The last one month has been very difficult for the market in terms of sentimental setbacks like geo-political tension, weak data in the domestic GDP and cut in global growth outlook. But on a positive note the market ignored all these issues with a very broad-based rally against the muted trend of the last 15 months. This rally – global and domestic – is now interestingly poised. This could create some volatility in the near-term, but we continue to strongly believe that the outlook has improved for the long-term. We advise our clients to add their exposure in equity with higher mix of high quality mid and small caps.

The last one month has been very difficult for the market in terms of sentimental setbacks like geo-political tension, weak data in the domestic GDP and cut in global growth outlook. But on a positive note the market ignored all these issues with a very broad-based rally against the muted trend of the last 15 months. This rally – global and domestic – is now interestingly poised. This could create some volatility in the near-term, but we continue to strongly believe that the outlook has improved for the long-term. We advise our clients to add their exposure in equity with higher mix of high quality mid and small caps.

The geo-political effect

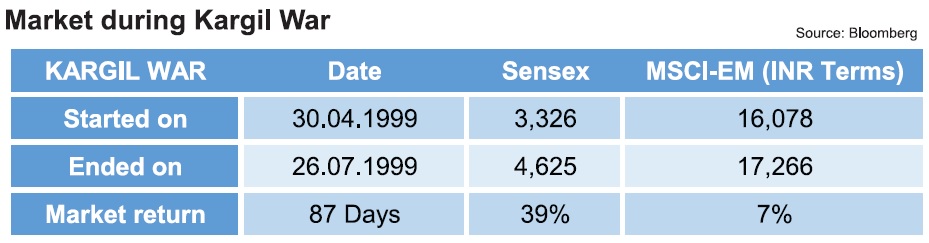

The Pulwana attack had a sentimental effect on the market. Political strategists had a view that this will lead to uncertainty in the region. Geo-political risk was expected to escalate and the market had a watchful round over the developments. Market had a dip on the day of the attack but since then it has traded with a mixed bias, assessing announcements to evaluate further risk. This market trend was short-term in nature given the global diplomatic stand and strength of the country. Also, it is important to note that such events had not impacted the market on a real basis, even during the Kargil war.

Institutional investors’ sentiment has improved in the last two months

Foreign inflows have increased in the domestic market, stimulating liquidity in the system. India is outperforming emerging markets. . In February and March, FIIs have continued their aggressive buying with inflows of Rs17,000cr in February and Rs26,500cr as on 20th March. FIIs are positive on India due to better bargain led by prolong pause in FED rate stance and a positive outlook in the future. Rupee gained strength and moved below 70/dollar for the first time in more than two months owing to increase in foreign inflows and stability in oil prices.

This is not the time to lose hope

Investors have been very risk-averse in the last 15 months. Today due to continuous price erosion many retail investors are considering reduction in exposure to equity and shifting to fixed deposits or debt schemes. This is actually the opposite of what they should be doing now. We believe that continuity in SIP and higher mix of quality mid and small caps will provide better gain in the long-term. It is important to note that interest rate in India is likely to reduce by 50-75bps in the coming two to four quarters which is positive for equity rather than debt or fixed deposit. It is the right time to churn your portfolio, over the next three to six months, by increasing the mix of mid and small caps. At the same time, we may have to reduce few blue-chips from our portfolio which are very expensive and may not generate enough return in the medium-term. We have a positive view on sectors like banking, infra, cement, chemical, and oil and gas which can give above normal return in the medium-term.

From the valuation perspective, in a broad index like Nifty 500, about 60-65% of the stocks are currently below or in-line with the seven-year average valuation on trailing P/E basis. This is very attractive. We can conclude that a majority of stocks have corrected well while a few sets of blue-chips and sectors like FMCG, consumer discretionary, chemicals and IT are valued on the higher side.

Market bounced in the last one month… will sustain in the long-term.

