by Vincent K Andrews

by Vincent K Andrews

Globally, capture fisheries (fishing from natural water bodies, sea, lakes, ponds etc.) was the key source of seafood until 1970s. The industry then started witnessing a shift from capture fisheries to aquaculture (rearing and cultivation of aquatic species under controlled conditions) due to better fisheries infrastructure, disease management and government support. During last decade, share of aquaculture in overall global seafood industry production has increased from ~34% in 2006 to ~47% in 2017 and is expected to reach ~53% by 2026, while capture fisheries is expected to remain stagnant. India’s aquaculture with a size of ~USD10.6bn (representing 0.4% of total India’s GDP) contributes ~5% to global aquaculture production and ranks 2nd after China. The industry is among major contributors of foreign exchange with exported value of USD7.08bn in FY18.

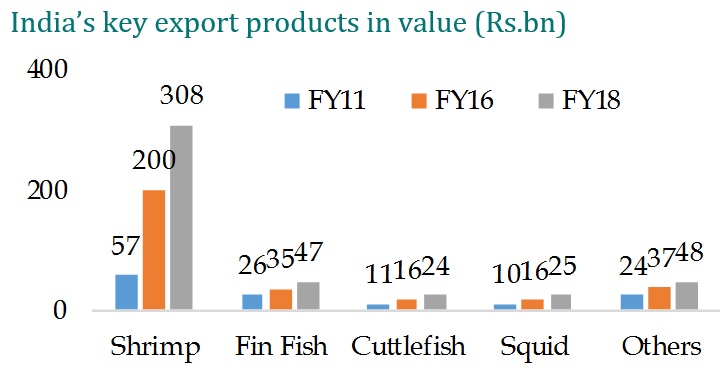

Indian marine exports market dominated by shrimps

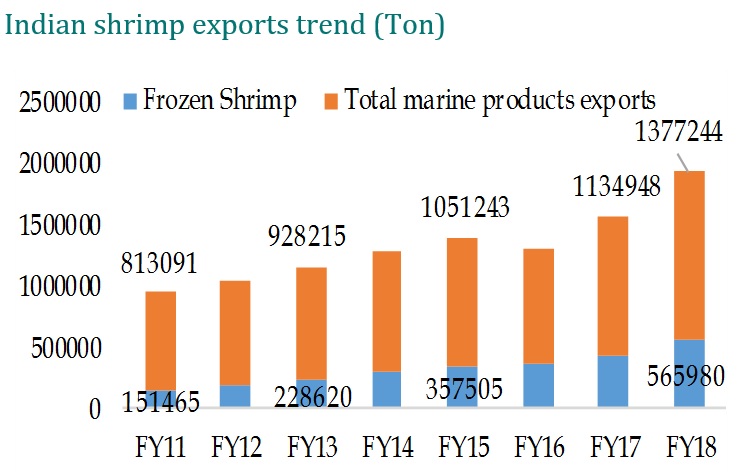

Shrimps are the major chunk of aquaculture market in India. Of the total aquaculture production in India, ~ 80% is exported. India’s marine products exports mainly comprises of frozen shrimps, cuttlefish, frozen squids and dried fish with shrimps dominating the exports basket. In FY18, shrimps contributed 41% in volume and 68% in value terms to total exports. Shrimp exports size has grown at a CAGR of 21%/27% in rupee/dollar terms over FY11-18 to Rs308bn/USD4.84bn.

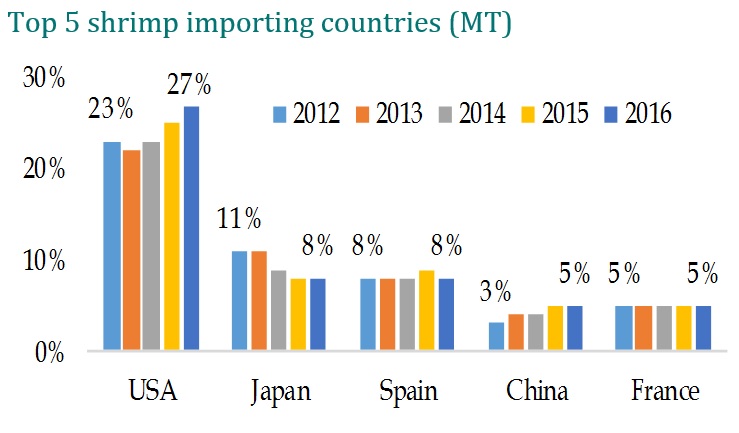

Major Shrimp Consuming countries…

As per 2016 data, USA is the largest consumer of shrimps, (29.60%) followed by China (24.30%), Europe (18.60%) and Japan (7.34%).

