We were anticipating a rally in the short-term since the downturn in the market was overdone. Nifty rallied from a low of 10,000 as on 26th Oct to 10,656 on 20th Nov, up by 6.5% within a span of one month. Despite volatility in global markets, sharp fall in oil prices has supported the domestic market. In the last two to three days, market has been very choppy despite sharp decline in oil prices. It has been trading in a narrow range on account of issues like domestic liquidity concerns, upcoming general election and weak global cues. Globally also markets have been very volatile due to receding optimism on US – China trade deal and next FED policy meet in December which is likely to see hike in rate. Such cautiousness may remain in the very near-term with positive bias in the short-term.

We were anticipating a rally in the short-term since the downturn in the market was overdone. Nifty rallied from a low of 10,000 as on 26th Oct to 10,656 on 20th Nov, up by 6.5% within a span of one month. Despite volatility in global markets, sharp fall in oil prices has supported the domestic market. In the last two to three days, market has been very choppy despite sharp decline in oil prices. It has been trading in a narrow range on account of issues like domestic liquidity concerns, upcoming general election and weak global cues. Globally also markets have been very volatile due to receding optimism on US – China trade deal and next FED policy meet in December which is likely to see hike in rate. Such cautiousness may remain in the very near-term with positive bias in the short-term.

Rising yield – The yields in global markets are surging and currency is becoming extremely volatile. Today, we are quite unsure of the possible rate hikes going forward, and the magnitude of its impact on the financial market, especially on NBFCs in the domestic market. As a result, FIIs have turned cautious on emerging markets and the question is how it will impact the domestic market inflows and fiscal math in future.

The Elections – History teaches us that general elections have never impacted the intrinsic value of the country in the long term, but definitely brings volatility in the short to medium term depending on the stability of governance, macro and micro situations. This time we have a set of important state elections before the national election, which is having a dragging effect on the market due to the negative indicators in the opinion polls.

Oil prices – Oil prices after hitting a high of $86/barrel in early October declined to ~ $66/barrel as production from major producers like Saudi Arabia, Russia and US is increasing. Additionally, concerns over trade war between US and China, and slower growth in global economy is also dragging prices. Till the oil prices stabilise, it’s going to have an impact on related sectors and fiscal target.

Broad market is likely to maintain a positive bias with stock specific movement

Stock specific buying is continuing on the basis of quarter results and decline in oil prices. Softening of Consumer Price Index (CPI) inflation to 3.31%, stable Index of Industrial Production (IIP) and gains in INR added to the positives. Decline in oil prices is likely to invoke positive sentiments for domestic market in the near term. The market has already factored a gradual downgrade in earnings in the second half of FY19. The market started this quarter with an earnings expectation of about 15% YoY growth in PAT for Nifty50 index stocks. Broadly the numbers have been a tad below expectations which was at 11.3% YoY, while the quality and sustainability has reduced, leading to downgrade in earnings growth in the broad market.

Given the thin structure of the market with lack of liquidity and skewed movement, forecasting the broad market with the real world has become incomplete and empty. Currently, we have a one year forward base-target of 10,250 for Nifty50, which is reduced from 10,400 in Q1FY19. This is based on 12.5% earnings growth in FY19 and 15% earnings growth in FY20, which is lower than the market forecast of 15% and 22% respectively. In the last 2 quarters, market has reduced the earnings growth forecast for FY19 from 20% to 15%, while we have reduced it from 15% to 12.5%. Our reduction is based on H1FY19 numbers which is likely to be in a range of 5% to 10% as per the actual result of Q1FY19 and on-going Q2FY19. We are valuing the market on a one year forward P/E of 17.5x while the market is trading today at 16.4x.

