By Geojit Commodity Research Team

By Geojit Commodity Research Team

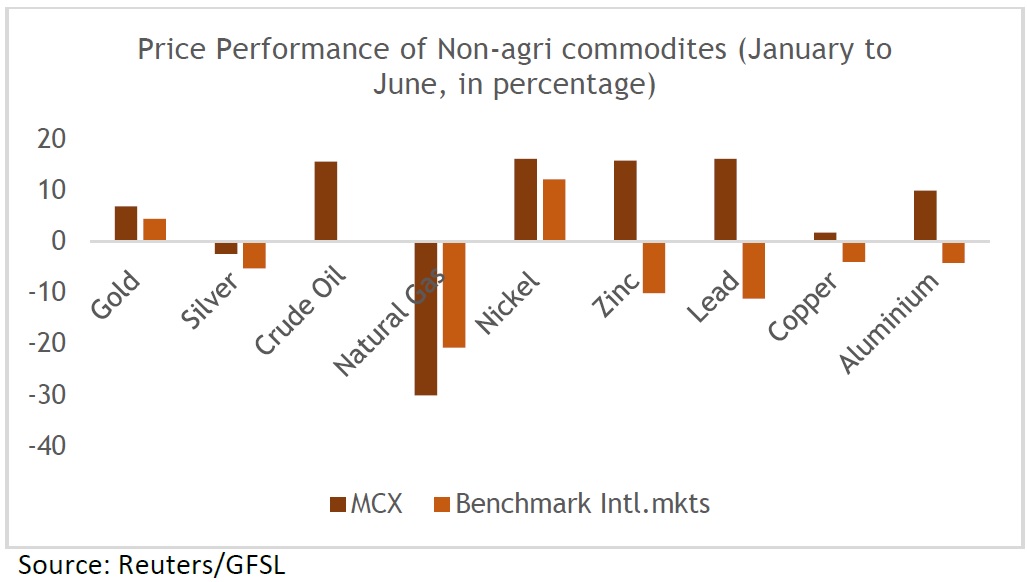

As the first half of 2019 draws to a close, we are witnessing lacklustre performance in many commodities. Debilitated business confidence in advanced economies have rendered support for safe haven assets including precious metal gold. Whereas, industrial metals and crude oil slipped in global platforms facing headwinds from sluggish demand.

Uncertainties surrounding trade policies between the world’s top two economies, the US and China, and Brexit worries continue to brew concerns over commodity prices. The downwardly revised global economic growth forecast for 2019 from IMF added to the concerns, while decelerating industrial activities in China and Euro area worsened the sentiments in financial markets.

Amid waning economic growth prospects, the US Fed has signalled more accommodative policy stance to prevent further deceleration. Apparently, the major central banks including the European Central Bank, the Bank of Japan, and the Bank of England have all shifted to a more relaxed policy stance to negate the effects of trade tariffs.

Bullion

Spot gold rose to $1383 an ounce in the international market, its highest level since March 2014. Geopolitical tensions, especially from the Middle East and feeble economic releases from China and US raised the metal’s safe-haven demand. Weak global growth forecast amid growing trade tensions and hopes of US interest rate cut moved investors towards the yellow metal. Gold’s performance in the domestic market was neither different though gains were limited due to a surging Indian rupee.

Gold usually trades higher during times of economic or political uncertainties. The rising risk of war in Middle East escalated gold’s safe haven appeal. US – Iran tensions got escalated after reports of attacks on oil tankers at one of the world’s main sea lanes.

In contrast to the safe have sentiments reflected in precious metals, the demand for silver faced headwinds from cooling industrial activities in China. As the industrial utilities of silver is not diminutive, considering its applications in automotive sector and the utilities in solar panels, the economic slowdown has locked silver prices in a rather narrow path.

Looking ahead, the ongoing US-China trade frictions would continue to support gold’s safe haven appeal. A volatile dollar, US Fed’s policy decisions, geopolitical tensions and Brexit worries are likely to keep the sentiments higher in the immediate run. On the domestic market, expectations of strong INR followed by a stable newly elected government may restrict major gains. Meanwhile, forecast of a normal monsoon probably lift physical demand for gold from rural sector later. Silver is likely to trade in a narrow range but major liquidation is unlikely due to rising geopolitical tensions.

Energy

Despite heightened tensions in the Middle East, oil prices held steady at its multi-month lows. Oil rose since the start of the year due to supply cut threat from key producers but later drifted down on weak global demand prospects. Prices jumped from a multi-year low of $44 a barrel in January to $66.60 a barrel by end of May, but recently plummeted to near to $50 a barrel again.

Tight market conditions due to ongoing OPEC plus supply cut, production decline from Iran and Venezuela due to US sanctions and Russian outage owing to Urals contamination supported prices earlier. However, reports of record level production from US and weak global demand forecast hit the sentiments later. As per International Energy Agency (IEA), the booming oil output from US would offset the shortage of exports from Iran and Venezuela. The country also expects higher output this year due to uptick in drilling activity.

Looking ahead, escalating tensions in Middle East are likely to push global oil prices higher. Meanwhile, the slowing global economic growth would be a major headwind. Increasing trade war tensions between US and China is a threat to global economic growth and demand for oil. Anyhow, oil traders are now worried about the supply tightness than the slumping demand. Natural gas prices too plummeted to three-year lows due to increased supply amid low demand.

