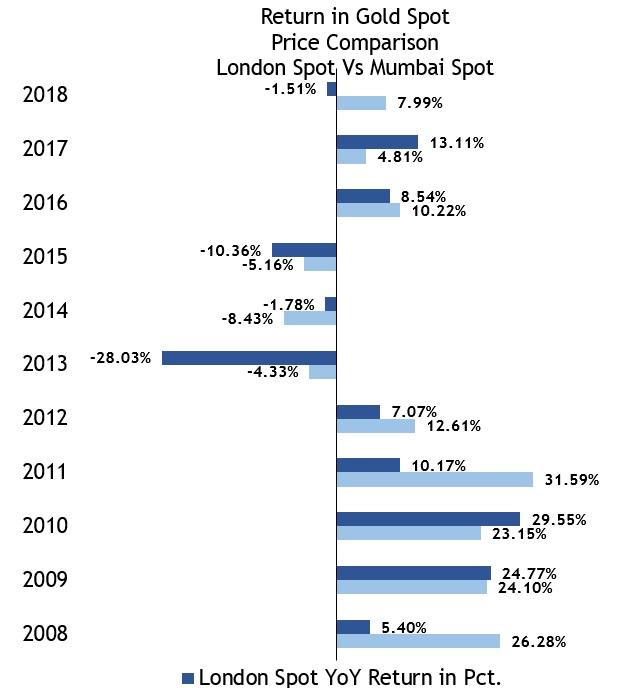

The benchmark London Spot gold closed the year 2018 moderately down by about two percent, near $1,282 a troy ounce. Though prices fell to a one-year low of $1,160/troy oz. in August, an overall breakdown in global equity markets and escalating geopolitical tensions reinvigorated gold’s safe haven appeal in the last quarter of 2018.

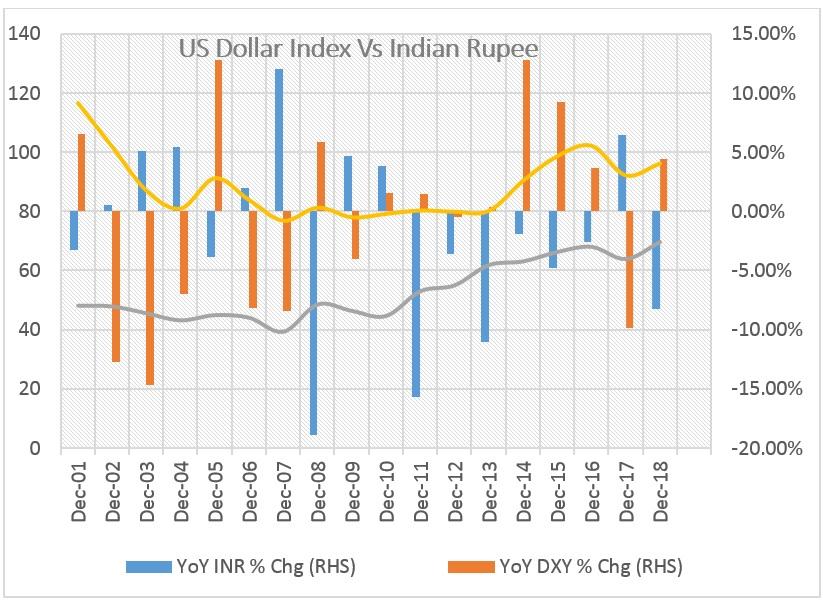

The yellow metal had faced significant headwinds for most of the year. Rising U.S. interest rates had reduced gold’s appeal as a safe haven earlier. A firm greenback makes gold expensive for holders of other currencies as the metal is priced in dollars. Since the U.S. administration started imposing tariffs on imports, the dollar index strengthened and prices jumped to a one and half year low during mid-October.

However, concerns over slowing global economic growth and the impact of tariff clashes between the world’s two large economies influenced investor sentiment. Anxiety over Brexit, Italian budget crisis and health of emerging markets hit investor confidence as well, prompting them to bet on safe haven assets like bullion.

In the meantime, even as sentiments stayed subdued in the international market, domestic gold prices held firm supported by a weak local currency. A weak currency increases the landed cost of commodities imported into the country. Gold in key MCX futures platform closed the previous year at Rs 31,391 per ten grams, up about eight percent.

Why Gold in 2019

Since 2014, gold has effectively meandered in a tight range of $1050-1380 an ounce. But, there are signs that gold may make an effort to challenge its upper obstacle of the range by breaking the multi-year long commodity cycle in the coming months. Moderate pace of global economic activity amid trade disputes between the world’s top two economics and a possible correction in dollar is most likely to support the metal.

