Markets have always reacted to news regarding Foreign Institutional Investors (FIIs) Foreign Portfolio Investors (FPIs). On a dynamic basis, it has been their daily buy and sell which has had an impact on the markets. So let us know more about FIIs or FPIs as they are known now. Mr. Justin Jose, Branch Manager of CG branch had raised a query on this, based on a client request.

FPI – Foreign Portfolio Investors

FPIs are allowed to invest in Equity, Depository Receipts, MFs, ETFs, and Debt and these are held by investors in another country. Just like a normal portfolio investment, this is done in the expectation of making a return, higher than what they would have made in their home countries. As a result, some of the countries, which see a high level of foreign investor participation, are usually developing or emerging market economies, which have relatively higher growth potential, as compared to the host investor’s country (usually a mature economy). This is the reason why many foreign investors are interested in India. The attractive rate of growth and potential businesses to invest in emerging markets are impressive. The FPI regime in India is regulated by SEBI, and it merges two existing modes of investment, i.e. Foreign Institutional Investor (FII) and Qualified Foreign Investor (QFI).

Following are the few types of FPIs investing in India:

- Hedge Funds

- Foreign Mutual Funds

- Sovereign Wealth Funds

- Pension Funds

- Trusts

- Asset management Companies

- Endowments, University Funds, etc.

There were earlier 3 categories of FPI. But following a SEBI review of FPI regulations, FPIs were re-categorised into 2 categories. Category I – Government and government related foreign investors such as Central Banks, Sovereign wealth funds, and Appropriately regulated funds including MF, Insurance Cos., Banks, AMCs, Investment/Portfolio Managers, and University funds, Pension Funds etc. Category II – Appropriately regulated funds not eligible as Category I, endowments, charitable societies, corporate bodies, Trusts etc.Appropriately Regulated funds account for around 50% of the total FPI flows into India, followed by Pension funds, Sovereign wealth funds, and foreign government agencies.

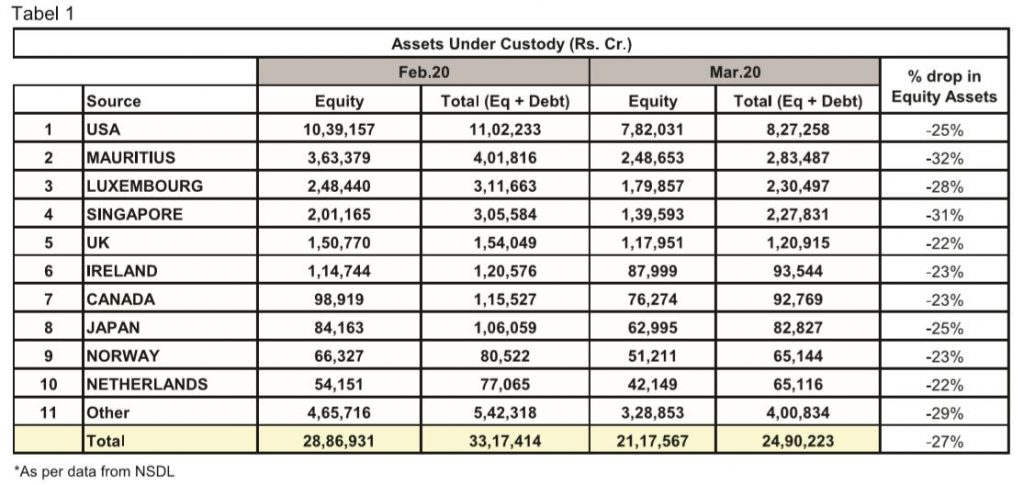

Below is a chart, which shows the Top 10 countries which bring in Investments. The market crash in March has impacted the FPI Assets under Custody (AuC). There was net selling of around Rs.60000 Cr in equity by FPIs and combined with the value erosion, their equity assets registered a drop of 27%.

FPI is different from Foreign Direct Investment (FDI). With FPI, the investor does not actively control the company and has no direct control over the assets or the business. FDI means to purchase or building up direct business interest in the country. The FDI investor is actively involved in the running of the company. As such, the FPI route is more feasible for foreign retail investors and offers the investor a chance for a quicker return on investments and liquidity. From the Indian economic perspective, FDI is more attractive than FPI since it generates employment, strengthens infrastructure, and advances technological innovations, and is more of a long-term investment. This is compared to FPI money, which is considered as “hot money” or more volatile than FDI money.