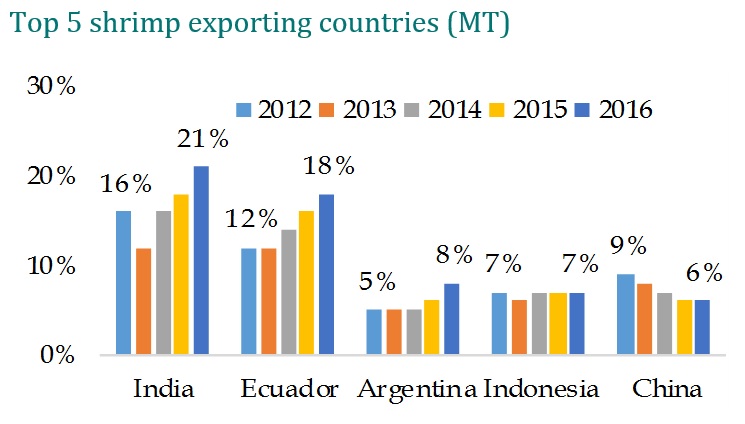

India is the top exporter of shrimp globally

The rising demand for shrimp is met by top exporting countries such as India, Ecuador, Argentina, Indonesia and China, accounting for 60% (in volume terms as of 2016) of total shrimp exports. The spread of EMS (Early Mortality Syndrome) disease in aquaculture farms in south-east Asia have helped India to gain market share.

India’s share has grown from 16% to 21% in 2010-2016.

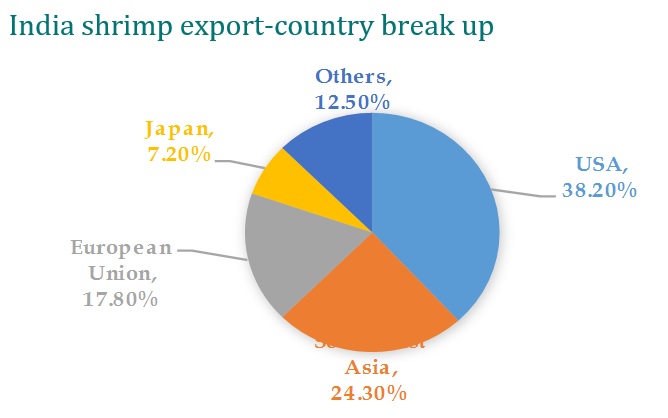

USA, the major export market for Indian shrimps…

Of the total frozen shrimp exports from India, USA is the top-most destination (38.2% in FY17) followed by south-east Asia (24.3%), European Union (17.8%) and Japan (7.2%).

India’s potential for shrimp export…

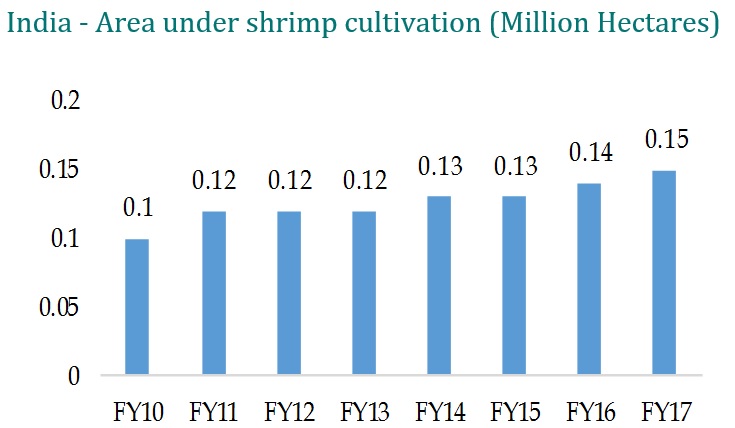

India has emerged as one of the leading seafood suppliers in the world, due to a long coast line and favorable weather conditions. The country has a long coastline of 8,129 km in addition to vast inland water resources and hence offers the scope for large exploitation of marine wealth. In India, there is a tradition of extensive culture of shrimp in large water bodies. India’s potential for shrimp production is enormous given around 12 lakh hectares available for brackish water but only 1.4 lakh hectares has been brought under shrimp cultivation.

