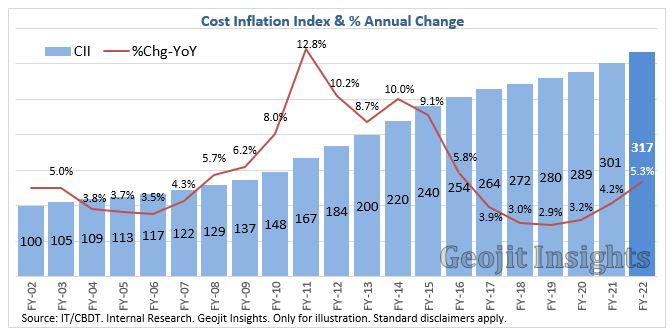

CBDT had notified Cost Inflation Index (CII) for the FY 21-22 (AY 22-23) as “317”, a rise of 5.3% year on year, high since FY16.

What is a Cost Inflation Index? Cost Inflation Index, also referred to as CII, is an index maintained and notified by Central Board of Direct Taxes, on an annual basis, according to Section 48 of the Income Tax act. It essentially measures the relative inflation that prevailed between two given Financial Years.

How CII is computed? According to the explanation given in Section 48 of IT act, CII of a financial year is notified by the central government, having regard to 75% of the average rise in CPI (Urban) index during the immediately preceding previous year. The comparison index is changed to CPI (Urban) since 1-4-16.

Base Year shift for CII: Base year is the year from when the CII series is being published with the base value as 100. Earlier the base year for CII used to be 1981-82. Budget 2017, proposed to amend the Base Year of CII from 1981-82 to 2001-02. The reason for base year change is mainly due to the difficulties and problems tax payers used to face for valuing the properties bought before the 80s. It was equally difficult for the tax authorities to go by such reported valuations. Henceforth, for capital assets (properties) bought before 2001, Assesses can use the ‘Fair Market Value (FMV) as of Apr.2001’ or the ‘Actual cost of purchase’, whichever is higher.

CII and its applications: CII is primarily used to compute the inflation effect, also called indexation, on the gains during the sale of certain specified assets and investments such as property, debt mutual funds, certain specified listed debt securities, gold, unlisted shares, etc.

What is Indexation? Indexation is the process of improving ‘Original cost of acquisition’ of a capital asset, with that of inflation as measured by CII that prevailed during the holding period while calculating the capital gains. Since gains are the difference between sale value and the purchase cost, an improved cost of acquisition (as per CII) would likely result in lesser gains, and hence lesser tax outgo. Indexation benefit helps in ascertaining the capital gains after adjusting for inflation, to reflect a more realistic economic result.

Gains arising out of sale of capital assets are called capital gains. Capital Gains can be of 2 types, Short-term and Long-term depending on the asset type and the holding period. There are stipulated holding period for different assets for the gains to qualify as ‘long-term’.

• In the case of Property: Gains arising from the sale after 2 years (since Apr’17) qualifies as long-term capital gains.

• For Debt and non-equity mutual funds, gold, etc.: Gains arising from sale after 3 years, qualifies as long-term.

How to calculate the Indexed cost of Acquisition / Purchase?

Indexed Cost of Acquisition / Purchase = Original Cost of Acquisition X [CII during the year of sale / CII during the year of purchase or 2001-02, whichever is later]

Effective Use of CII in Mutual Funds with Indexation Benefits: (Non-Equity Oriented Schemes like Debt Funds, FMPs, Gold Funds, etc.)

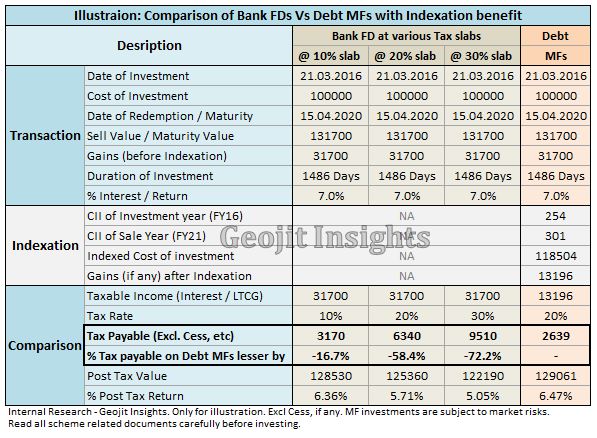

Below table illustrates the tax impact of income from FDs (interest) and Debt funds (Gains).

Let’s assume, that an Individual invests Rs. 1,00,000 on 21.03.2016, in a Debt Fund that is eligible for Indexation. She redeemed the investments on 15.04.2020 at Rs. 1,31,700, resulting in a gain of Rs.31,700 with a 7% CAGR. Gains are Long Term, since the investment is held for more than 36 months.

In the case of FDs, the entire income (Rs.31,700) is taxed at the Individual’s respective Tax Slabs (as applicable). Which means an assessee at 30% Tax bracket would have a tax liability of around Rs.9510 and those in 20% Tax Slab, around Rs.6340 (plus cess, etc). On the other hand, Debt MFs are taxed after indexation, improving the cost of investment at the pace of CII rate. This is where Debt mutual funds scores over other fixed income investment options (without Indexation benefits). In Debt funds, with Indexation, the tax liability works to Rs.2639, which potentially brings down the tax liability by -17% for those in 10% tax slab ; -58% for those in 20% tax bracket and by -72% for those in 30% tax bracket on a Rs.1 lakh investment.

CII has moderated due to the decline in the average CPI inflation, from FY16. Yet, Debt mutual fund Investors were able to reduce on the tax out go, due to the Indexation benefits it carries. During high inflation years, the tax advantages could be more (as CII would be higher), sometimes resulting in nil tax (like it happened during FY’10 to FY’15). Debt Mutual Funds has a good potential to maximize the post-tax net yield and returns by way of indexation benefits, and hence lesser tax outgo.

Extending the redemption date and availing additional year of Indexation benefit: As CII and indexation are applied and calculated on a financial year basis, Investors can avail additional year of indexation benefit by holding the investments and crossing over to another financial year (of course, subject to investor specific requirements and circumstances). Many informed investors do this.

Taking the same illustration, one could notice that the redemption took place on 15.04.20 and since it falls in FY20-21 investor was eligible to avail indexation for 5 years (FY16 to FY21).

Key points to keep in mind while investing in a debt scheme:

Debt MF offers advantages over other traditional fixed income products, but they also come with Market, Interest rate, Liquidity and Credit risks. As explained by us earlier at different occasions, primary factors one should consider while looking at debt funds are, the Credit quality of the portfolio – how much of the instruments are rated AAA / Sovereign and below ones, the average maturity and the modified duration – which basically indicates the degree of fluctuations in case of interest rate changes, the concentration level in the portfolio – how much % weight the top holdings / sectors carry, single group or company exposure, the scheme’s and the fund manager’s track record, the risk management processes adopted by the fund house, etc. It is highly advised that investors study and understand these factors thoroughly before investing.