By Abijith T Cherian

By Abijith T Cherian

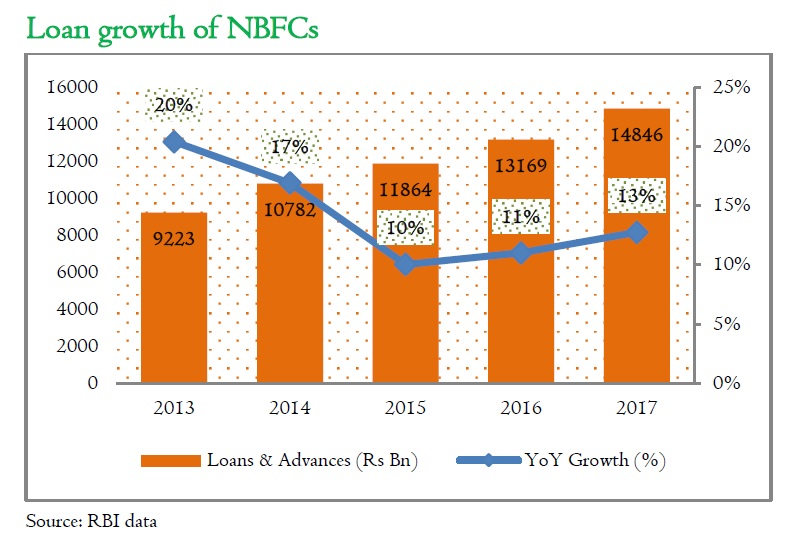

Non-banking finance companies (NBFCs), including Housing Finance Companies (HFCs), form a vital part of the Indian financial system. These entities complement the mainstream banking in the process of taking credit to the unbanked segments of the society, driving financial inclusion and nation-building. NBFCs enjoy the advantage of better product lines, lower processing fees, wider and effective reach, robust risk management capabilities, financial innovation and regulatory arbitrage. They often play a vital role in the emerging economies mainly because of their abilities to reach out to inaccessible areas, and even the provision to substitute banks in areas where they are confronted by stricter regulatory constraints. Customers also tend to find non-banking finance companies convenient due to their prompt services, quicker decision making ability and expertise in niche segments. In past few years, NBFCs are part of many multi-bagger portfolios and have marked a loan growth of more than 12%, during a period when banks have struggled to increase lending due to the overhang of non-performing assets (NPA) and subsequent slowdown in corporate lending.

The risks associated with NBFCs

NBFCs carry various inherent risks mainly due to the nature of their operations. The entire business of the NBFCs revolves around borrowing and lending cycle which makes them highly leveraged. The over-reliance of these companies on the wholesale funding from banks, mutual funds, and insurance companies also adds to the risk as banks were reluctant to lend after IL&FS issue. As most of the NBFCs cater to the needs of some niche segments, they are also prone to concentration risks like, the HFCs were affected from Real Estate Regulatory Authority (RERA) implementation in 2016 and the consequent slowdown in the sector and gold loan NBFCs got adversely hit from falling gold prices in FY12-13.