Shrimp Value chain

Industry value chain:

- Broodstock

- Hatchery

- Cultivation, Harvesting and storing

- Processing & value addition

- Exporting

Broodstock: Pacific white leg shrimp broodstock is either sea-caught and pawned, or purchased from tank-reared broodstock from the USA. Majority of broodstock used in India is being imported from Hawaii or Florida. Broodstock imported is sent to quarantines set up by Coastal Aquaculture Authority in India to ensure the SPF (Specific pathogen free) status, before transferring to licensed hatcheries.

Hatchery: Quarantined broodstocks are kept for hatching approximately 20 days before reaching larvae stage and being sold to shrimp farmers.

Farming: Baby shrimp are fed for approximately 20 days before being transferred to open ponds, where they are reared for 120 to 180 days before developing into a fully grown shrimp. Feed is the major input in farming, constituting ~60-70% of total cost. Farmers are able to crop twice a year.

Processing & Value addition: Fully grown shrimps are transferred to processing plants for primary processing which involves slicing of shrimp heads and washing. Then undergoes sorting process based on commercially accepted sizes and weights before having their skins peeled off and being soaked in phosphate chemicals helps to maintain the quality and taste of the shrimp. The raw shrimp is then frozen before packaging. Further value addition can be carried out by partially or completely cooking the shrimp. Indian exporters are increasingly focused on value-added products, where higher value-add typically leads to higher price realisations

Four players:

Farmers

Feed manufactures

Processors & exporters

Consumers.

Shrimp farming is generally fragmented due to its labour intensive nature. Farmers generally do not have cold storages due to high cost and hence lower their bargaining power. Processors can directly procure shrimp from farmers or from agents with cold storage facility. Due to seasonality in cropping, processors need to procure in large quantum during harvest season which increases inventory and working capital requirements.

As per latest data, India has 2433 (source: CAA, India) approved farms permitted for the culture of pacific white leg shrimp, 548 processing facilities with a combined installed capacity of ~ 27,000 MT per day (Source: MPEDA) and 590 cold storage capacities with a combined capacity of ~3,03,000MT (Source: MPEDA).

Any adverse change in the demand-supply and export prices will impact the farmers most, as the farm gate prices moves in tandem with global prices. Feed manufactures will also get impacted if the farmers’ income reduces as it will affect cultivation. However, processors are relatively less impacted as they pass on the changes to farmers, but any short of supply from farmers will impact volumes.

Outlook…

Growing Indian shrimp exports…

Indian marine exports have witnessed a robust growth of 20% & 21%YoY in FY17 & FY18 respectively, after witnessing de-growth of 10%YoY in FY16. Shrimp exports which accounts for ~68% of total (in value terms) grew by 16%/30% in FY17/FY18. The increased production of L.Vannamei, along with increase in infrastructure facilities for production of value added products supported growth in the last two years. The main reasons for de-growth in FY16 was revival of the shrimp aquaculture production in Thailand and Vietnam, which was down due to diseases, resulted in better supply situation and eased the prices of shrimp in the world market. India’s total shrimp exports had touched 5.65 lakh tons in FY18 with a growth of 21%YoY.