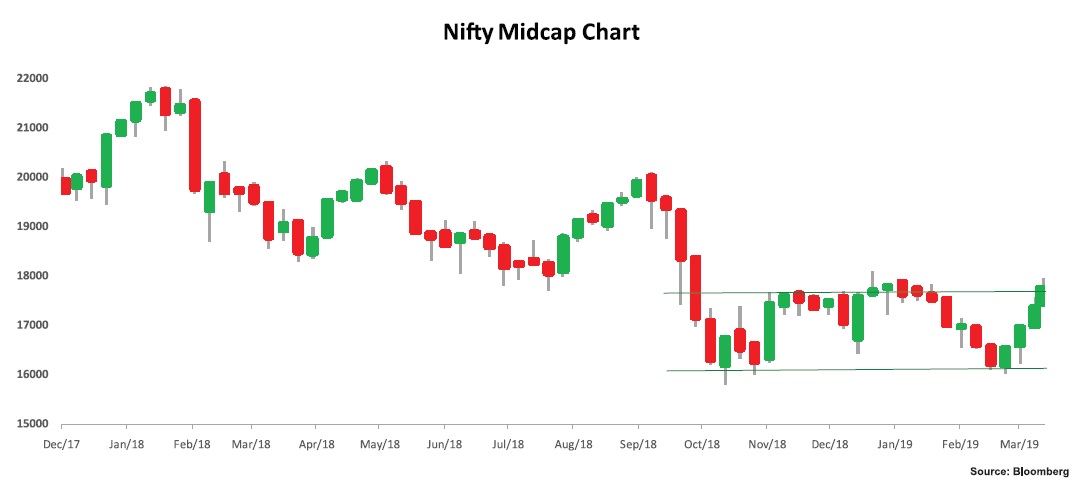

We had a strong rally in mid and small caps in the last one month. Nifty-Midcap100 and Nifty-Smallcap100 indices are up by 11% and 15% from their recent lows between 18th February and 18th March. Market feels that one of the important reasons for this rally is de-escalation in geo-political risk and opinion polls showing positive vibes for the ruling party in the upcoming election. What we feel is that this could be the secondary factor whereas the main reasons are cheap prices and valuation given the tremendous fall between January 2018 and February 2019, and improved outlook in the future. Nifty Midcap Index was down by 24% and Small caps Index by 37% during the same time.

Nifty Mid Cap Index

This fall was triggered by premium valuation compared to large caps by 20% above the long-term average, while a slowdown in economy due to bunch of disruptive reforms (Demo, GST, IBC) impacted the economy in FY19 and a similar slowdown in world economy led to downgrade in earnings. Strict norms from SEBI and reduction in liquidity in the banking system due to nonperforming assets (NPAs) and Non-Banking Financial Company (NBFC) issues impacted the stocks.

Earnings growth for Midcaps was positive in between FY17 and FY18 which slowed heavily from Q1FY19 onwards. At the same time the average valuation on a one year forward P/E basis was as high as 25x which has come down to 15x. Market expects earnings growth to revive in FY20 with betterment in economic momentum from Q2 to Q3. Domestic worries like slowdown in business has stabilized and financial liquidity has improved. NPA issue is at the second phase of development led by IBC while monthly GST collection has improved indicating some progress in the ground reality. Post general election and stability in domestic market, capex cycle can return. This is likely to be supported by reduction in interest rate. All these factors are supporting mid and small caps.

Currently, pledged stocks issue was highlighted due to two reasons: continued fall in mid and small cap prices due to which pledging has automatically increased and the tight financial situation of NBFCs and banks. Specifically, stock issue increases when pledging goes beyond 50 percent. We will have to be careful and take a call as per the leverage situation of the company in future. If there is a possibility of moderation in the leverage in future with positive business outlook, there could be an opportunity.

Euphoria in domestic and global market is attracting investors

The undercurrent in mid and small caps is positive due to cheap valuation. The risk is minor with marginal downgrade likely in Q4FY19 earnings leading to some profit booking in the near-term. However, on a long-term perspective, we believe that such volatility will generate an entry point. Opportunities in domestic economy are picking up and analysts expect earnings to gain traction during FY20 due to revival in sectors like cement, infra, consumption and banks. Market is focusing on domestic businesses in expectation of improvement in future outlook while growth is normalizing in the rest of the world. Probability of a stable government formation at the center and inflation being continuously below the RBI’s target increases the chance of rate cut in the coming two to three quarters. After the slowdown in Q3 GDP, investors are focusing on rate sensitive stocks. The 10-year yield has declined in anticipation of a dovish monetary policy.

March will be very crucial for the market both globally and domestically. Clarity is likely to emerge in US-China trade deal by end of March. Similarly, Trump is contemplating a similar tactic with Europe, Japan and India. Till date the development of this meeting is positive and not likely to be as hazardous as expected earlier. The other points are Britain’s role in EU (BREXIT) by 29th March, and central banks meeting of FED, ECB and Bank of Japan which will define the support to the slowing world economy. Economic data of US, China and EU will be very eagerly watched by the market to decide the outlook for CY2019. IMF had cut its world GDP forecast for the year in January. While global liquidity condition is expected to ease in the expectation of more dovish stance by FED diverting funds to high yield emerging markets.

Only few domestic macros are due in March but the above-mentioned global events will weigh on the domestic market. It will be data heavy in April – May led by RBI policy meet, Q4FY19 results and the general election. This ongoing rally may take a break in between given the sharp nature of the bounce, but we believe that it will build a positive momentum in the long-term and we continue to have a very positive view on mid and small caps.

marjet may not act as per the norms. the prophecies of experts is only guiding but the final decision has to be our own. when we dont have our own views then experts view can be considered. i always go by own intuition while selecting shares