By Vinod Nair

By Vinod Nair

We can expect some sanity in the market after having fallen by 9% from the all-time high, in a short span of 1.5 months. As on 16th of March, Nifty has reversed back to the recent low after a set of ups and downs in the last 3 weeks. We feel there is room for improvement in the near-term but volatility is likely to stay. Compared to key indices, certain set of stocks and sectors are performing fairly well, while the market continues to float near oversold region for some time with a notion to catch-up with the rest of the world, where India has been under performing till date.

It is a humble market…

Market seems to be not reacting to positive macro and micro factors. Initially, market was very humble, not celebrating the improvement in political stance after the North-East election and not responding to positive data like GDP and PMI. India reclaimed its status as the fastest growing economy with 7.2% growth in Q3 GDP. But market was easily falling to global and domestic volatility. Consolidation continued with selling across the sectors led by the financial sector due to NPA issues and increase in lending and deposit rate. Global headwinds on fears of a trade war by US, triggered by hike in duty by 25% in steel and 10% for aluminium, slid the world equity market. Metal, which was amongst the best performers in the last 2 years, is losing its sheen.

Stability in the financial market is helping the market…

We can anticipate some improvement in equity market in the near-term as financial markets stabilise. RBI has initiated open market operation post the reported banking fraud in India. Post which liquidity has marginally improved in the financial system. RBI is likely to maintain its stance till the bond market stabilizes. The 10 year yield has reduced marginally to 7.6% from 7.8% while USD/INR is stable at 64.9. At the same time, positive developments like reduction in CPI and WPI are providing depth to the bond market. CPI reduced by more than what was anticipated at 4.4% in February compared to 5.2% and 5.1% in December and January ’17, due to reduction in food prices. Other macro data like industrial production and manufacturing will also help the market.

Mid and Small caps continue to underperform, as investors are still jittery waiting for further ease in valuation. Deposit and lending rates are increasing and trajectory of inflation is still on the higher side. This augurs well for some further cut in valuation as risk-reward ratio is still dear. But here and there we can see value buying since domestic market is down by 8-9%. And, as the bond situation rationalise, equity market can extend its range. Additionally, mutual funds have high amount of cash in hand. Though FIIs are on a selling mode, MFs are increasing their exposure in equity on a MoM basis. Some stability in the global market, non-redemption in MF and availability of market at bargaining price can provide some support to the domestic market in the near-term.

Retail Investors may be pondering about PSUBs and Redemption…

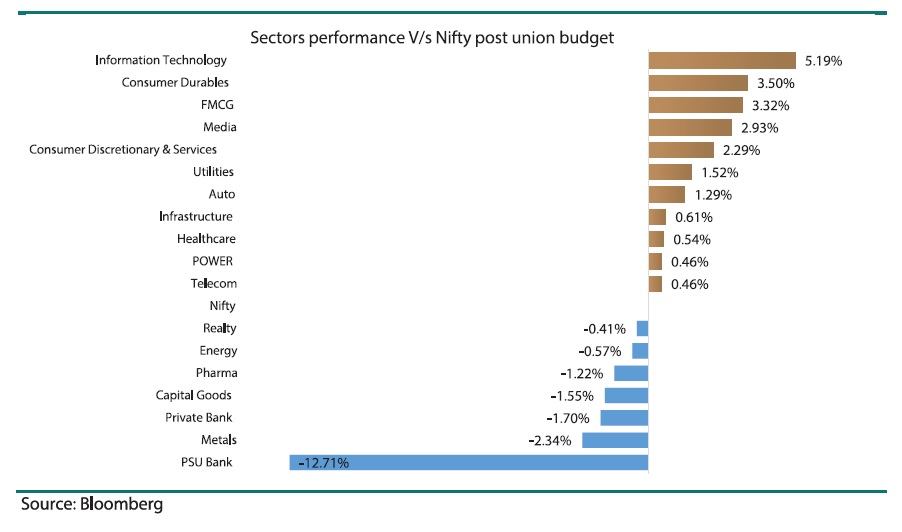

PSU Banks are a big discussion point for the retail investors given the ongoing NPA and fraud issue. Given the weak financials and likely notional losses it is difficult to infer the actual book value. It gives a vague picture and it is difficult to conclude whether it is a good time to invest in PSUBs now. It may be best to see some stability in the situation. The valuations are still high, but it can provide an opportunity in the long-term as PSU Banks consolidate into niche segments in the future. (Please see our full note on PSUBs in this edition).

The threat of redemption in the near-term as market is not performing well and risk to redemption is high due to LTCG, which will be applicable from 1st April 2018. We feel the specific impact will be shallow and will be in the short-term. Till 15th March MFs have sold only Rs500cr, compared to strong inflow of Rs16,000cr in Feb. A correction in market will be a blessing in the long-term, the best way will be to check your choice of SIPs and compare its performance, if it is outperforming, increase the pay-amount for gain in long-term as market consolidation continues.

Global Trade War…

A big talking point in the world market today is a trade war instigated by US. India was already under the belt of tightening due to protectionism in hiring and pricing for IT and Pharma sectors. As far as the imposition of tariffs on steel and aluminium by US, it is unlikely to directly impact India since our exposure to US in commodities export is limited. But indirectly it will impact over the medium-term, as it will inevitably force major steel producing countries to divert part of their exports to other major steel consuming countries like India. This could distort the domestic market considerably, raising the threat of imports and oversupply of steel leading to reduction in prices globally and in India . A 1% drop in steel prices leads to more than proportionate impact on EBITDA. Such impacts are subject to any contradictory decision taken by rest of the world and India government.

Churned to better portfolio…

Market may trend in positive trajectory as the market is near to the oversold region and the financial market is set to stabilise in the near future. A caveat is that the uptrend till date has not been very solid and India is underperforming compared to the rest of world. This underperformance may be due to constraint in the banking system (increase in bond yield) and upcoming elections. The market feels that the continuity of the ruling party strength will be difficult this time compared to 2014, which is impacting the equity market. A key state election in Karnataka is likely to be fought in the month of April-May.

Increase your exposure to outperformers like…