export hub in segments like manufacturing, chemicals, IT and engineering. India will be able to capitalize on the “Make in India” strategy in the long-term.

An imminent benefit to India is the drop in crude prices from $70 to $57 in mid-February due to slowdown in global demand. This will lead to huge saving to the exchequer given our high oil deficit. Number of enquiries for new orders with India has started to increase for segments like textile and chemicals. Indian chemical players are likely to benefit from the robust world supply chain. In textiles, where China accounts for 40% of total world exports, opportunities are emerging. Domestic metals and mining will benefit when supply from China reduces, increasing volume and prices for the domestic industry.

Positive measures from RBI

Due to high inflation, RBI has initiated other measures to provide liquidity and boost the slowing economy. RBI has announced supportive and encouraging measures for stressed sectors by cut in Cash Reserve Ratio (CRR). Commercial banks will not have to provide CRR to RBI for six months between January to July 2020 for sectors like retail, automobiles, housing and MSMEs. Additionally, huge open market operations of Rs 1 lakh crore has been announced which will reduce yield in the open market. Also, banks will not have to consider on-going real estate projects as NPAs for a period of one year.

RBI states that currently the consumer inflation in India is high due to short-term factors. It also states that inflation in India has peaked and expects significant reduction in CPI in the coming months. RBI recognizes that there is space for more policy actions in the future and maintained its accommodative stance and will cut interest rate in future as and when necessary.

We feel that the double whammy effect is not going to impact corporate earnings growth in India over the medium to long-term. We are assuming 15% CAGR in FY20-FY22. Our one year forward for Nifty 50 benchmark is 12700, which is not disturbed.