NBFC’s position in Indian financial system

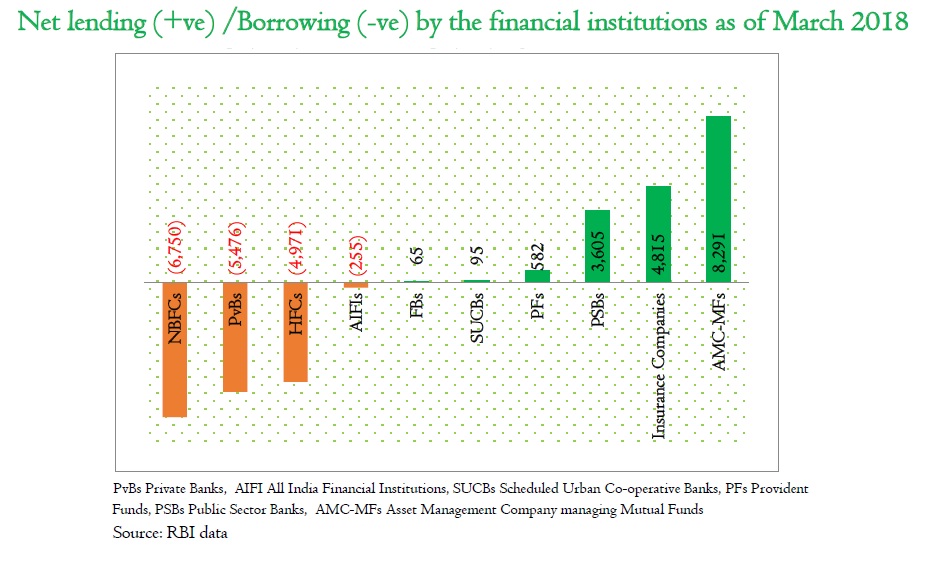

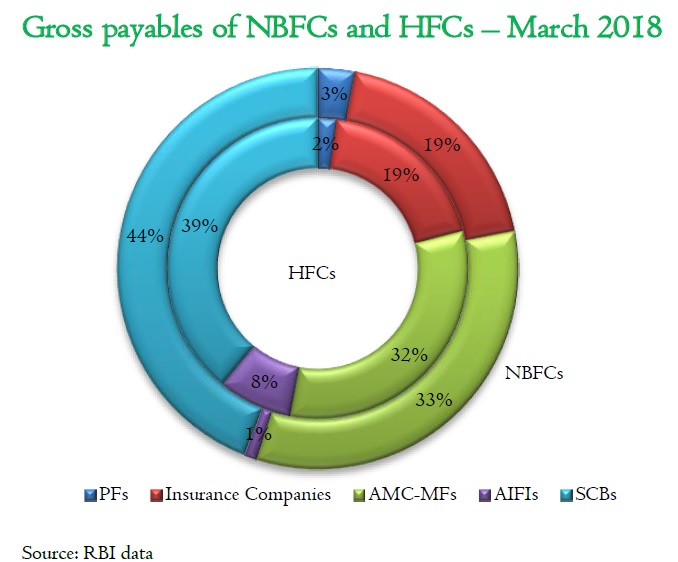

A financial system enables the exchange of funds between investors, lenders and borrowers, and comprises various sub-systems which operate in a close combination with each other like financial institutions, financial markets and financial instruments. The various financial institutions that form a part of Indian financial system are NBFCs, PvBs, HFCs, AIFIs like National Bank for Agriculture and Rural Development (NABARD) and National Housing Bank (NHB), Foreign Banks, SUCBs, PFs, PSBs, Insurance Companies and AMC-MFs. Among these financial institutions, NBFCs and HFCs are net borrowers whereas the major net lenders include PSBs, insurance companies and AMC-MFs. As per the latest Financial Stability Report (FSR) of RBI, as of March 2018, NBFCs have gross payables of around ₹7,170 billion and gross receivables of around ₹419 billion and HFCs have gross payables of around ₹5,284 billion and gross receivables of ₹312 billion.

As per the latest data available in FSR, scheduled commercial banks (SCBs) have the highest exposure to NBFCs at ₹2,970 billion, followed by asset management companies managing mutual funds (AMC-MFs) at ₹2,228 billion and insurance companies at ₹1,283 billion. HFCs’ borrowing pattern was also quite similar to that of NBFCs except that AIFIs also played a significant role in providing funds to HFCs. Here also SCBs had the highest exposure at ₹1,939 billion, followed by AMC-MFs at ₹1590 billion and insurance companies at ₹944 billion. The over-reliance on these sources acts as a risk element, as recently banks became reluctant to lend to the sector after IL&FS issue and mutual funds were unable to extend further lending due to regulatory capping.

