The precious white metal, silver, is trading near multi-month high in the international market. Since mid-November last year, the commodity has gained about 15 percent due to escalating global geopolitical tensions and a weak dollar.

The precious white metal, silver, is trading near multi-month high in the international market. Since mid-November last year, the commodity has gained about 15 percent due to escalating global geopolitical tensions and a weak dollar.

Silver has been in an extreme bear market since hitting its all-time high of $49.51 during December 2011. Prices have been confined in a tight range of $22.16-13.6 an ounce since 2013 in the key London spot market. Upbeat global equities and a rally in US dollar had made the sentiments of metals like silver feeble.

High industrial usage

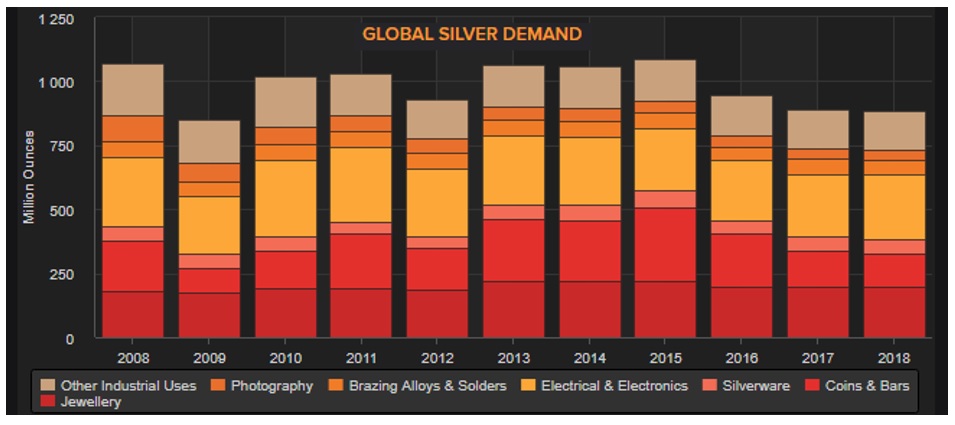

Silver has a uniqueness in metals complex as it is treated both as an industrial metal as well as precious metal. Approximately, 60 percent of silver demand comes from industrial requirements and the rest from investors in the form of coins and jewellery.

This soft, ductile heavy metal has the highest electrical and thermal conductivity among all metals. These special characteristics make silver an indispensable one in industrial areas like electricals, electronics and optic as well as photography. About half of the global industrial demand for silver comes from these industries alone.

Silver has fewer substitutes in a wide range of industrial applications like making electrical components, solar panels and chemical-producing catalysts, etc. Nowadays the metal is largely used in micro-electronics devices like smartphones and making of electric wires, switches and printed circuit boards as well. Its malleability, ductility and its uniquely beautiful shine makes it a perfect metal for making jewellery and silverware.

Demand supply mismatch makes silver a potentially promising investment

Considering the demand – supply scenario it seems that silver has further tremendous catch-up potential.

Silver market has been in deficit as demand has been outpacing production for the past several years. Production outpaced demand only in four years during the last 18 years. Output throughout the globe has declined especially from top producers like Peru, China and Argentina due to supply disruptions. Mexico ranks first among silver producing nations followed by Peru and China. These three counties contribute almost half of global silver production.

The production shortfall is chiefly associated with the conservative development activity of many precious metal companies in the earlier years. Mine activities of most of the companies were completely stopped due to record low prices, leading to supply tightness.

Weak base metals prices and related mine closures of lead, zinc and copper also adversely affect the output of the by-product silver as well.

Though the commodity is found in the earth’s crust on its own in a pure form, it is also most commonly mined as a secondary metal, usually found combined with gold, copper and lead. Only about 30 percent of silver is mined from pure silver mines, while the rest originates as by-products from other mines.

In 2018, mine output of silver posted a record straight sixth year of decline. Market expectations are that silver production and decline of overall silver supply would extend till 2019 as output from the new mines are seen barely compensating the shortfall from the base metal mines. Silver production for the year 2019 is expected to be the lowest since 2013 due to closure of several medium and large sized base metal mines and lack of new investments.

Historic price performance and gold-silver ratio

Silver has been prized for centuries as an investment and storehouse of wealth and used as a medium of exchange. While considering its historic performance, a ten percent increase in gold would attract 12-14 percent change in silver prices. So, it is clear that silver is more risky, but also potentially a more promising investment.

