In the last edition, while discussing moving averages, I had briefly touched upon their uses and looked at some of the technical indicators which are based on moving averages. One such widely used technical indicator where the concept of moving average is prominently used is “Moving Average Convergence Divergence” or MACD as it is popularly called. In simple terms, it does exactly what the name implies; the convergence and the divergence of moving averages or their crossover, giving trading signals. This simplicity is evident to anybody who has used this indicator at least once. The plurality implied in the name is because of the multiple moving averages that make up the MACD analysis. Let us break it down.

1. Understanding MACD

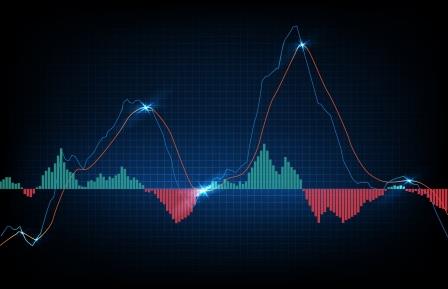

The MACD analysis involves the construction of three items first. First is the MACD line, which is a plot of the difference between two moving averages, usually the 12 day EMA and 26 day EMA. Second is the signal line, which is a plot of the 9 day EMA of the MACD line. The third is called either the MACD forest or MACD histogram, which is a plot of the difference between MACD line and the Signal line.

The construction details may interest only a connoisseur or those interested in tweaking the indicator for better results. Others may just let these details pass, as these are usually pre-sets in any normal charting tool available today.

2. Analysis using MACD

The next step is about carving out price ideas using the three tools constructed as above. As I said earlier, MACD is all about the convergences and divergences. Let us investigate both.

2 a. The convergences: Convergences happen when the shorter and the longer moving averages move towards each other resulting in a crossover, and hence these signals also called crossover. Such crossovers can happen in two ways: Centre line crossovers, or signal line crossovers.

2 a. (i) Centre line crossovers: On chart, MACD appears to move like a snake line, fluctuating between positive and negative figures. The crossing of the zero line, when it shifts between positive and negative territories is what constitute a centre line or base line crossover. Such crossovers signal that the faster day moving average, here the 12 day EMA has crossed the slower moving average, here the 26 day EMA. Centre line cross overs usually confirm a change in trend. The increase in gap between the shorter and the longer EMAs result in a steeper rise or fall in MACD, signaling that the ongoing trend’s momentum is increasing.

Trader’s note: Centre line cross overs mainly serve as a confirmation of a trend that is already in place. In other words, this is a lagging indicator. Some traders address this short coming, by just accepting it for what it is, and by not visualizing signals that it doesn’t provide. Yet some others, tweak the moving averages to suit their convenience, or also view the plot in smaller time frame, for say an hour, or 15 minutes depending on how aggressive the trading set up is.

2 a. (ii) Signal line cross overs: Signal line crossovers address the lagging nature of centre line crossovers, by signalling much before the centre line crossover occurs. These crossovers happen when MACD, the faster EMA, crosses the signal line.

Trader’s note: Though signal line crossovers answer the lagging question better than the zero line crossovers, they are still a lagging indicator. Most often this lag works well for short to medium term trading, unless you are very aggressive, trying to pick the very bottom or top. And as suggested earlier, experimenting with different time frames could give better results depending on the trading time frames.

2 b. Divergences: Divergences are much more potent than crossovers, as they serve to provide an early indication towards a change in trend. The divergence talked about here, occur when MACD stops following price closely. A bullish divergence occurs when price makes a lower low and MACD forms a higher low, while a bearish divergence occurs when price makes a higher high and MACD forms a lower high.

Trader’s note: While divergence picks are potential multi baggers, the search for the same often ends up in jumping the gun, or acting on signals way too soon. It is important to note MACD in its role as an oscillator loses its potency in a trending market. We know that there are corrections in every trending market, but not all may be trade worthy, which means that signals from divergences may have to be strengthened with signals from other indicators as well.

3. MACD Forest

MACD Forest or MACD Histogram is obtained by plotting the difference of MACD and signal lines and is displayed as vertical lines on the zero line.

Trader’s Note: By the time your analysis has reached a histogram level, you must take note that you have come far from price, having smoothed the price several times over by taking moving averages, and subtracting them multiple times. So, on the face of it, it gives a visual confirmation of what we could infer from the first two signals. But the histogram also gives out a solid trading idea. And that is the divergence between MACD and the histogram, which may not be as visible in price or the MACD crossovers or divergences.

Overall impression:

1. MACD is unique in that the same indicator gives signals toward both the strength of the trend, as well as potential turns.

2. Being derived directly from price, it may not be comparable across securities of different prices.

3. Though MACD is an oscillator, it sets itself apart from other oscillators, in that it does not fluctuate between upper and lower boundaries, because there are none. The oscillation here just refers to the journey from one side of the centre line to the other. The lack of extremities also help it score over other oscillators in that it can also be used in trending markets, unlike most of others which fail terribly once out of sideways bias.

Tail Piece

As always, no indicator is complete. To put it better, no indicator should be used in isolation, for picking trends. Indicators are meant to hunt in packs, for best results. There is no magic here, and technical analysis is a tough nut to crack. With MACD, too many indicators are not needed for corroborations though, as the convergences, divergences, and the histogram when drawn alongside judiciously with the appropriate time frames and settings give fairly usable trading ideas often times, and some brilliant set ups, occasionally.