By Manu Jacob

As the US and China signed a preliminary trade deal in January 2020, the 18-month old trade conflict offered some relief to global markets. Trade related worries that fanned recession fears have adversely hit the global economy, particularly that of the US and China. The prolonged uncertainty about trade policies between the world’s two large economies had affected global trade and demand for commodities. Escalation of hostilities has led to most industrial metals losing ground, suppressing prices in a tight range near its multi-year lows. Chinese industries are the key consumers of all base metals. The trade dispute has roiled the Chinese manufacturing sector and demand for industrial commodities. In 2020, the trade deal developments and its impact on the global economy remain the trendsetter of commodity prices. A successful trade deal will boost global economic activity and improve the demand for base metals.

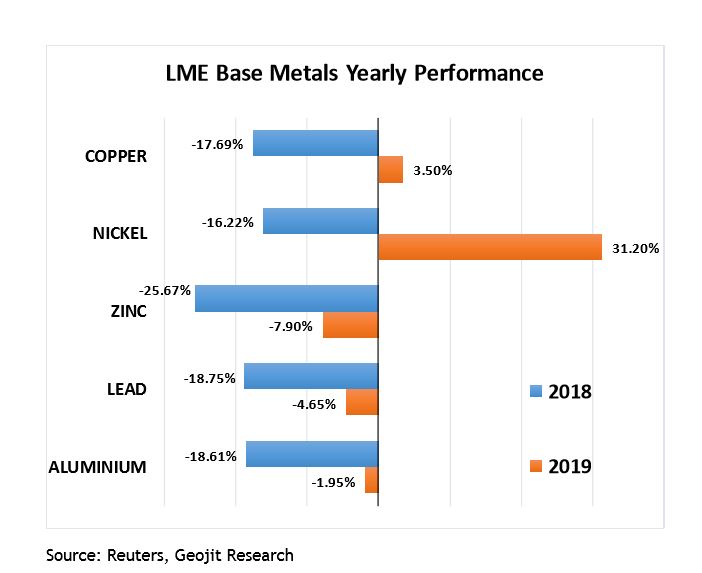

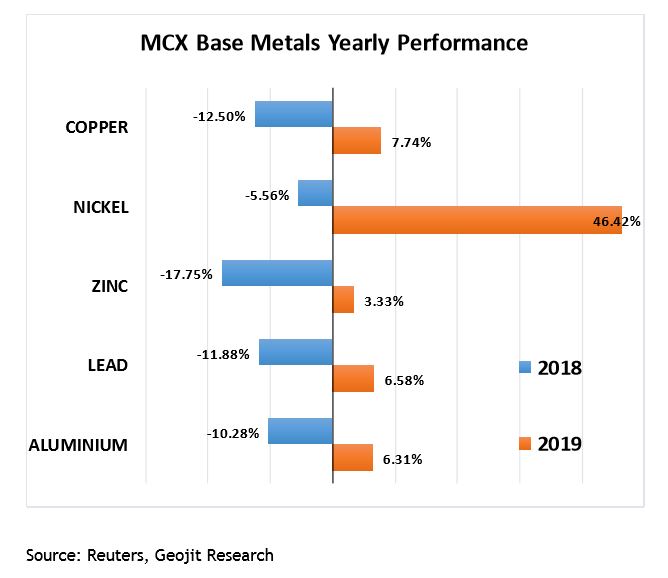

Performance of base metals

The industrial red metal, copper, gained in the first four months of the year 2019 on optimism that the two sides would resolve the dispute and spur demand. Regardless of supply deficit scenario, copper prices dropped to a two-year low later as there were no signs of a breakthrough until the end of third quarter. Prices witnessed a rebound in Q4 of 2019 as US and China came to an agreement on signing phase one trade deal. The year ended with copper gaining 3.5 percent in London Metal Exchange (LME) while in India’s Multi Commodity Exchange (MCX) copper gained 7.74 percent.

Aluminium prices often witnessed a downward pressure throughout 2019. Oversupplied conditions and lacklustre demand have led the prices southward. As a widely used industrial metal in the automobile industry, slowdown in automobile sector due to escalating US-China trade tensions also contributed to the fall in prices. The LME aluminium fell 1.95 percent while the domestic MCX aluminium prices gained 6.31 percent during 2019.

