Market touched again the psychological mark of 12,000 and 40,000 for Nifty 50 and Sensex 30, respectively. The last rally was triggered by the reform to cut corporate tax announced on 20th September. The market is up by more than 10% as on 15th November. This rally is also being supported by positive tailwinds from US-China trade talks, good Q2 results, stimulus measures for realty sector and expectation of more reforms in future. Nevertheless, post this rally the gap between valuation and earnings growth has expanded. Nifty50 one year forward P/E is at 19x, near its last high, but economic indicators are poor with very low factory output and consumer spending. Inflation is rising and fiscal deficit is expected to breach the target and rise to a range between 3.6 to 3.8% against 3.3% forecasted, unless Bharat Petroleum Corporation Limited (BPCL) and Air India are divested. This is going to impact the performance of the market in the short-term. In spite of all this, outlook for equity as a financial asset has improved due to the reduction in global risk, cheaper interest rate, supportive vibes from government and lower taxation. During this period midcaps, finance, green resources and healthcare sectors will do well.

Market touched again the psychological mark of 12,000 and 40,000 for Nifty 50 and Sensex 30, respectively. The last rally was triggered by the reform to cut corporate tax announced on 20th September. The market is up by more than 10% as on 15th November. This rally is also being supported by positive tailwinds from US-China trade talks, good Q2 results, stimulus measures for realty sector and expectation of more reforms in future. Nevertheless, post this rally the gap between valuation and earnings growth has expanded. Nifty50 one year forward P/E is at 19x, near its last high, but economic indicators are poor with very low factory output and consumer spending. Inflation is rising and fiscal deficit is expected to breach the target and rise to a range between 3.6 to 3.8% against 3.3% forecasted, unless Bharat Petroleum Corporation Limited (BPCL) and Air India are divested. This is going to impact the performance of the market in the short-term. In spite of all this, outlook for equity as a financial asset has improved due to the reduction in global risk, cheaper interest rate, supportive vibes from government and lower taxation. During this period midcaps, finance, green resources and healthcare sectors will do well.

Weak macro data can ruin the momentum in the short-term

We feel that in the near-term, the trend of the market will be dictated by macro factors, which have turned from bad to worse. India’s CPI inflation has expanded to 4.65% much above RBIs average forecast for FY20. This is unlikely to change RBI stance to hawkish from the current accommodative monetary policy. RBI will cut interest rate to support the weak economy but may develop a careful strategy in future. Despite the festive season, IIP steeply declined to -4.3% YoY in September. This is likely to impact the GDP data of Q2, the range of forecast by economists are 4.2% to 4.7% from the actual 5% of Q1. For FY20, RBI had forecasted a growth of 6.1% which is likely to be downgraded further.

We have a real question regarding fiscal position. Based on H1FY20 actual data announced by the Controller General of Accounts, the fiscal position of the government is weak. It will be difficult for the government to provide more stimulus in the near future, since it will impact tax revenue. The actual tax revenue for H1FY20 is much below the budget target, net tax revenue growth was only 4.2% YoY. Government had forecasted 25% growth in net-tax revenue to Rs16,496bn in FY20 from the provisional Rs13,169bn of FY19, as per Controller General of Accounts data. It is lower due to slowing economy and cut in corporate tax rate. Government expects BPCL and Air India to be sold by 31st March, 2020.

Regarding the cut in outlook by Moody, we don’t think that it will specifically change the performance of equity market, since it is based on outdated data which is already digested in the market. It may impact the bond market in the short-term. However, if the fiscal deficit issue gets expanded, it can spread to equity market in future. The probability of which looks limited today which is expecting extra income from divestment, spectrum sales and dividend to fix the fiscal deficit gap. Market is likely to be range bound with a negative trend as investors stand side-line from expensive large caps and blue-chips.

Good Q2 result…

Q2 result was better than expected. Nifty50 PAT grew by 10% on a YoY basis compared to a 2% growth expectation (excluding telecom). For broad indices like Nifty500, a similar traction was visible with 20% growth in consolidated PAT, which is 8% up on a QoQ basis. This is led by the cut in corporate tax rate, interest cost and raw material cost providing a hope that business outlook will progress further from H2FY20. Better performance is seen in sectors like Banking, Cement and FMCG. Weak performance is seen in Auto and IT sector.

Much better numbers by the Banking sector is the key point to note. It indicates that India’s financial segment’s NPA problem is normalising. It was good due to low base effect, reduction in provisioning and positive vibes over NPA resolution. The outlook for the future has improved led by increase in liquidity and cut in operational cost. The negativity is that slippage is still happening with stock specific issues. But given attractive valuation and positive verdict by the Supreme Court on Essar Steel case, banking sector will do well and outperform the market in the future as distressed asset improves.

Q2 is giving a hope to the market that the best part of earnings growth will be in the second half of the fiscal year due to cut in taxation, post festival season uptick, good monsoon and reduction in interest rate. Sentiment of equity market has also improved due to weak crude oil prices, positive global news from US-China trade deal and Brexit.