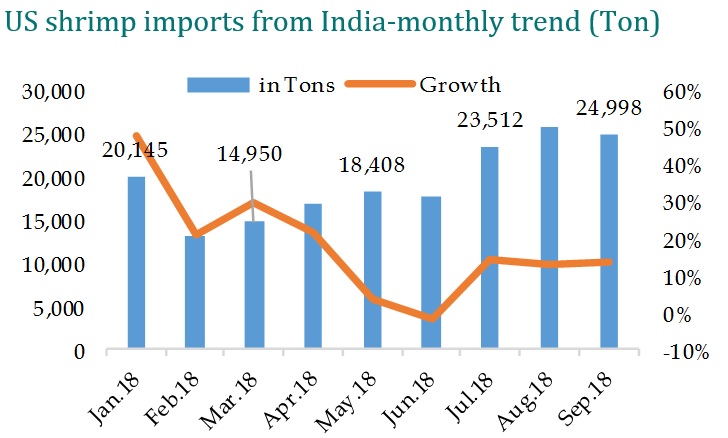

Current demand-supply mismatch in US…

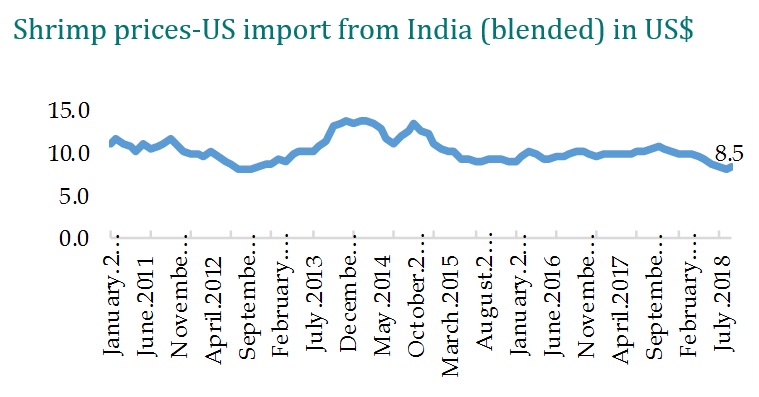

USA is still the top destination for Indian shrimp exports with ~40% contribution. The extended winter in US coupled with strong supply from exporting countries (14%YoY in FY18 Vs flat growth in FY17) caused a demand-supply mismatch in US. India’s supply to US grew by robust 39% YoY in FY18 (Vs 10%de-growth in FY17). Due to this, the shrimp prices started to decline from 2HFY18. The lower export prices of shrimp impacted the domestic farm-gate prices and hence profitability of the farmers which affected stocking density in the farms.

Measures to stabilise temporary slowdown

To stabilize the falling farm-gate prices in March/April in India, especially in Andhra Pradesh, exporters agreed to pay slightly more to farmers, after the intervention of the state government. Farm gate prices remained much lower during April-June 2018, compared with the last 5–6 years and improved sharply (~20-25%) in Q2FY19.

Indian shrimp exports to US resumes growth…

The price crash in international trade caused a near zero negotiation trade situation among the US buyers during May-June 2018, particularly with Indian exporters. Consequently, the Indian exports to the US have slowdown in the months of May (4%YoY) & June (2%YoY de-growth). However, latest US import data shows growth of 15%/13%/14% YoY in July/Aug/Sept 2018.

Shrimp prices started to stabilise from Q2FY19 from recent decline

Since India is the second largest producer and the largest farmed shrimp exporting country in the world, Indian supply and price structure are likely to influence the overall international trade. The overall production in India is expected to be stable with good harvests until October/November. Due to the excess supply and extended winter in US, the shrimp prices were consolidating to $8/kg levels (blended average) against average $10.5 levels in Q3FY18 from where the prices started to decrease. However, the sharp decline in shrimp prices is likely to support consumption going forward. Additionally, recent rupee depreciation (~13% in last 1 year) supports the shrimp prices in rupee value. The prices has now started to stabilise from Q2FY19 but the recovery will depend on the future demand-supply. Growing world population, rising incomes, urbanisation, and improved distribution channels are expected to provide further cushion to global consumption growth.

Recommendation

We have identified two investment opportunities in the sector, Apex Frozen Foods Ltd (Target Rs434), one of the largest player in processing segment and Avanti Feeds Ltd (Target Rs427), the market leader in shrimp feed segment.

Key Risks…

- Any adverse development in major markets like US and EU.

- Any high volatility in prices of shrimp, raw material and shrimp demand.

- Risk of break out of new infections/diseases.

- Any adverse change in US anti-dumping duty.

- High volatility in foreign exchange rates.