India is among the leading global producers of cost-effective generic medicines and vaccines, supplying around 20 percent of the total global demand by volume. In FY19 drugs and pharma accounted for nearly four percent of total inflows (Foreign Direct Investment) to the country in dollar terms. Strong presence in the US generic segment is one of the major strengths of the Indian pharmaceutical industry. According to an analysis done by Nomura based on sales data from IQVIA (American Contract Research Organisation), the share of Indian companies in total generic prescriptions in the US rose to 45% in FY19, compared to 35% at the end of FY17.

India is among the leading global producers of cost-effective generic medicines and vaccines, supplying around 20 percent of the total global demand by volume. In FY19 drugs and pharma accounted for nearly four percent of total inflows (Foreign Direct Investment) to the country in dollar terms. Strong presence in the US generic segment is one of the major strengths of the Indian pharmaceutical industry. According to an analysis done by Nomura based on sales data from IQVIA (American Contract Research Organisation), the share of Indian companies in total generic prescriptions in the US rose to 45% in FY19, compared to 35% at the end of FY17.

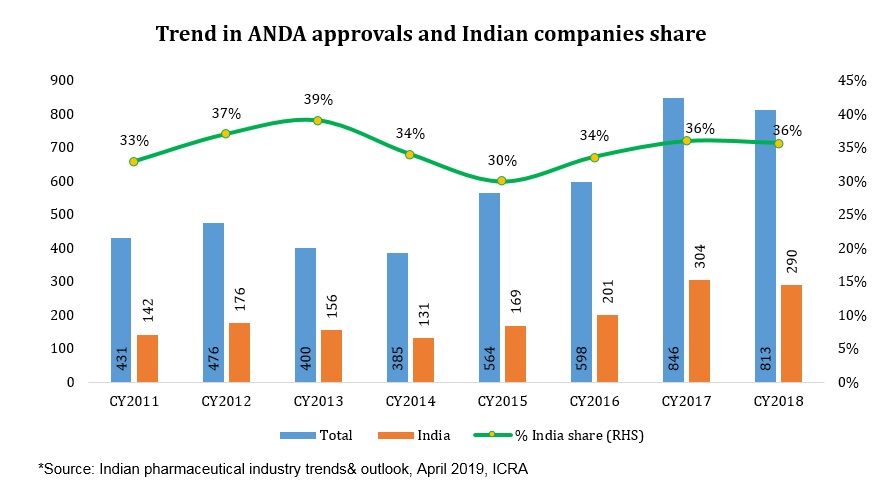

Further, it is estimated that drugs worth US$16 billion got off-patent in the US in 2018 while another US$26 billion each will become off-patent in 2019 and 2020 respectively, offering a sizeable opportunity for Indian generic players. Increased pace of Abbreviated New Drug Application (ANDA) approvals by US Food and Drug Administration (USFDA) leading to more launches in the US generic market and expectation of ease in pricing pressure still upholds the US as an attractive market compared to others.

An adverse change in trajectory post 2015

The years from 2009-2015 were the golden period for Indian pharma. This was on account of optimism driven by increased patent filings and higher R&D focus. However, of late the industry has not been performing well as seen from the downfall in the BSE index by 30% to 12,675 points from its all-time high of 18,212 points in 2015 and fall in FDI (73% drop between April 2018 and March 2019, compared to same period a year ago).

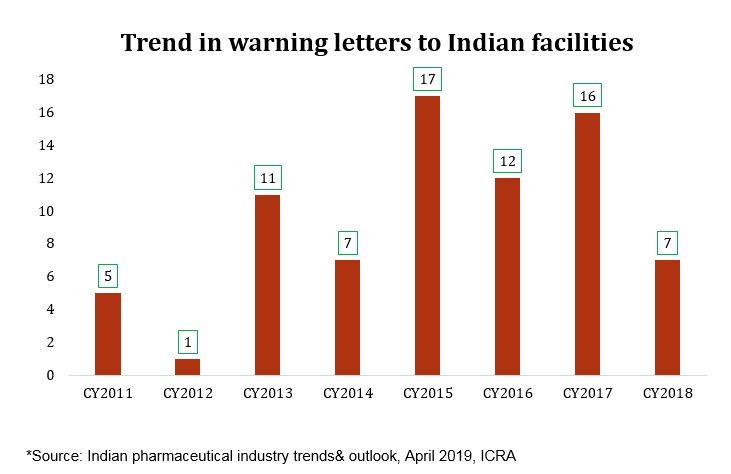

This change in direction is primarily attributed to increased pressure from the US market due to higher inspection rates from the USFDA, allegation of price fixing in the US, higher competition and consequent price erosion. While on the domestic front, the effect of regulatory interventions by National Pharmaceutical Pricing Authority (NPPA) such as Fixed Dose Combinations (FDC) ban, price control of drugs, push for generic medicine over branded drugs and more products getting added to National List of Essential Medicines (NLEM) list have been hampering the velocity of growth.Further, lingering effects of demonetisation, GST implementation hassles and weak intellectual property added uncertainty in the sector.

