Unlike other base metals, demand for nickel from China, the world’s biggest consumer, has not dampened during the trade war with the US.

Unlike other base metals, demand for nickel from China, the world’s biggest consumer, has not dampened during the trade war with the US.

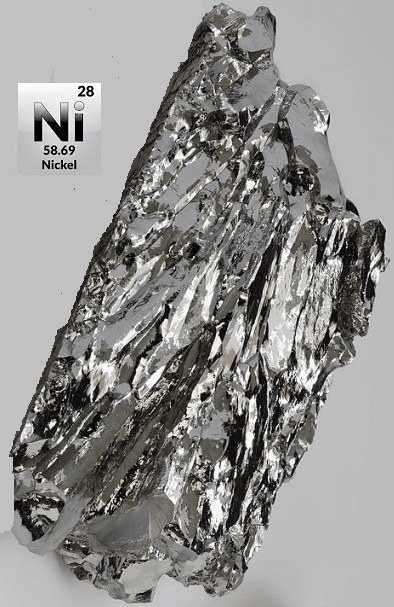

Nickel, the commodity used for making alloys, has gained more than 45 percent at the benchmark London Metal Exchange (LME) since the start of 2019.Unexpected large-scale buying by Chinese companies and supply threat from the top producer, Indonesia, aided sentiment.

Similar moves were seen in domestic prices, too, with the MCX near month futures gaining more than 50 percent to a near five-year high.

Unlike other base metals, demand for nickel from the top consumer China has not dampened during the ongoing trade standoff with the US. Prices are insulated from major fall on buoyant outlook due to increased appetite from the stainless steel industry.

Stock accumulation by Chinese companies to supplement their own output has resulted in a sharp surge in global prices. Large-scale buying by these companies is reflected in LME inventories as well.

Stocks at LME warehouses have plummeted to their lowest level since January 2013. Inventories shed about 70 percent since it peaked in mid-2015.

Inventories at Shanghai Warehouse have seen a sharp uplift after stocks dropped to a four-year low.

A possible halt in nickel shipments of Indonesian ore from 2022 further supported prices. Based on a 2017 mining regulation, Indonesian authorities would enforce a ban on exports of unprocessed ore starting January 2022.

This move is expected to trigger a supply shortage. However, traders associations in the country have requested the government to revoke the plan and are waiting for the final decision.

As per government data, Indonesia has 13 operating smelters, with an operational capacity of 24.52 million tonnes that mostly produce nickel pig iron. Also, 22 more nickel miners are being developed with an additional capacity of 46.33 million tonnes.

Almost 70 percent of global nickel is used for making stainless steel and most of it in China. Chinese nickel demand is met by Indonesian and Philippine mines, which dominate the industry.

Indonesia is the world’s top producer followed by the Philippines.

However, the ongoing market trend shows that electric vehicle segment would fundamentally alter the demand structure of the metal.

Market participants expect the battery sector to be the second-largest demand area after stainless steel in the coming years. Currently, the battery sector constitutes almost 5 percent of the global nickel demand. Data shows demand from the battery sector is growing at a frenetic pace.

Global nickel market is in a deficit. As per the International Nickel Study Group, global deficit widened to 12,500 tonnes in May from 7,500 the previous month. In the first five months of 2019, global nickel deficit was 73,000 tonnes against the same period in 2018.

Looking ahead, demand is expected to be higher and supply short. The Indonesian government’s decision will be critical to a long-term price direction.

Any halt to the proposed ban will hamper the buying sentiments and trigger selling pressure. Possible economic stimulus measures taken by the Chinese government to prop up the economy amid the prolonged and costly trade standoff may give lower-level support to the metal.

On the price front, strong resistance is seen at $16,700 a tonne at LME which needs to be cleared for further sharp rallies. In MCX, prices have potential upside till Rs 1,200/1,350 levels but have room for a corrective selling before triggering sharp rallies.

First published in Moneycontrol.