By Sankaran Naren, CIO & ED, ICICI Prudential Asset Management Company Limited

The Indian equity markets have been in a fine fettle and have withstood the test of demonetization and GST implementation over the last one year. Since last November, the benchmark index Nifty 50 has rallied nearly over 20%, with both foreign and domestic institutional investors actively participating in the market.

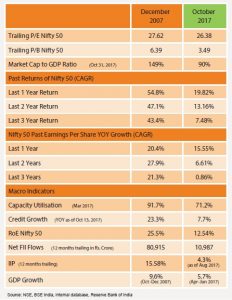

Given that the markets have been heading north over the last two years, many investors are pondering if the Indian equities have run ahead of its fundamentals. We are of the view that the market is in a mid-cycle and from a cyclical perspective, the market is yet to reach its peak (Dec 2007) as capex cycle, credit growth, corporate earnings and capacity utilisation is yet to improve. On valuation basis, when compared to mid and small cap names, large caps are relatively better valued, at this point in time.

In terms of corporate earnings, we believe India Inc can deliver results over the next two years. We expect capacity utilisation to increase, which in turn can drive the earnings, which in turn is likely to be a positive for Public Sector Banks, as well. Going forward, what could certainly drive credit growth is a capital expenditure cycle initiated by the private sector.

Sector Views

We are positive on IT, Pharmaceuticals from a three-year view. In pharma, many of names in this space are currently trading at reasonably inexpensive valuations. We believe turnaround can happen in the Pharmaceuticals space with increased traction in key FDA approvals and strong R&D focus on complex generic products. When it comes to IT, growth is stabilising after 24 months of erosion and is expected to pick-up with the rupee depreciation and margin expansion.

From a near term perspective, banking and infrastructure are the sectors which are likely to see some traction. Within banking, we like financial supermarket banks or lenders which offer a variety of financial products such as mutual funds and insurance. In the infrastructure space, ports and aviation industry is poised to witness expansion due to government thrust on improving the infrastructure. The Power sector is currently going through low capacity utilisation. With an uptick in capex cycle, we believe the sector could register higher topline growth and earnings.

Stick to asset allocation

Despite the positive outlook, one has to be cognizant of the fact that Indian markets are no longer cheap. As the market head higher, there could be instances of volatility which could unnerve a novice investor. Therefore, we would advise investors to be cautious in their investment approach. The best approach in the current market would be to strictly adhere to one’s asset allocation.

Following asset allocation is likely to ensure that investors stick to pre-decided allocation based on risk appetite and investment horizon, irrespective of market movements. So, let’s take an example if the pre-decided allocation to equities is 30 per cent, and the current allocation is 45 per cent, due to a bull run, an investor should rebalance the portfolio accordingly. Investing into dynamic asset allocation schemes is another alternative which an investor can consider as these schemes adopt a strategy which shall invest in debt and equity according to the prevailing market scenario. Investing in such schemes can help investors stick to asset allocation and yet benefit from market volatility.

The other option one can consider is investing in large cap funds. This is because as the market moves from mid phase to the last phase (bubble) in a market cycle, the number of sectors that participate in the rally becomes much narrower. This trend is currently playing out in the US as the markets there are nearing the end cycle.