Both zinc and lead prices have remained on the back foot during the best part of 2019. Worries of supply shortage have balanced with feeble industrial demand from China. Low demand from the automobile sector and supply bottlenecks have kept the market under deficit. As per the International Lead and Zinc Study Group (ILZSG), the global demand for refined lead will move into a surplus of 55,000 tonnes in 2020. Meanwhile, refined zinc is likely to move into a surplus of 192,000 tonnes in 2020. The study group anticipates demand for refined lead to rise by 0.8% to 11.90 million tonnes and demand for refined zinc to rise by 0.9% to 13.80 million tonnes in 2020.

Despite the supply shortages, zinc and lead in LME platform shed 7.9 percent and 4.65 percent respectively in 2019. Both metals in MCX platform gained during the same period, where zinc gained 3.3 percent and lead gained 6.5 percent.

Nickel is insulated from major fall on buoyant outlook due to increased appetite from the stainless steel industry and supply concerns from the top producer Indonesia. The supply worries lifted nickel prices to near five year high $18,850 per metric tonne in LME in September of 2019. As the year 2019 ended, nickel became the top performer in the base metal complex gaining 31.2 percent in LME and 46.4 percent in MCX platform.

Global Economic Outlook

At the same time, IMF predicts that the weak global growth outlook is likely to continue for the rest of the year and next. IMF cut its 2019 global growth outlook by 0.3 percentage points to 3 percent. This is the slowest pace of growth since the 2008-2009 financial crisis.

IMF also added that US, China, Eurozone and Japan, the four largest economies of the world, will remain under pressure over the next few years. The US will further slow down to 2.1 percent from its present 2.4 percent growth by next near.

The Chinese economy will slow gradually to post a growth rate of 5.5 percent by 2024, down from its current rate of 6.1 percent. Manufacturing crisis, especially in the automobile sector, will keep Eurozone economic growth slower than before.

IMF estimates the Eurozone growth rate to be 1.2 percent this year, revising its previous forecast of 1.3 percent. It also predicts that the economic expansion in countries that are far removed from the US-China trade war will also moderate this year.

The continued downbeat in manufacturing and other areas of the economy hint at a further weakness in the world’s top metal consumer. Also, market experts are pessimistic about China’s economy, even though the country recently posted some bright economic numbers.

For base metals such as copper and nickel, the supply deficit is likely to underpin the prices in 2020. In India, recent measures like the tax cut and infrastructure spending are likely to translate into firmer demand for base metals in the coming quarters. The ailing global economy may find relief from accommodative monetary policy stance adopted by the major central banks. Although the infrastructure spending and stimulus measures adopted by Chinese government is yet to show any significant difference in its economy, investors are now watching the trade deal developments to get an indication of the direction of the global economy. Phasing out the tariff rows and improved trade relation between world’s top two economies will boost economic activity and improve the demand for base metals.

Changing face of base metal trading in India

In the year 2019, base metal futures trading witnessed a crucial transformation in India’s MCX futures platform. The country’s largest commodity bourse that offers a comprehensive suite of base metal derivatives in its portfolio commenced physical settlement for its base metal contracts.

Earlier, the delivery logic of these contracts were “Both option” and was settled in cash at its expiry and the prices were at par with the international market. The domestic settlement price was calculated by converting international price in rupee terms. The local market premium or discount has not been considered in the price discovery mechanism and hence it was unattractive among real hedgers. Due to the insignificance of domestic prices, the key market players preferred to hedge in international exchanges due to its liquidity and contract design.

The commodity bourse now offers futures trading in base metals with compulsory delivery. MCX now started trading in deliverable futures contracts of base metals such as Aluminium, Zinc, Lead, Nickel and Copper on a staggered manner.

In line with the instruction from SEBI, the MCX has altered the contract designs of base metal variants. The lot size of copper contract has been changed to 2.5 MT from 1 MT and the lot size of Nickel contract has been changed to 1.5 MT from 0.25 MT. Apart from that, the exchange discontinued the mini variants in copper and nickel. In the case of aluminium, lead and zinc, the exchange discontinued the contracts with 5 MT lot size and retained the contracts with lot size of 1 MT.

The first ever physically settled metal contract was started in Aluminium futures in March 2019. Following the successful completion of delivery process in Aluminium the exchange gradually started the physical settlement for rest of the futures contracts. The metals have conformed with the exchange quality parameters and were delivered at the approved warehouses.

Compulsory delivery mechanism would improve better warehousing facilities and best practices in the system. As all deliveries are processed through Demat account it makes buying and selling easier for traders as well.

Looking ahead, metal exchanges would play a prominent role in industrial activity by ensuring metals at a pre-fixed price and quality for manufactures. Also, it can assure prompt delivery by acting as an efficient intermediary between the buyers and sellers.