Base metals

After a confluence of factors took toll on the price performance in 2018, base metals started the year 2019 with a hope of regaining the lost steam on a possible settlement in the US-China trade war and the fiscal stimulus plan put forth by Chinese administration. The recent Chinese economic numbers were downbeat, signalling slowdown in the industrial activities in the major base metal consumer China. Moreover, the sluggish growth in automobile sector in major economies has dented the demand for unwrought metals.

Supply shortages underpinned the industrial metals to certain extend through early 2019. In London Metal Exchange, copper, nickel and zinc rallied in the first quarter of 2019, during ‘trade truce’ between US and China. Other metals such as aluminium have barely kept their head above water so far this year as concerns over supply surge mounted. Similarly, lead prices were found mostly below the levels that were seen at the start of January 2019.

Accommodative monetary policy stance signalled by the US Fed and other major central banks is expected to restrict the downward pressure in the metal complex. The stimulus measures from Chinese administration involving tax cuts and infrastructure spending, are expected to boost the industrial activity in the second half of the year. A settlement in US-China trade war would rekindle the expansion in the industrial sector which would eventually translate into firmer demand for base metals henceforth.

Agriculture Commodities

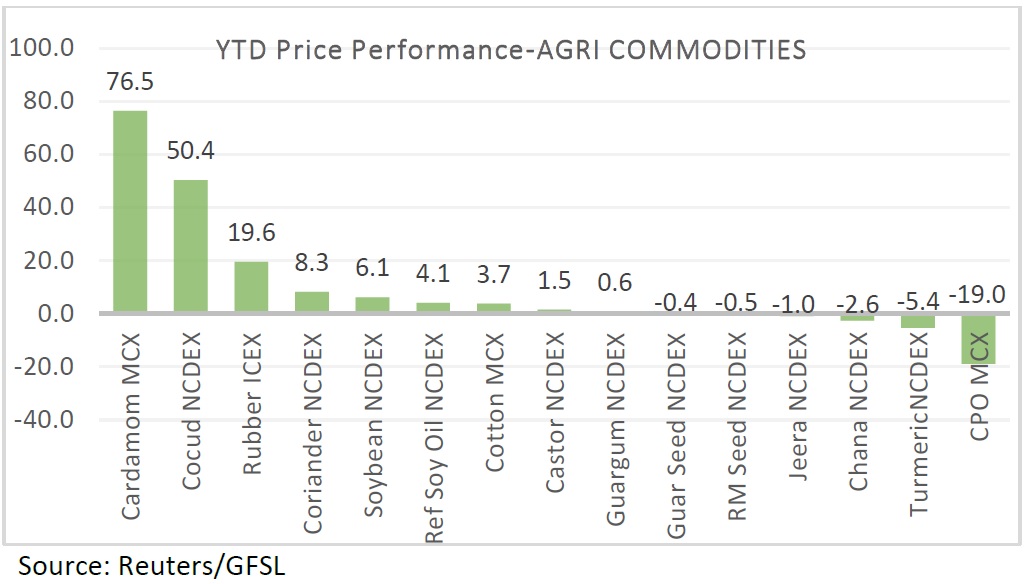

The first half of 2019, so far, has rather been a volatile one for agri-commodities. Cardamom turned out to be the top performer among the exchange-traded agriculture commodities followed by cottonseed oil cake (Cocud) and natural rubber. In the meantime, Crude Palm Oil (CPO) has been the worst performer so far, falling about 19 per cent.

Cardamom has rallied a whopping 76.5 per cent this year, hitting an all-time high of Rs.2899 a kg on MCX, bolstered by decline in production and unconducive weather in the major small cardamom growing state of Kerala amidst robust demand. Apart from cardamom, in the spices complex, coriander was on a positive trajectory as well, climbing to two-year high on expectation of decline in production, lower arrivals to the mandis compared to last year and firm demand. In the meantime, while turmeric stayed on the bearish turf, a recovery was seen in jeera prices after it slumped to near-one year low in March this year.

Cotton oil seed cakes (cocud) climbed to a record high as well on account of higher demand for cake as feed in poultry and animal feed industry amidst lower output. Fall in production, unfavorable weather and lean production season in some of the key natural rubber growing countries amidst export curbs by Thailand, Indonesia and Malaysia lifted rubber prices to its highest level in more than two years.

Trend was mixed in oil and oilseed complex with soybean gaining the most and CPO falling the most. Despite higher production expectation in soybean, firm export demand and cues from the major overseas market lifted prices. However, forecast of normal monsoon and simmering US – China trade tension kept gains under check. Meanwhile, for mustard seed, it was a rollercoaster ride. Prices fell in the initial months of the year on back of higher production expectation along with higher arrivals in the spot markets, though high crush margin, improved demand from exporters etc. limited losses. Crude palm oil came under pressure from rising stocks in Malaysia, the top producer, and higher imports.

Among the other commodities, cotton traded firm on fall in production and robust domestic demand even as higher arrivals and the US-China trade spat kept gains under check, while for guar seed, guar gum and chana, price movement was confined to a range.

Going ahead, with the southwest monsoon setting in and Kharif sowing beginning, a seasonal shift is happening in agriculture commodities. The delayed onset of monsoon and untimely entry of cyclone Vayu has disturbed the way of monsoon wind in Indian subcontinent that has affected the sowing of many kharif crops. Anyhow, measures to be taken by the government to strengthen the agriculture sector in the upcoming budget and possible changes in MSP are likely to set the direction of agriculture commodities, going forward.