Although FII investment is an important source of capital for emerging economies, many nations, including India, have placed limits on the total value of assets an FII can purchase. This helps limit the influence of foreign entities on businesses and the nation’s financial markets. There is also the risk of damage to the economy and the currency if foreign investors flee during any adverse situation. New FPI limits, effective from April 1, 2020, was announced in 2019 Union Budget and confirmed by the Ministry of Finance in October 2019, in which the FPI limit in individual companies was raised from 24% to the respective sectoral limits. Sectoral caps or limits refer to the maximum amount of investment in notified sectors by outside investors and the limit is decided by the Ministry of Commerce and Industry. The limits to each sector depends on their category. There are sectors that fall under the 100% or up to 100% automatic route, meaning no requirement to obtain approval (like Agriculture, Manufacturing, Pharma, Automobiles); sectors that come in FDI under government route, meaning investment in it requires approval of respective ministry (like Print Media, Broadcasting content services); and sectors that can be invested partly under automatic and balance under government route (like Air transport services, Defence, Telecom).

Total Equity Assets under Custody (AuC) in India, as per data from NSDL, is more than Rs.53 lakh crores. 40% of the total equity assets are held by FPIs, around Rs.21 lakh crores. The remaining major investors in equity are Mutual Funds (16.5%), FDI Investments (15.2%), Insurance Companies (13%) etc. This in itself highlights the importance and the power of FPIs. This is a better situation, as compared to even 5 years ago, when FIIs held close to 60% of total equity AuC and MFs held just 9% (as on March 2015). Since then DIIs have started increasing their percentage ownership in equity.

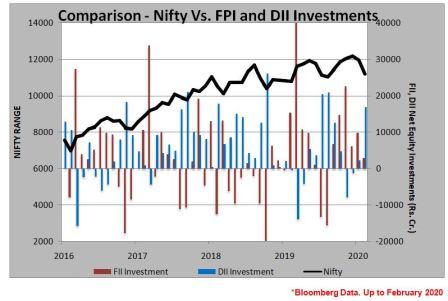

FPI investments have always had an impact on the markets. The chart below highlights the correlation between FII, DII investments, and the stock markets.

From the chart, we can see that Institutional investor investment has a clear correlation with the Nifty performance. But what we also need to note is the support of the DIIs in the past few years. A market rally has always been preceded by an increase in DII (Domestic Institutional Investors) participation, while the subsequent positive FII inflows have prolonged the market rally. Of late, we have seen a good amount of DII support when the markets have fallen. Even in March, when the FIIs net sold Rs.60000 Cr of equity, DIIs stepped in with Rs.55000 Cr of net buying in equities. This should be seen in a positive light, considering the discount at which many of the companies were trading at. Provided their sectoral and stock picks are right, investors can expect better returns, when the markets stabilize and the FIIs make a comeback. This has to happen, considering that India is expected to be one of the few countries with a positive GDP growth rate for 2020.

Investors need to understand that our domestic support is also now almost matching with the FII inflows, and would have played a major part in supporting the markets from a worse fate. During mid-2019, DIIs stepped up their equity investments, when FIIs were net sellers. It was only when the market started recovering that the FIIs started emerging as net buyers of equity. In fact, the trend is visible across the chart from 2016. DIIs have increased their participation when the market has fallen, and ideally, this should have translated to better returns for the investors when the market subsequently recovered along with an increase in FII participation. DIIs have emerged as a strong offset to FII selling, but the market still gives more importance to the FII selling rather than DII buying. The DIIs have been supported by strong SIP inflows, which translated into a monthly investment of around Rs.8600 crores systematically into equity. Total DII equity ownership has steadily increased over the last few years. This portends well for the equity markets because this means the Indian mindset is changing towards equity and they are well placed to take advantage of the returns on offer, in the long term.

For now, FPIs/FIIs play a major role in deciding the direction of the markets and it plays an important role in building up the markets. Hope this has helped you in understanding FPIs and the role they play in the Indian capital market.

A valuable Information, thank you

A good researched information. Thank you very much.