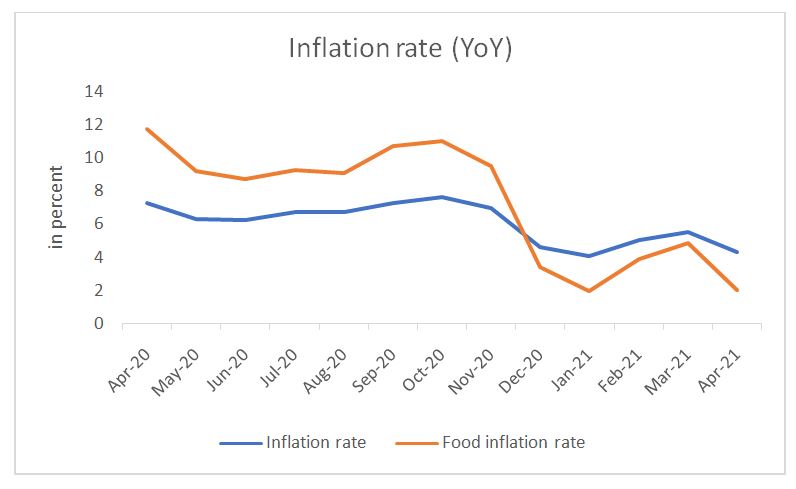

Inflation

- In April’21, inflation rate as measured by Consumer Price Index (CPI) eased to 4.29 percent.

Food inflation rate stood at 2.02 percent.

Vegetable prices registered a decline of 14.19 percent in April’21, whereas inflationary pressure on pulses and products eased to 7.5 in April’21 from 13.25 percent in March’21.

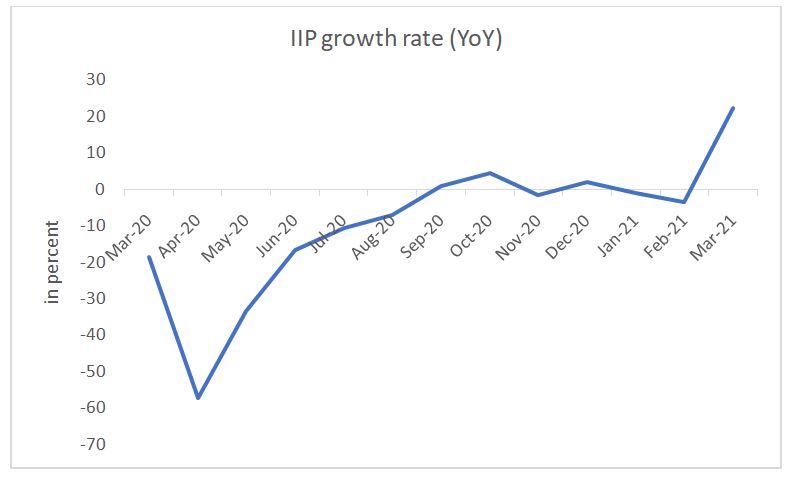

Industrial Output

- Index of Industrial Production (IIP) recorded a growth of 22.35 percent in March’21, mainly due to favourable base effect

Mining and quarrying registered a growth of 6.11 percent, whereas manufacturing grew by 25.81 percent and electricity by 22.53 percent in March’21.

Core sector output grew by 6.79 percent in March’21, compared to a contraction of 4 percent in February’21.

Manufacturing PMI in April’21stood at 55.5

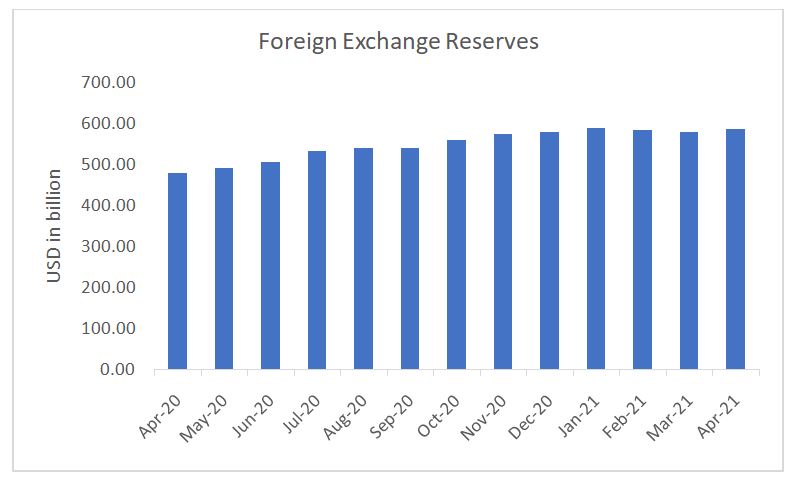

External Sector

- As on 30thApril’21, India’s forex reserves reachedUSD 588 billion.

