From the desk of Ashok T Kanawala, Vice President – Products & Business Development, HDFC Asset Management Co. Ltd.

From the desk of Ashok T Kanawala, Vice President – Products & Business Development, HDFC Asset Management Co. Ltd.

India being the biggest democratic country (in terms of population) in the world, elections have always assumed a special place in the country’s psyche. From 17.3 crore voters and 53 political parties in the first election (1951) to 83.4 crore voters and 465 political parties in 2014, elections in India have evolved over time with adoption of electronic voting machines and None of the Above (NOTA) option being introduced in the electoral process.

While the outcome of election does impact various aspects of our economy in different ways, the skepticism associated with stock markets leading up to the elections is palpable. The biggest fear in investors’ minds leading up to the elections is the possibility of a fractured mandate resulting in a coalition government of multiple parties.

However, is this skepticism warranted if one is looking for long term wealth creation? Do coalition governments really spell bad news for markets in the long run? Do election results actually have any bearing on market returns?History answers these questions for us better than anyone else.

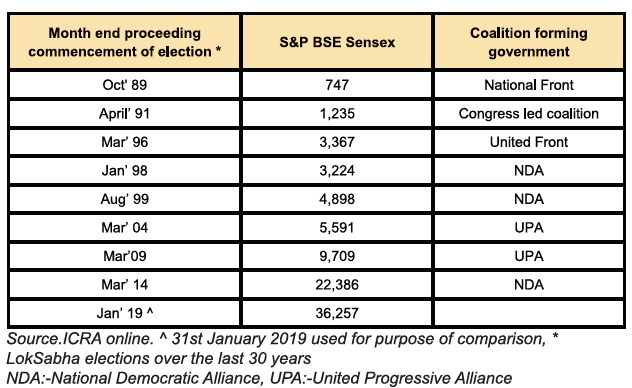

Although, it can be observed that India has consistently had coalition governments over the last 3 decades, SENSEX has grown almost 50 times from 747 in October 89 to 36,257 as of Jan’19. In spite of the risks associated with coalition governments, markets continue to reward patient investors. Why so?

In the long run, financial markets are dependent on the economy and track a country’s economic growth/corporate profitability, although, in the short run they may not move in tandem with economy, owing to market sentiments driven by various factors.The relation between economy and markets can be explained with a simple example. We go to a park where we see a dog owner walking his dog. While the dog owner walks the dog in a particular direction, the dogleaps randomly from one direction to the other, stops abruptly, barks at passersby etc. While one cannot predict what the dog will do next, one can be sure that the dog will eventually reach the destination where the dog owner is headed. Similarly, as an investor, one needs to pay more attention to the long term growth of economy instead of short term volatility in the markets.

Any volatility leading up to the elections, due to uncertainty about election results, could provide a good buying opportunity for investors looking for long term wealth creation.

While you may not be untouched by the hype around elections, your investment decisions should be free from any predictions and uncertainties around election outcome. Next time someone asks you whether election results have positive or negative impact on stock markets in the long run, you can certainly opt for NOTA.

“The opinions expressed in this article are those of the author alone and not of HDFC AMC, and should not be regarded as investment advice. Investors should obtain their own independent advice before taking a decision to invest in any securities.”