On the start of 2019, we visualized a volatile market especially in the first half of 2019. We also anticipated stability by the end of the year and better performance in H2 as the concerns are eliminated during the year. The main reason for the muted expectation on H1 was due to slowing domestic economy. Accordingly, the earnings outlook was muted at least for the next two quarters. The valuation of World/India was above the averages, providing limited room for equities to grow. Fall in liquidity of PSUBs & NBFCs, had the risk of having a cascading effect on the economy. National Election was expected to add volatility in the short-term with risk of populist measures. And the pace of interest rate hike in the US was lingering and uncertainty over US-China & Brexit trade was expected to have a double effect on the slowing world economy.

At the same time, we expected a better investment period in the second half of 2019 as, disruptive effects of reforms like Demonitisation, GST & IBC were expected to settle during 2019. While world & domestic economies were expected to stabilize by the latter half of the year. India was expected to handle the fiscal positive better this time supported by stable oil prices & government efforts. Food inflation was brought under control by government reforms & measures undertaken in the rural economy. Monetary policy was very supportive. And the volatility from national election was expected to be over by the mid of 2019. The global financial market was hopeful of a truce between US & China. And pace of interest rate hike in the US market was likely to slowdown in H2 2019, helping emerging markets like India as funds increases from FIIs.

However, the reality was a bit different, India GDP growth collapsed to sub 5% in the latter part of the year led by disruptive effect of reforms, drop in liquidity led by NPA problem, and slowdown in world economy. In hindsight H1 performance was better than H2 but completely polarized where only a handful of stocks and sector did well. H2 turned weak due to the adverse effect of union budget which was much below the market expectation with dire effect on equities by higher taxation. But liquidity was solid from FIIs which maintained the overall buoyancy of the market especially on super large caps in the first 8 months of the year in expectation of better economics & reforms. In overall, CY19 was better than CY18 as anticipated.

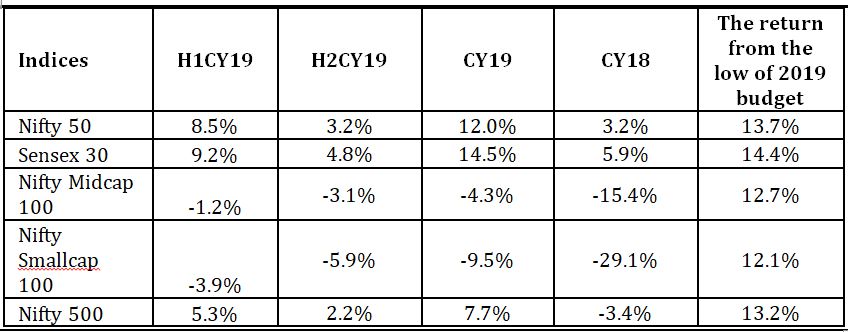

Post budget, the market hit a low, the government understood the issue and came out with corrective and supportive measures which turned the sentiment. And after the low, the market has given very solid return (tabled below). We expect this momentum to continue in the next 2-3 years since the measures (to be elaborated next week) will have a multiplier effect on the economy & financial market for long-term gains. The sectors on which we are very positive are Pvt Banking, Rural Small Banks, Chemicals, Metals, AMCs and Insurance. We are also positive on value stocks, mid and small caps compared to premium valued super large caps.

Performance of CY2019

Source: Bloomberg