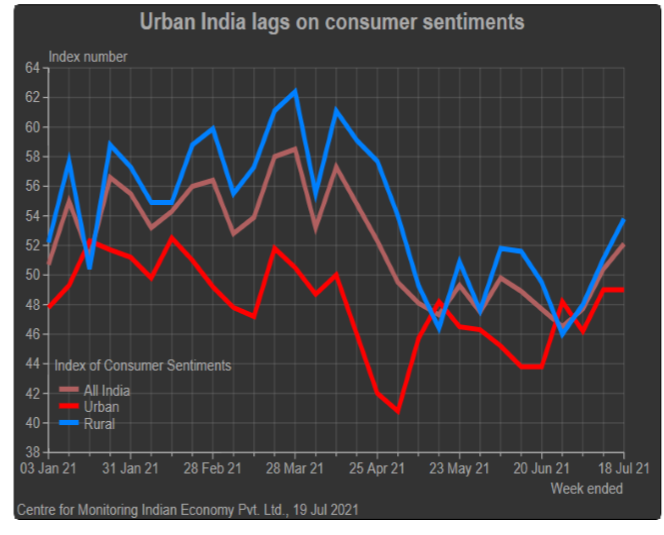

Consumer sentiments seem to be turning around in July. The week ended July 18 was the third in a row when the Index of Consumer Sentiments registered an increase. Cumulatively, the index climbed 12.2 percent over these three weeks since June 27. Consumer sentiments, badgered by the second Covid-19 wave, had been falling steadily from the beginning of April 2021. It fell more than 20 percent from its recent peak of 58.5 on March 28 to a low of 46.5 on 27 June. This fall seems to have bottomed out in late June.

The recent improvement in consumer sentiment is almost entirely a rural India story. Cumulative consumer sentiments improved by 17 percent during the past three weeks in rural India. The improvement here was also steadily robust in each of the three weeks. The Index of Consumer Sentiments for rural India scaled up by 4.3 percent in the week ended July 4, then by another 6.5 percent in the week ended July 11 and by 5.4 percent in the week that ended on July 18.

Consumer sentiments in urban India were a lot less sure-footed. They fell by 4.2 percent in the week ended July 4 but rose by 6.1 percent in the week ended July 11 and then remained flat in the week ended July 18. As a result, they ended the first three weeks of July with a modest 1.7 percent increase.

Perhaps, the rural-urban divergence in consumer sentiments reflects the movements in employment in the two regions. The employment rate improved by 6.7 percent in the first three weeks of July in rural India. Urban India, on the other hand, saw a much smaller improvement of 1.5 percent in the employment rate.

Sentiments in rural India have improved essentially because less people feel that their economic conditions have worsened over the past one year and also because less people are pessimistic about the future. But, there isn’t much improvement in the people who feel that their own conditions have improved. There is less despondency in rural households on the state of economic wellbeing but there isn’t any improvement in the spread of growth. Households reporting growth continue to remain abysmally low.

In the week ended July 18, only 4.6 percent of the rural household respondents said that their incomes were higher than a year ago. This is worse than 5.4 percent who said that their incomes were better than a year ago in the week ended June 27. Similarly, the proportion of rural households that said that this is a better time to buy consumer durables dropped from 2.3 percent as of the week ended June 27 to 1.9 percent in the week ended July 18.

Although rural households do not yet reflect optimism on their current economic conditions they have started showing greater confidence in the future. Like in the earlier case, we make comparisons between the week ended June 27 and the week ended July 18. The proportion of rural households that expect their incomes to improve in a year has gone up from 2.5 percent to 3.2 percent. This is abysmally low but the consolation in the numbers is that they are moving in the right direction. The proportion of rural households that expect the financial and business environment to improve in the coming twelve months has increased from 2.8 percent to 4.7 percent. And, the proportion of households that expect financial and business conditions to improve in the coming five years has increased from 2.8 percent to 4.5 percent.

The improvement in rural consumer sentiments could be the result of a revival in monsoon. In the weeks ended June 30 and July 7, the monsoon precipitation was 30 percent and 46 percent below normal. In the week ended July 14, the precipitation was only 7 percent below normal.

The monsoon this year seems fickle. Early indications suggest that the week ended July 21 may not be great. Errant monsoons have had an impact on kharif sowing. As of July 16, these were down 11.6 percent compared to a year ago. All major crops except for sugarcane, arhar, sunflower seeds and jute had recorded lower sowing compared to a year ago. Prices have been high and the IMD continues to talk of a monsoon revival and normal monsoons this year. Hopes therefore are alive of a reasonable if not robust turnaround.

Much of the Indian corporate sector reposes faith in rural India to fuel its growth. Post the two Covid-19 shocks, NBFCs have been complaining of increased delinquencies. It will help these companies that the proportion of households reporting a fall in income has started to fall. Of course, it is important this is just the beginning. Fast moving consumer goods companies have mostly held the view that the urban markets have saturated for them and further growth is possible mostly in rural India. But, for these markets to grow it is imperative that there is an increase in households that report an increase in income. A mere fall in households reporting a fall is not enough. Consumer goods companies need to see an increase in households reporting willingness to buy. This is still some distance into the future.

Article first published in Business Standard