Gold-Silver Ratio

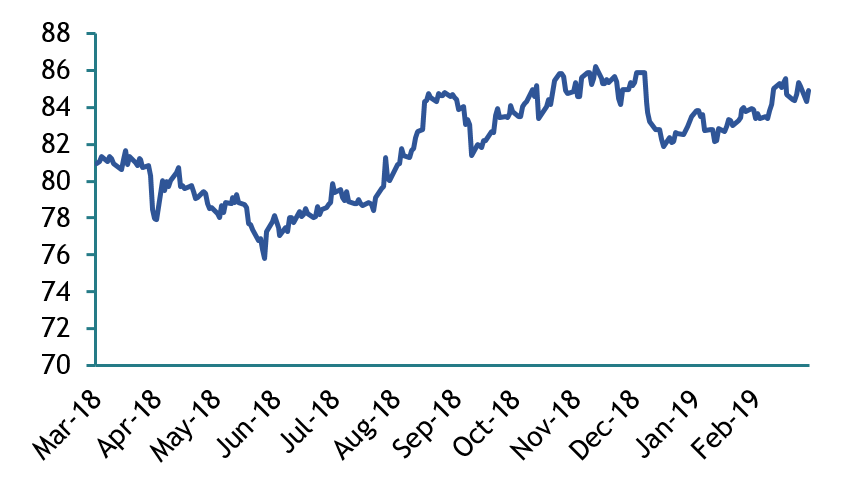

The other reason for additional prospect on silver is the historic gold-silver ratio. The gold-silver ratio is defined as number of silver ounces required to buy one ounce of gold. The ratio between gold and silver price would always at 16:1. This is because availability of silver ounces in the earth’s crust is approximately sixteen times higher than gold. The same ratio is found for annual silver and gold production as well. This is the reason for the historic price ratio between gold and silver of 16:1. Meanwhile, the current price differential between gold and silver is 75:1.

Present market scenario

Most recently, gold’s cheaper cousin’s safe haven demand rose sharply. This was due to the U.S-China trade disputes and a weak dollar. The prevailing U.S. – China trade dispute has put strains on the global economy and global agencies like IMF cut their global growth rates recently. A weak economic forecast usually prompt investors to bet on safe haven assets like gold and silver. As an investment avenue, silver is considered a secure and affordable investment and has earned a place in portfolios of many investors.

However, slow global economic growth prospect may adversely impact the industrial usage of silver. Though the commodity is highly popular among consumers as jewellery, the metal has numerous industrial uses. Due to its high conductivity of electricity and heat, it is an essential component in many industries. Almost 60 percent of annual silver production is consumed for industrial application only.

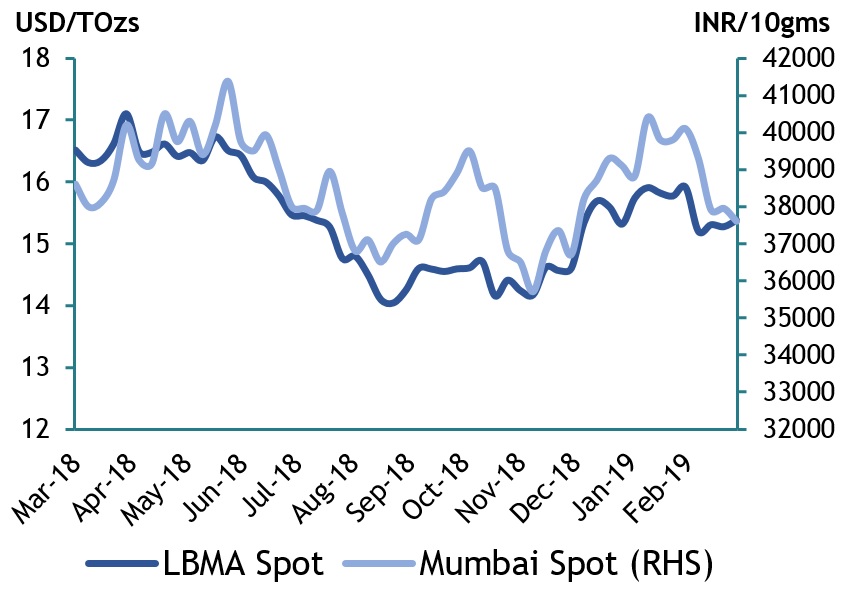

At the same time higher demand for non-industrial use of silver may lift the sentiments. As per the GFMS Gold Survey Report, silver jewellery consumption in India had increased by 20 percent in the fourth quarter due to its affordability, and as an alternative to gold jewellery. However, silver prices in India have a bearish tone even though a recovery was seen in gold and multi-year lows in domestic currency.

Looking ahead

Expectations of more economic stimulus from China to revive economic growth may perhaps lift the global industrial activity and support silver. Prospects of higher demand for electronic vehicle and solar panel segments are likely to push demand later.

On the price front, as it stays firm above the psychological resistance of $15 an ounce, it is expected to continue the positive momentum. If the weak global economic sentiments continue, a move to $17.2/18.6 an ounce is initially expected, followed by $21. Anyhow, a close below $14.20 would negate any bullish outlook in the counter. In the Indian market, weak domestic currency and high demand for silverwares may support the prices. If the strong support of Rs 37000 a kg stays undisturbed, the commodity could edge higher later.