Reduction in risk is accommodating equity…

Equity market usually advances before the revival of an economy. The transitory lag between equity market and economy could be in a range of three to twelve months depending on the economic cycle. The private sector is not investing today since the capacity utilisation is at a decade’s low. Today’s economic problem in India is a mix of structural and cyclical issues. The economy had slowed down about two years back due to cyclical problems which got extended due to structural issues. Structural problems are being resolved today by initiating reforms. The biggest concern is the weak financial position of the banking sector led by NPA problem which is at the peak level. Market is expecting that to vanish in the coming quarters led by reforms and faster resolution by IBC (Insolvency and Bankruptcy Code).

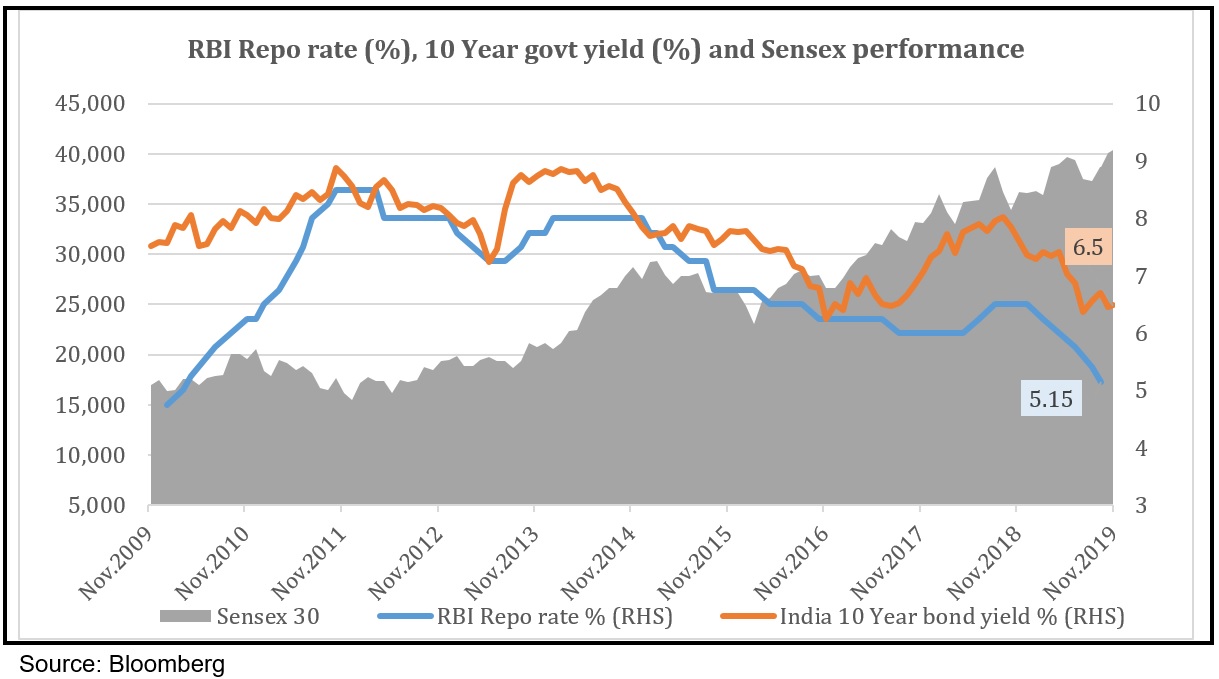

Reduction in interest and tax rates are very positive for equities, and during such periods they outperform other assets like bonds, commodity, gold and currency. Equity usually starts to do well when interest rate reaches near the bottom of the cycle. In India, repo rate is at a nine tear low of 5.15% and RBI is likely to continue its reducing stance in the medium-term. Globally, interest rate in Euro Union is sub-zero for a long time, but economy did not improve, while in the US it is just coming down from the ten year peak as economy started to slowdown. Today, we have a trend of sharp reduction of interest rate in India, an early reduction cycle in the US and Europe at the lowest. India has an advantage in this interest rate cycle given tax reforms and likely reversal in economy from the second part of the year, hinting that equity can do well. The long-term investment scenario for equity has improved.

A part of the recent rally is also on expectation of further reforms from the government with likely cut in personal income tax, long-term capital gain tax, dividend distribution tax, providing an incentive to consumers and equity market. Government had cut the corporate tax which is fuelling the ongoing Q2 result with better than expected PAT growth. Government intends to reach a 5trillion dollar economy by 2024, and provide more supportive measures. But for more stimulus, the fiscal position of the government needs to be strong. Going forward it is going to depend on non-tax revenue like divestment and other sources along with control in expenditure.

We had a target of 12,600 for Nifty50 which we are maintaining. This is a good time to consider investing in mid and small caps which are available at reasonable valuation compared to large-caps. Along with this, their holding by institutions has reduced in the last two years. Such stocks will do well as the economy improves and systematic risk reduces in the future. SIP or SWP will be a good method to increase your exposure in such stocks. The economy has reached its worst, and is likely to improve in a couple of quarters. Liquidity in the global market is also good which will support emerging markets. Banks, PSUs, Pharma and export-oriented stocks will do well. We also have a positive view on Insurance and AMC sectors given its early phase of business growth led by low penetration, leading to a healthy business outlook in the long-term.

good analysis,encouraging market directions.Thanks and like to read more.