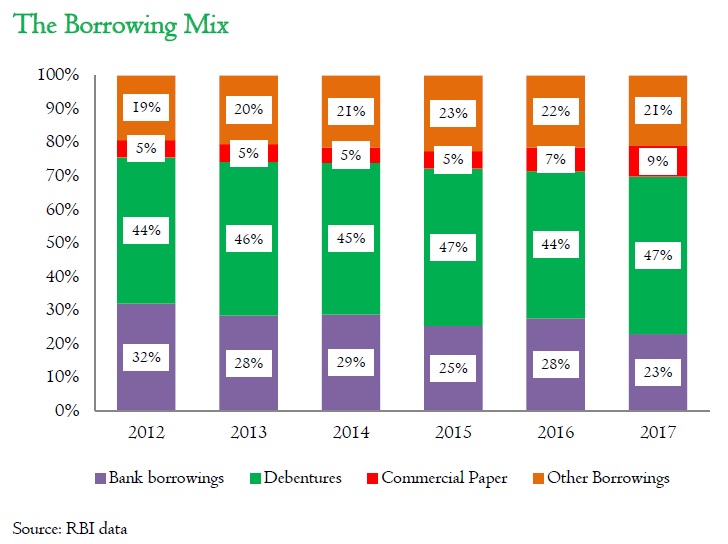

Commercial paper, debentures and borrowings from banks form the main source of funding for most of the NBFCs. They have migrated towards shorter tenure borrowings in recent years since they became relatively cheaper and helped them to lower their borrowing cost. In 2012, commercial papers and debentures formed 49% of the funding source for NBFCs whereas this has increased to 56% in 2017, and at the same time bank borrowings has reduced from 32% to 23%. As per the latest RBI data on “sectoral deployment of bank credit”, the outstanding credit to all industries stood at ₹27.01 trillion and more than 20% of these go to the non-banking finance companies. In a 2017 publication by the Reserve Bank of India, it states that about 99.7% of shadow banking (defined as entities and activities fully or partially outside the regular banking system) in India involves loan provisions that are dependent on short-term funding and is primarily done by NBFCs and HFCs. In a rising interest rate scenario, it gets easily reflected on market-based instruments like debentures and commercial papers, which increases the borrowing cost. The sector was spooked after DSP Mutual Fund (MF) sold DHFL’s commercial paper at a yield higher than what the paper was trading at, and this raised liquidity concerns. The sector witnessed heavy selling pressure after the news spread that some NBFCs are having an Asset-Liability mismatch: a mismatch between their borrowings from the short-term money market and their lending.

Asset Liability Management

The pressure builds on net interest margins when the liabilities are maturing and getting repriced faster than assets since the funds need to be raised at a higher yield, to roll over the short-term positions. Any further tightness in liquidity would also create refinancing challenges, as most banks are also stretched out with NPAs and various regulatory issues, and most of them being reluctant to lend to NBFCs in the background of IL&FS default. The additional funding to these non-banking finance entities would certainly depend on how they cope with the commercial paper redemption pressure.

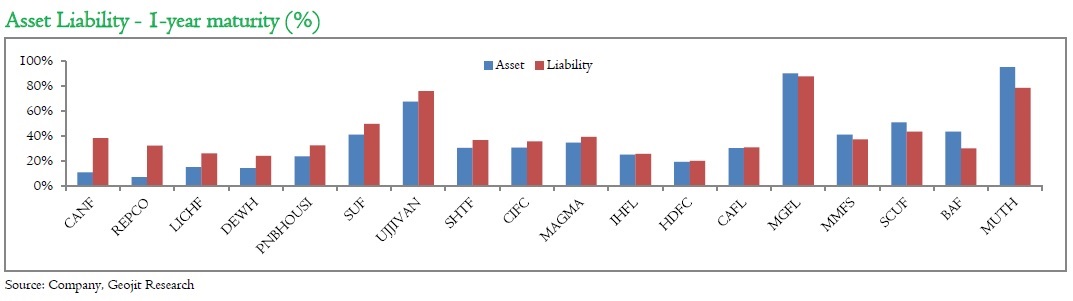

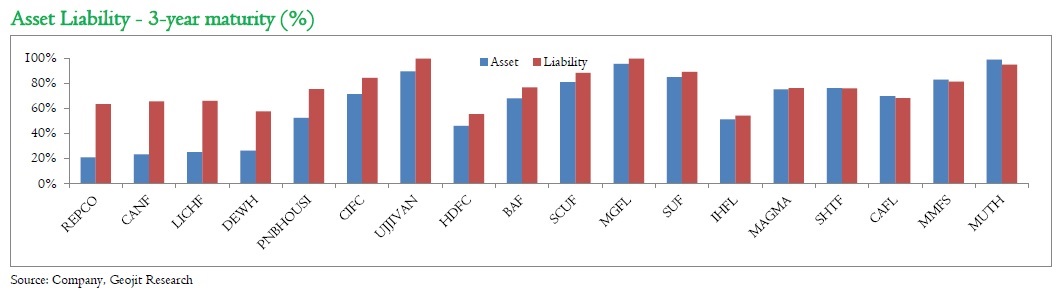

Study of the asset-liability mismatches of 18 NBFCs including HFCs for a period of one year and three years, based on the FY 18 annual report, indicate that the mismatches are significant for housing finance companies. For example, in the case of Can Fin Homes, 11% of the total assets get matured within one year whereas about 38% of total liabilities get matured in the same period. Almost similar trends are visible for the asset-liability mismatch over three years.

