A high or rising unemployment rate is not a desirable phenomenon. Similarly, high inflation is not covetable. What if both are rising or both remain high? That would be a terrible outcome.

American economist Arthur Okun is credited to have proposed a Misery Index in the 1960s. The Misery Index is the arithmetical sum of the unemployment rate and the inflation rate. It measures the misery that a society suffers as a result of high unemployment and high inflation. During the America’s boom period in the 1960s, the Misery Index in the United States was around 7. During the second half of the 1970s it rose sharply to over 16. But, it is down to less than 7 now.

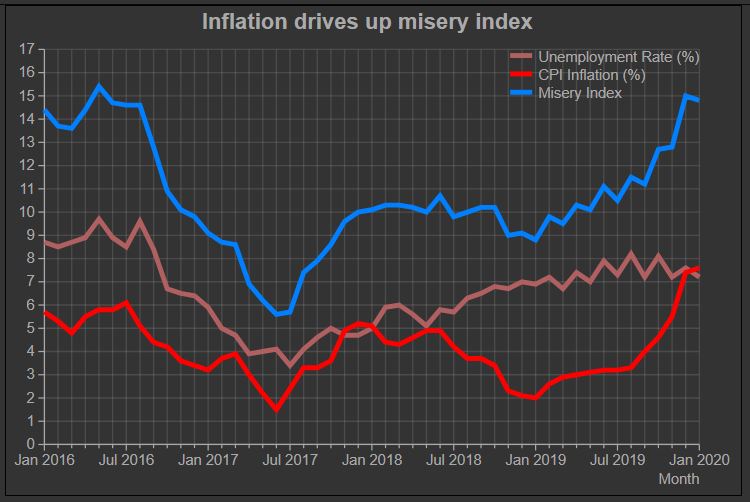

The Indian Misery Index computed similarly peaked at 15 in December 2019. In January 2020 it declined to 14.8. We compute the Indian Misery Index using the official inflation rate based on consumer prices and the unemployment rate produced using CMIE’s Consumer Pyramids Household Survey. Monthly estimates of both these indicators is available from January 2016.

Although it is called an index, the Misery Index is not an index in the usual sense of the term. Although both its constituents are expressed in per cent, it does not have any unit. It is just a number that reflects the level of the misery that a society suffers as a result of two evils – unemployment and inflation. In India, this misery is currently very high.

While the misery of unemployment seems to have plateaued after rising steadily for two years, the misery of inflation has been rising sharply in the past five months. As a result, the combination of the two, the Misery Index, has been on a steeply rising gradient over the past one year. It has risen from 8.8 in January 2019 to a peak of 15 in December 2019.

The unemployment rate in India seems to have stabilised between 7 and 7.5 per cent. While the unemployment rate has breached 8 per cent twice in the past six months, it has quickly retreated substantially from there. However, February 2020 seems to be headed towards breaching 8 per cent again. This occasional spike to 8 per cent notwithstanding, it is good to know that the unemployment rate has stopped its persistently rising trend that was seen between mid-2017 and early 2019. Nevertheless, the 7-7.5 per cent level is high.

What makes matters worse is that the inflation rate has risen sharply during the period when the unemployment rate began to plateau.

The inflation rate has risen from a recent low of 2 per cent in January 2019 to 7.6 per cent in January 2020. The increase has been particularly steep since August 2019 when the inflation rate was 3.3 per cent.

Inflation, therefore, has been a bigger contributor to the rise in the Misery Index in recent months than unemployment.

Economists have juggled with unemployment and inflation as policy options in the past. In policy choices, the two have often been seen as alternate choices. Implicitly (and simplistically speaking), you could choose one evil over the other. In 1958, William Phillips suggested an inverse relation between unemployment and nominal wages. This led to the creation of the Phillips curve that extends the inverse relationship as between unemployment and inflation.

Implicitly, high inflation and high unemployment cannot co-exist. But, they do. The US witnessed a combination of high inflation and high unemployment in the 1970s and we are witnessing it today. This brought into question the relationship between inflation and unemployment. But, it does not question the existence of the double-whammy – the existence of high inflation and high unemployment. The ’base-less’, unit-less Misery Index is still an interesting concoction. It is worth keeping an eye on this measure and finding ways to keep it in check.

Robert Barro, a Harvard economist, extended the misery index to include interest rates into Okun’s Misery Index. High unemployment, high inflation and high interest rates is truly a terrible mix. This measure probably is too early to try out in India. Interest here means those that are paid by households. In India, it would be difficult to measure the interest rates paid by households for a variety of reasons.

In India, the observed unemployment rate and inflation alone do not convey the complete story of the miseries of households. It is not just the misery of the unemployed. It is also about the discouraged labour force that left the labour markets disheartened and the youngsters who postponed entering the labour markets. The labour participation rate is therefore a ripe candidate for India’s misery index. Till we measure that, we must at least worry about the Misery Index that is high and is rising.