As a safe-haven, gold’s demand historically has been strongly responsive to periods of heightened risk. Worries over increased market uncertainty is likely to prompt central banks to adopt more proactive economic policies, which will make gold increasingly attractive as a hedge.

The U.S. Federal Reserve has signalled a more neutral stance on their policy during this year, therefore, the impact on policy changes are expected to be limited. Usually gold faces headwinds from higher interest rates and strong dollar. Gold’s performance was largely affected by a strong dollar last year.

As consumer goods and long-term saving vehicle, gold demand historically has been positively correlated to economic growth. Structural global economic reforms in emerging markets, especially from the key consumers like China and India, is most likely to prop up demand from these countries. China is the world’s top gold consumer followed by India. Both country’s internal demand was limited last year due to high domestic prices.

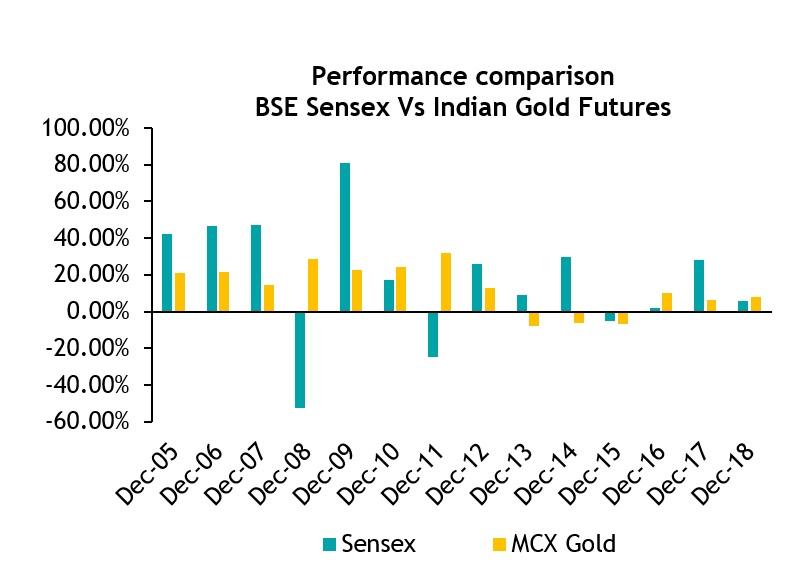

Increased central bank buying to diversify their foreign reserves and counterbalance fiat currency risk may also lift the demand for the yellow metal. A volatile global equity market and mounting geopolitical tensions would add more support to prices.

World Gold Council too expects positive outlook for gold this year. In their 2019 outlook, the agency said that ‘the interplay between market risk and economic growth in 2019 will drive gold demand’. The agency predicts gold’s performance in the near term to be heavily influenced by perceptions of risk, the direction of the dollar and the impact of structural economic reforms.

Gold had an unprecedented run-up from 2004 to 2011, when the price of gold went up from $400 to $1900 an ounce. Need for gold as a safe asset amid concerns over global recession, western driven investment demand and physical demand from India and China had supported the price during that period.

Though central bank buying remained steady, investment and physical demand for the yellow metal has moderated after September 2011. This was due to recovery in the global economy which limited the fear-appeal of gold. High domestic prices impacting physical demand in India and China also weighed on the sentiments. Moderate demand prospects kept prices under tight region since then.

Indian scenario

Domestic gold had given positive return for the last three consecutive years. This was particularly due to weak domestic currency. Since hitting its lowest level of Rs 24251 for ten grams in 2015, MCX futures prices gained about thirty percent so far due to weak INR.

During 2018, rupee had weakened by more than nine percent on strong dollar and weak momentum in emerging market currencies. Widening current account deficit and net capital outflows influenced the currency. Many emerging market currencies like Turkish lira, Brazilian real and South African rand have dropped sharply last year. During October, the Indian rupee hit an all-time low of Rs 74.48 versus the dollar but closed the year at Rs 69.56. Considering its last ten year performance, Indian rupee has depreciated about 75 percent.

At the same time high domestic prices kept investors away from taking large positions. This has led to a decline in gold imports.

Looking ahead, if the key demand pillars of gold continue to work together and supply remains steady, there are high chances of gold continuing its positive momentum. If economic sentiments continue to weaken and global geopolitical conditions remain the same, gold would be the front runner this year. On the price front, a tight trade inside $1,370-1,160 a troyoz would be seen initially. Breaking either side would suggest fresh directions to the commodity. The immediate upside hurdle of $1370, if broken, gold can move up to $1500 or even higher later.

In the domestic market, uncertainties over upcoming Lok Sabha elections and its aftereffects on equities and currency market would set domestic gold’s direction.