We expect a much better 2020 than the narrow markets of 2018 and 2019, where only a handful of stocks performed well. This is because of an evident reduction in the risk profile of equities and businesses, led by corrective and supportive measures announced by the government and stability in world economy. The government is concerned about the slowing economy and is prepared to support as required.

What was our expectation for CY2019?

We expected a volatile market especially in the first half of 2019 and anticipated it to stabilize during the year leading to a better performance in the second-half of the year.

The main reasons for the muted start were:

- Domestic economy was slowing down.

- Accordingly, earnings growth was expected to be muted in the next two quarters.

- While the valuation of World/India was much above the averages.

- Liquidity in the financial system was falling due to PSUBs and NBFCs issue, and had the risk to have a cascading effect on the economy.

- National election was expected to add to the volatility in the short-term with risk of populist measures.

- The pace of interest rate hike in the US was lingering and uncertainty over US-China trade war and Brexit could have a double effect on the slowing world economy.

At the same time, we expected a better investment period in the second half of 2019 based on the below factors.

- Disruptive effects of reforms like Demonetisation, Goods and Services Tax (GST) and the Insolvency and Bankruptcy Code (IBC) were expected to settle during 2019.

- Global and domestic economy was expected to stabilize by the latter half of the year.

- India was expected to handle the fiscal deficit issue better this time supported by declining oil prices and government efforts.

- Food inflation was brought under control by the reforms and measures undertaken in the rural economy.

- Monetary policy was expected to be supportive.

- The volatility from national election was expected to be over by mid-2019.

- The global financial market was hopeful of a trade truce between US and China.

- Pace of interest rate hike in the US market was likely to slowdown in H2 2019, helping emerging markets like India as funds inflow increases from Foreign institutional investors (FIIs).

What was the reality?

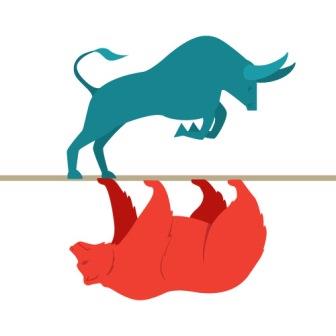

India GDP growth collapsed to sub 5% led by disruptive effect of reforms, drop in liquidity led by extended NPA problem and slowdown in the world economy. In hindsight, H1 performance was better than H2. H2 turned weak due to the adverse effect of union budget which was much below the market requirement with dire effect on equities with higher taxation. Though H1 looked better, it was a completely polarized market where only a handful of stocks and sectors did well.

Post the budget the market hit a low, at the same time the government understood the issue and came out with corrective and supportive performance completely turning the sentiment positive. After the low the market has given solid returns (see table below). We expect this momentum to continue during the next two-three years since the changes elaborated below will have a multiplier effect in the financial market for long-term gains.

The long-term outlook for equities is very solid…

We expect a much better phase from 2020 onwards given corrective and supportive measures undertaken by the government which are expected to be enhanced further as the world economy further stabilizes. The key points are:

- The government is concerned about the slowing economy and is ready to support with more measures as required.

- FPI surcharge was reversed.

- PSUBs are recapped and consolidated.

- Support is being provided to Housing and NBFCs sector.

- Tax relief is offered to start-ups.

- Additional depreciation of 15% for new vehicles and lifting the ban on the purchase of new vehicle by government to replace old ones.

- NPA level has started to reduce.

- Huge cut in corporate tax of 10% for existing companies and 20% for new companies which will have a positive effect on FDI and private spending.

- Stimulus and incentives were announced to uplift exports and realty sector.

- Plan to double expenditure on infrastructure for the next five years.

- Monetary policy is very accommodative. Government’s 10 year interest rate is reaching five year low and trend is downside, on long-term basis.

We expect these domestic measures to be enhanced further in 2020-21 Union Budget. The environment for earnings growth has been boosted with corporate tax cut and tax for equities is likely to improve further with tax incentive and reduction in personal income tax. Government’s readiness to provide further fiscal stimulus as required in future is a very positive sign which reduces policy and corporate risk.

The global environment has eased…

Additionally, the global risk has reduced. The three key factors impacting the world economy and equity market were US-China trade-war, Brexit and geo-political issues. World economy had slowed down due to reduction in trade and investments. This hangover is decreasing and economy is expected to recover as these blockages are removed. A full trade deal is expected to be finalized in the first half of 2020 between US and China; Brexit is likely to develop as a new deal with European Union and geo-political risk has subsided in the last six months with recent needless chaos between US-Iran, which is visible in range bound oil prices and drop in global bond yield.

The interest rate in US has peaked. Federal Open Market Committee (FOMC) is unlikely to increase FED rate in CY2020 and will wait for the US and World economy to flourish. This is positive for emerging economies, which will cut interest rate and support their economies. This increases the possibility of FIIs to invest more in emerging markets in the next two years as system risk reduces further.

FIIs net inflows increased in CY19 due to risk-on strategy as developed economies slowed in CY19 and interest rates reduced. At the same time outlook for emerging markets improved due to reasonable valuation and anticipation of earnings growth. Net investment by domestic investors reduced due to slowdown in economy and crunch in liquidity which is expected to reverse in CY2020.

We expect more action in the broader market…

Our target for Nifty50 is 12,700 which is only 4.4% up from 12,168 closing as on 31st December 2019. This is based on assumption of 15% EPS growth in FY19 to FY22 with a valuation P/E of 17.5x on one year forward basis (on EPS of 31st December 2021). We feel that the room for the main indices to grow may be limited since valuation is on the higher side due to the polarized market of CY18 and CY19. We would also like to note that valuation of super large stocks is above the averages while fall in risk provides leeway for other stocks and sectors to perform better in future. Tailwinds will be more towards value and upcoming sectors. We feel more action will be in mid and small caps given uptick in economy and improvement in risk appetite for corporates and investors.

Please see our model portfolio and direct equity SIP platform to identify the stocks and sectors on which we are very positive (available on Selfie Trading platform). The sectors on which we are positive today are Private Banking, Rural Small Banks, Chemicals, Metals, AMCs and Insurance.

The risk in the offering are…

These factors can delay the benefits to the economy impacting the performance of equity market in the medium-term.

- Economy is still fragile and will take time to stabilize and reward across segments.

- Fiscal position is weak, impacting government spending and investment.

- Government’s income in 2020-21 will depend a lot on divestment, spectrum sales and dividend leading to instability in the fiscal income structure.

- GST system needs a revamp and NPA resolution process can take time to clean-up the system which will impact recovery of the economy.

- US-China trade deal and Brexit deal are still work in progress.