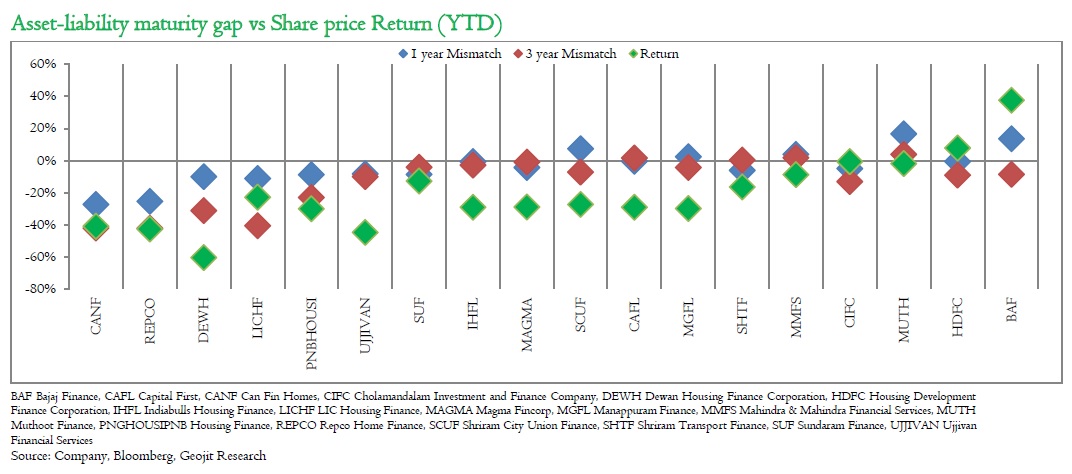

We have compared the YTD share price return of these companies with the asset-liability maturity gap for one and three years, and some interesting facts can be inferred from this as below:

- a) Top five companies having the highest asset-liability maturity gap (both one year and three years) are housing finance companies.

- b) Top five companies having the lowest share price return include four out of these five HFCs.

- c) Top five companies having the highest return include three large cap companies.

- d) Top five companies having the lowest return include three small cap companies.

Regulatory measures to tackle liquidity concerns

RBI has permitted banks to consider an additional 2% of their treasury assets as high-quality liquid assets (HQLAs) under the Basel-III norms, making the amount of statutory liquid assets that can be considered as HQLAs to 15% of the total deposits from 13 percent earlier. This will enable the banks to have additional liquidity up to ₹2 lakh crore.

The central bank allowed banks to use government securities as level 1 high-quality liquid asset (HQLA) equivalent to the bank’s incremental lending to NBFCs and housing finance companies (HFCs) after 19 October 2018. This will be limited to 0.5% of the bank’s net demand and time liabilities (NDTL) or its total deposits. The central bank’s measure is expected to facilitate additional lending of ₹59,000 crore to NBFCs.

RBI has also decided to allow banks to provide partial credit enhancement (PCE) to bonds issued by the systemically important non-deposit taking non-banking financial companies (NBFC-ND-SIs) registered with the Reserve Bank of India and Housing Finance Companies (HFCs) registered with National Housing Bank.

The way forward

Though the matter looks isolated, the fundamental issues that the market had not heeded so far have come to the fore, gouging the investor confidence. Going forward, it is possible that RBI would tighten norms for these non-banking entities, to bring them at par with commercial banks from the regulatory viewpoint. The liquidity conditions could stay tight and the recent adverse sentiment within the bond market could even result in higher borrowing cost. Though most of the NBFC stocks witnessed a free fall, one should not paint all these companies in the non-banking space with the same brush. NBFCs with strong asset liability management and proven business models will easily sail through without any significant effect on the margins. Also, NBFCs with strong parentage will continue to earn support from banks and debt markets. One should also keep a note of further dilution in equity shares on account of the convertible NCDs issued by these NBFCs to overcome the liquidity constraints.