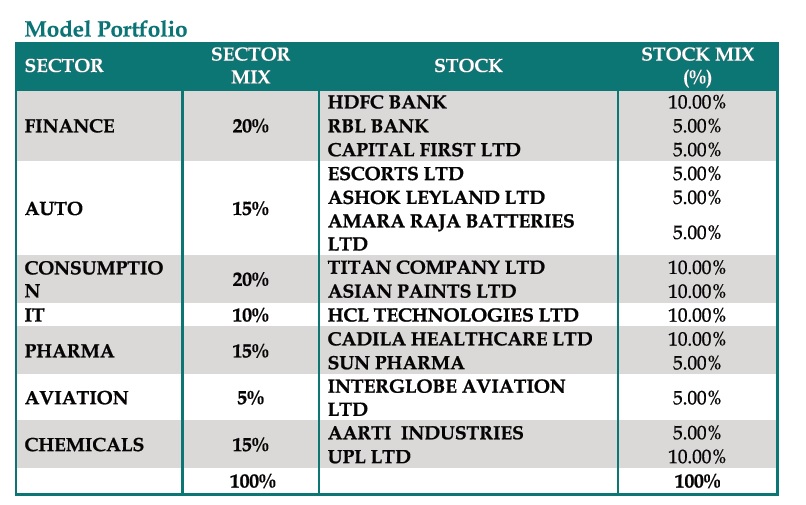

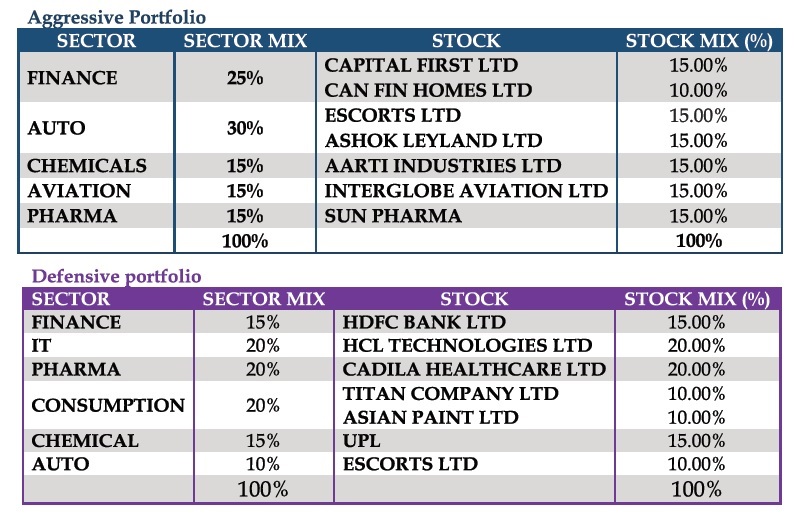

Today’s portfolio given the equity market situation

The short-term is looking positive whereas in the medium-term, the intrinsic value of equity as an investment asset is under evolution. Globally, we are seeing changes in the value of different assets like currencies, debt, equity, commodities and others. This adjustment may take some more time. Given the conservative view on the market, the exposure to equity for an average risk-averse investor may be in a range of 40% to 60% (including direct and MF investments). Whereas, the rest can be largely spread on the short-term debt and gold as per their objective and risk taking ability. Even though equity is likely to be volatile in the next one to three quarters, it will generate wealth in the long-term thus creating opportunity to own brands at attractive valuations.

Certainty and stability in business will be the key for the market, hence sectors which can outperform better are FMCG and consumption oriented, IT and possibly pharma too, assuming that the worst is over in terms of pricing issues in the US market. At the same time, we also feel that export oriented stocks and sectors like chemicals and auto ancillaries also will do well. The sectors which are likely to be under pressure are ones with lack of financial stability such as financials, NBFCs and infrastructure given the current situation. Again, churning will be the key as the development progresses; sticking to quality will be the key in the game.

Though ups and downs are part of the investment process, in which timing is a secondary factor, while ability to understand the change in risk and churn as per the need of the market maybe more important. To build a portfolio with key brands, sectors and leadership with well-diversified mix of large and mid-caps and patience to stick with the objective is the key. Equally, understanding the mistakes and reducing or booking losses and gains, improve portfolio’s objective.