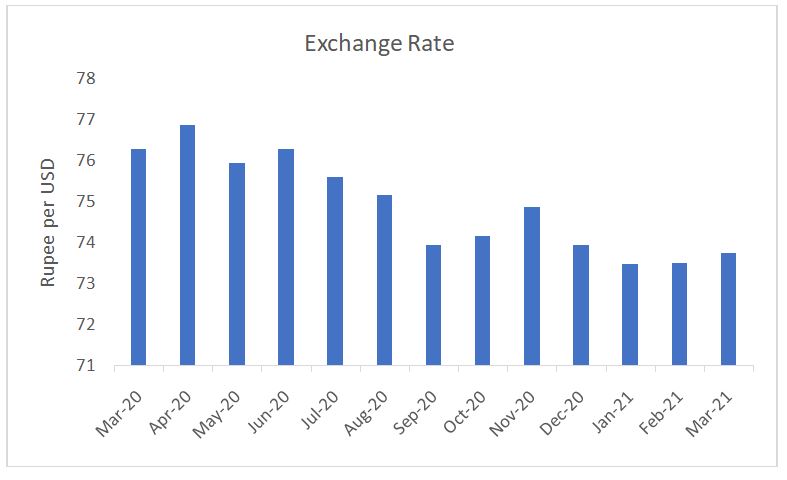

- Indian rupee against USD stood at 73.76 in March’21.

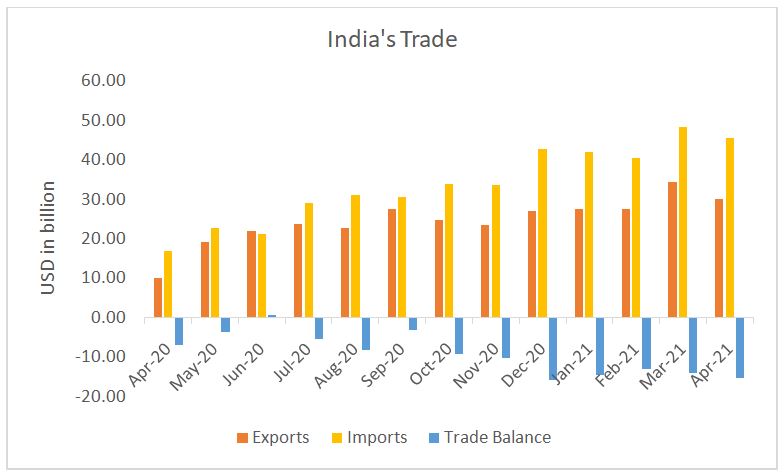

Foreign Trade

- India’s trade deficit in April’21 stood at USD 15.25 billion.

- In April’21, exports registered a growth of 197 percent (YoY) whereas imports grew by 166 percent (YoY).

Capital Market

- In April’21, SENSEX registered a decline of 1.47 percent to end the month at 48782, whereas NIFTY declined by 0.4 percent to end at 14631.

- FIIs/FPIs remained net sellers in the Indian market with the net investment in equity and debt market at USD -1.7 billion

- The net investment by mutual funds in equity and debt market stood at USD 3.7 billion in April’21.

Fiscal Scenario

- Revenue receipts of the Central government up to February’21 stood at Rs 13.7 lakh crore, which is 88.1 percent of the revised estimate for FY21

- Revenue expenditure stood at Rs 24.1 lakh crore making it 80.1 percent of the revised estimate for FY21. Capital expenditure up to February’21stoodat Rs 4.05 lakh crores, which is 92.4 percent of the revised estimate.

- Fiscal deficit up to February’21 stood at Rs 14.05 lakh crore making it 76 percent of the revised estimate for FY21.