A recent development: Price fixing suit in the US

One of the recent development from the US is the lawsuit filed by 40 states alleging drug manufacturers of conspiring to inflate prices of many commonly used medications. They have named 20 large pharma companies with seven of them from India namely Aurobindo, Dr Reddys, Glenmark, Lupin, Wockhardt, Zydus Cadila and Sun Pharma’s US arm Taro. There are allegations indicating that over 1,200 drugs saw their prices jump by 400 percent in one year, some by even 1000 percent. The objective of this cartelisation is to fix prices of certain drugs within the manufactures’ group.

Potential impact on the Industry

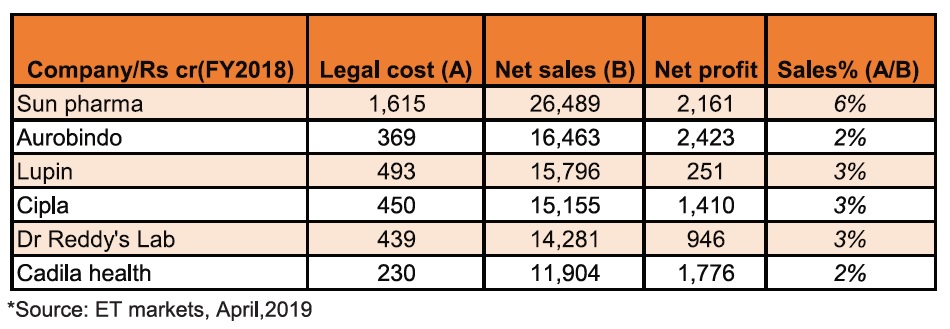

In the past, European and American drug firms have paid significant amounts towards settlement of similar suits significantly impacting their bottom line. Until recently, there has been limited bearing on Indian pharma companies by way of such litigations. Since this current litigation is backed by tangible evidence that the companies did it purposefully and not due to any shortages, we can be certain of repercussions. There are reports by analysts suggesting that the damage could be in billions.

Steven Tepper, an analyst at Israel Brokerage and Investments has hinted that fines could go up to $2billion while a report by global investment research network SmartKarma suggests that the aggregate liability could exceed $6 billion. That means potential fines could be in the range of Rs.500-2500cr for each of the company involved depending upon their participation. We will have to wait for the final verdict to assess the real impact on Indian pharmaceutical industry.

Present avenues of growth for Indian pharma

If we look segment wise, exporting formulations (final medicinal product) is the most profitable segment; especially to the US. However, Active Pharmaceutical Ingredients (API) business is gaining prominence in India due to supply constraints from China. Further, contract manufacturing organisations (CMO) and contract research (CRO) are also getting attractive due to our low cost capabilities. If we look at other markets, Europe still remains challenging for a direct entry. While in emerging markets (Brazil, South Africa, Canada, South East Asia) low pace of regulatory approvals, macroeconomic challenges and high competition are a concern. When it comes to the non- manufacturing side, the hospital business is seeing a consistent growth which is expected to continue given an increase in lifestyle diseases, higher penetration and rising health insurance coverage. However, the diagnostic industry growth rate has come down which is mainly attributed to higher competition.

Strengthening research and development is the key

Indian pharma should use their advantages in the most productive way. Focus on niche and complex segments will be the key growth drivers for Indian pharmaceutical industry. The benefits we enjoy are low cost manufacturing, skilled labour, proven chemistry skills and second highest number of US FDA-approved facilities (both API and formulations). Those companies which channel their R&D towards niche segments like injectable and bio-similar space could be the future multi-baggers. At the same time, rise in raw material costs and compliance costs are still a challenge for the sector. Besides, the recent price fixing scandal may bring despair in the short term.

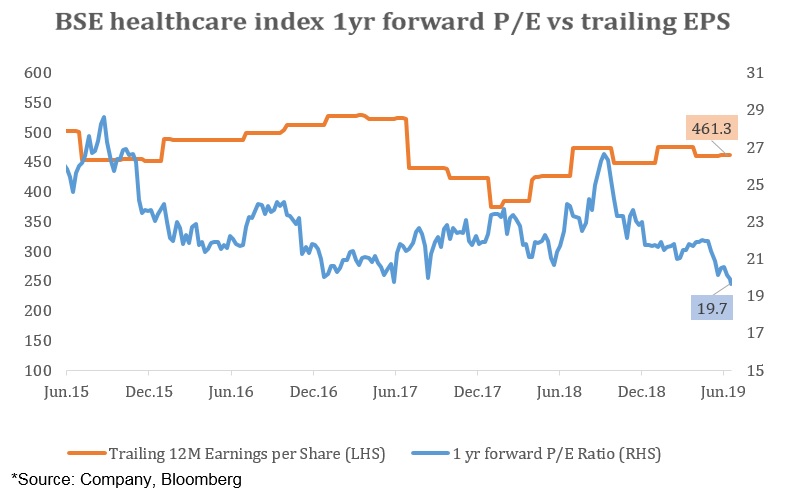

If we look at the valuation side, on a one year forward basis, P/E of BSE healthcare index stands at 19.8 which is lower than the five year average of 23. In the last five years, it has touched a peak of 29 while the low was in the range of 20’s. Earnings per share (EPS) have been relatively flat over the last five years.

Considering the recent adverse events along with slow pace in EPS growth rates, we expect the industry to witness moderate pressure going forward. For the purpose of investing, it is best to consider the companies which are outside the scope of this scandal such as Torrent pharmaceuticals, Cipla and Granules.