Saving for retirement is essential if you want financial freedom to enjoy your twilight years.

Saving for retirement is essential if you want financial freedom to enjoy your twilight years.

Did you know that in 1947 the average life expectancy at birth in India was 32 years and just 20 years ago it was 63 years? Now it is around 68. And over the next 20-30 years, it may rise to 90 years.

But longevity is not translating into longer productive work. Earlier generations joined the workforce early at around 20 years of age, but with increasing preference for higher education now young people are joining the workforce later,say beyond 22 years. Therefore, working life in India has been shrinking even while the average life expectancy has been rising.

This means a shorter working life and a longer retired life. Yet, retirement planning is the last thing on the mind of youngsters!

This brings us to some important questions:

- Are you adequately prepared to avoid running out of money when you need it the most?

- When should you start planning for retirement?

- And, how can you save for retirement?

Most people procrastinate when planning for retirement. But it’s only prudent to start early and save steadily. The earlier you begin saving, the more time your money has to grow. And by starting early you can earn more by investing small amount.

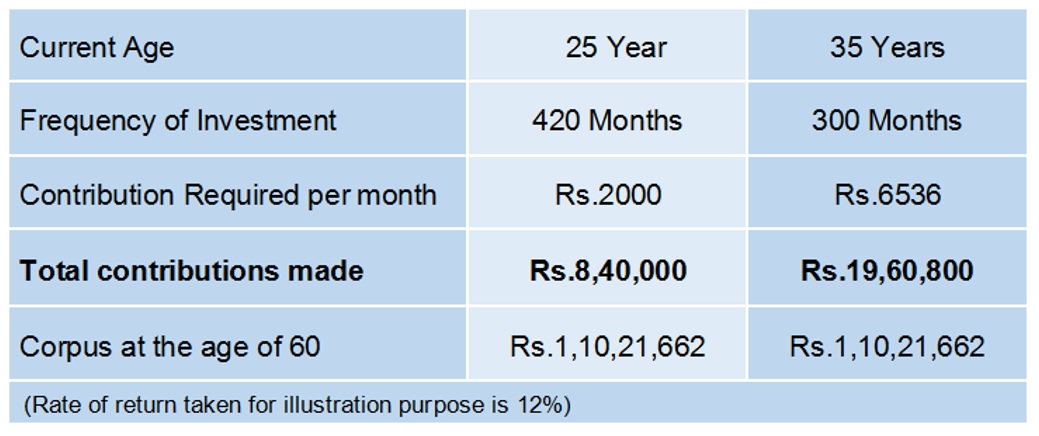

The following table illustrates the benefit of early saving and investment. If you start late by 10 years you will have to save 3 times more.

If you are 25 and want to accumulate Rs 1,10,21,662 by the time you are 60, you have to invest just Rs 2000 a month, assuming 12 per cent returns per annum. But in case you don’t have much time on your hands, you will have to contribute more towards the goal. If you start at the age of 35, you will have to increase your investments to Rs 6536 per month, given all other conditions remain the same.

The higher corpus for the person who started early is due to the power of compounding which has a magical effect over a long period of time.

There are two different stages in retirement planning, accumulation stage and distribution stage. The accumulation stage is the stage at which saving and investment for retirement corpus is made. The distribution period is the stage during which the income distribution (inflow) is required.

Before you start planning for retirement, you need to consider the following points to know the amount of money you would need to retire peacefully

- Check if you have adequate pension cover, if you have one.

- Assess how much money you need to live in your retirement years: Take into account rising medical expenses and inflation.

- Assess how much you can earn through interest and dividends.

Now that you know how much you will need you can plan for a retirement that lets you do what you want, when you want. Here are a few options you can consider:

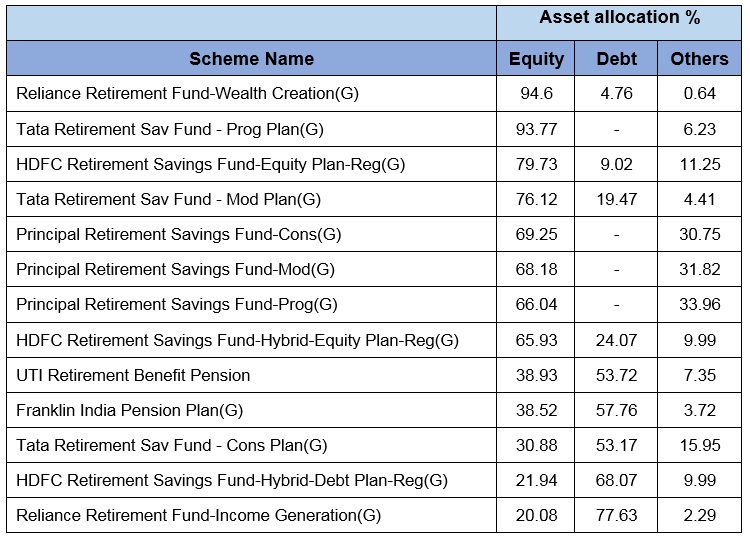

SIP in Mutual funds:

- An SIP with a reasonable goal in mind at an early stage of your career.

- Top up the SIP amount as your income increases over time.

- Do not touch the retirement corpus for meeting other personal or social commitments.

- Switch gradually to assets with lesser volatility as you age.

- Keep investing in SIP till retirement

Other Retirement Products

Public Provident Fund (PPF)

Employee Provident Fund (EPF)

Gratuity

National Pension Scheme (NPS)

Posted: October 2018