World economic view is getting better. GDP growth in 2021 is expected to rebound strongly; India’s GDP growth is expected to reach near 10%. The market has reverted above the pre-Covid level due to strong financial support provided across the world and cheap valuation. 2021 will be supported by the combination effect of more stimulus and real growth in economy. This is likely to provide solid earnings growth. As a result of this combo benefit (Liquidity + Earnings growth) the valuations are likely to stay at very high premium level. So historical rationales and valuation levels may not provide a reasonable view of the market’s optimism and momentum next year. Of course, today the level of greed in the market is high, which can trigger consolidation in the near-term. If so, this correction should be used as an opportunity to add more exposure in equity market. Economy and Corporate income will grow on a QoQ basis for the next 4 to 6 quarters. This will be supported by further opening of the economy, lag effect of stimulus announced till date, more stimulus, bigger than previous ones and positive impact of the successful vaccines.

What we had expected for CY2020…

Pre-Covid19

We expected 2020 to be much better than the polarized market of 2018 and 2019. Equities was tilted and the broad market was weak because the economy was slowing down continuously taking Indian GDP growth to sub 4.2% in 2019, the lowest since 2000. 2020 was expected to be good because post the strong mandate of the government in 2019 national election, ideology started to change. The new government realized the setbacks of the last policies, and planned to have structural changes in the economy. Immediately, the government announced progressive measures by correcting its earlier measures by replacing with supportive ones. They removed the FPI surcharge, PSUBs were recapped and consolidated, liquidity to Housing and NBFCs sector was provided, tax cuts were given for start-ups and corporates and planned to double Infrastructure expenditure in the next five years. The market had started to do well; it was up by 15% from the low of H2CY19, and was expected to progress in 2020 led by more reforms. But the unprecedented Covid19 ruined the recovery happening in the world and domestic economy.

And Post-Covid19

Initially, January to March 2020, the markets believed that Covid will not pan-out into a pandemic. This view was based on historical facts from similar diseases, like the recent SAR2003, and the data coming out from China stating that it is not very serious when it was first noticed in November 2019. The view drastically worsened as it spread to the western world and the real danger of the disease and its rate of contagion became clear. Quickly, the world equity market corrected by 1/3rd in a span of a month, February to March. Indian main indices collapsed by 40% while Mid and Small caps crashed by 50% and 60%, respectively. The main reason for the market to collapse so low and quick was because economies across the world went into an unprecedented lockdown. This was to address the spread of disease. The biggest uncertainty was that when will it reopen again.

Well, in a span of a month, the leading central banks of the world came up with huge monetary packages flooding the world’s financial markets with high amount of liquidity ensuring that the banking system perform smoothly. At the same time, governments announced fiscal stimulus to the common man and economy to overcome the economic crises. For example, in India high amount of supportive schemes for the poor sections and financial guarantees (most important Rs 3 lakh cr for MSMEs) were provided.

The highest fiscal and monetary measures announced in the world…

Fiscal stimulus announced by top 10 countries

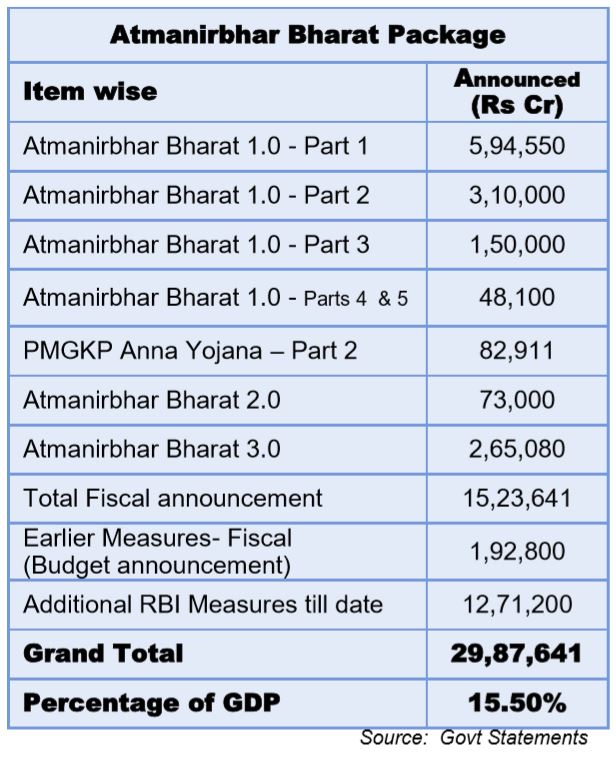

The details of total fiscal and monetary stimulus announced in India.

Outlook for 2021…

These measures undertaken to facilitate recovery from the pandemic will roll higher in 2021, which will support the economy and market. There is enough amount of liquidity in the economy and market to sustain more growth in the future. More supportive measures will be announced in 2021.

Main reasons for optimism of the market are.

· Pandemic will be brought under control in 2021, by vaccination.

· While fiscal and monetary support will continue in 2021 as economy and jobs situation is no way near the pre-Covid level.

· The US election win for Democrats will turn the world trade policy.

· High amount of funds was put on-hold, during the US election, now given the positive outcome, huge amount of funds including new money is being released.

· This new money can ignite new growth in the economy.

· The risk of bankruptcy caused by the pandemic has largely vanished.

· The world is now stable to work-on ‘new normal’.

India is likely to outperform others because…

World’s hostile view against China is growing, which will be strategic benefit for India.

India has found new brand value in the international market for sectors like IT, Pharma and Chemicals.

PLI (production linked incentive) scheme could be very positive for India and develop as a key manufacturer for the world, in the long-term.

India had started to reform the domestic economy with structural policies after the appointment of the new government. This will have a positive lag effect in the coming 1-2 years in addition to the stimulus announced till date.

The availability of vaccine for India is likely to be faster than rest of the world, due to high technical and capacity level, providing an advantage.

By next Dec 2021, 14,500 could be a target for Nifty50…

The market expects the earnings growth of Nifty50 index earnings to be high at plus 30% from FY21 to FY22, supported by QoQ improvement in economy. The earning growth for FY21 is likely to be flat, in-spite of pandemic issue, after the good improvement from Q2 onwards. The EPS of Nifty50 is forecasted at Rs480, Rs630 and Rs750 in FY21, FY22 and FY23, respectively, which is CAGR of 25% for the next 2years from March 2020. As a result, the valuation of the market will be at the upper-end of its history, supported by twin effect (liquidity + earnings). Currently, the market is trading at high one year forward P/E of 21.5x, as per Bloomberg. We assume premium valuation to stay in 2021 and value Nifty50 at 20x on December EPS on 2022, to arrive at a target of 14,500 on December 2021.

The risk is…

· Development and deployment of vaccine may be delay.

· There is a risk that the market can overheat further given high amount of liquidity in the market today, which can impact the recovery in 2021.

· Fiscal position of government is weak due to fall in revenue. It can trigger structural risk, on a country wise basis, then the economies will not revert back to normality in 2021.