By Vinod Nair

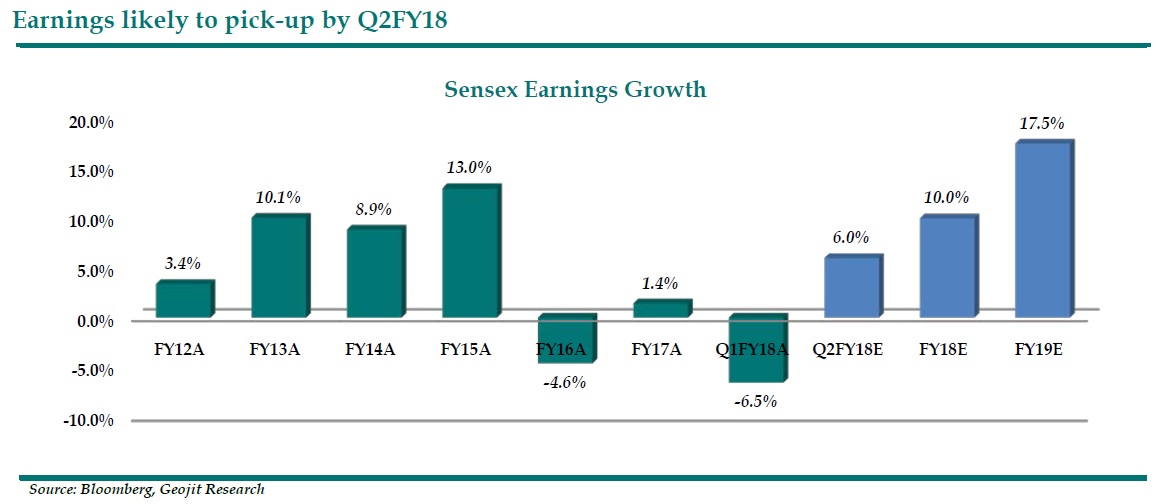

Q2 is expected to be better than Q1FY18. The financial year started with a disruptive Q1, given de-stocking before the implementation of GST, and the after effect of demonetisation. Q1 was a disaster since there was a big degrowth in earnings than anticipated. It gave a break to the positive trend of the market but came back since the degrowth was largely due to good reforms and earnings are expected to revive as economy structure gets in place. Sensex and Nifty PAT growth for Q1 was -6.5% and -9.0% respectively compared to the -1 and -5.5% anticipated.

Given the sharp lower base effect Q2 is likely to be better than Q1. Destocking is largely completed and economic activities have started to pick up as the procedure of GST is securing day by day. So on a QoQ basis we can expect growth in revenue and PAT for main indexes. On the economic front, data like WPI inflation, PMI and IIP are picking up from recent lows (detailed in October article). So organised sectors, well managed and listed entities will do much better than the under stressed broad economies due to slowdown in unorganised sectors and exports. This may continue to impact the growth of the economy over the next 1 to 2 quarters. Hence on a YoY basis earnings growth will be subdued and risks for further downgrade in revenue and profit are still possible since we had very high expectations. In spite of this slowdown the market expects 6% and 14% YoY growth in PAT for Sensex and Nifty respectively.

The market had started the financial year with an expectation of 20% earnings growth for Sensex in FY18. Post Q1 it was drastically reduced to 10-12%. In terms of market’s near-term forecasting dilemma, see the difference in actuals and expectations. When we had started Q1, expectation was -1% for Sensex-30 stocks but actual was -6.5%. Now we are starting Q2 with a high YoY growth expectation of +6%. But as per historical experience we may end at +/-3% for Q2. So H1FY18 earnings growth may end in a range of -1% to -3%; hence there is room for further cut in earnings, since to reach at 10 to 12% growth we need a very solid performance under such difficult economic scenarios.

The market is still hopeful that a large portion of the detrimental domestic factors are discounted and earnings will revive soon. Other than core industries, some sectors which are supporting the market are finance, metals, mining, infra, defence and chemicals. Market expects improved financials for banks given the restructuring NPA problems, reduced interest cost and improvement in consumer financing. At the same time government spending and change in policy procedure is benefiting infra and defence sectors. The global economy has improved as evidenced by the growth in US, Europe and China. Therefore, sectors like metals & mining and Chemical are doing well due to increase in commodity prices and higher procurement within and outside India. While the worst performing sectors on a YoY basis for Q2 will be healthcare, telecom, real estate, cement and IT.

There is hope for IT and Pharma sector…

Though on a YoY basis IT sector is coming under weak performing sectors, the current review after watching a slew of downgrades due to slowdown in their business model, is looking better now given attractive valuation and supporting tailwinds. Though the industry is likely to remain muted for FY18, earnings are expected to grow by 11% YoY in FY19. Nasscom has given a positive outlook and some tailwinds like appreciating USD and positive economic indicators from the US and Europe will allow the BFSI sector to stretch their discretionary spending in IT. Increase in trade ties with US in the field of defence and oil is expected to give room to renegotiate for faster processing of H1B visa. Initial Q2 IT results are better than anticipated. Historically, the average P/E of IT index during the last 5yrs was 16x while currently it is trading at 15x. Investors may consider this on a long-term basis.Pharma sector which has been going through a down phase in the past few years seems to have reached the trough in their business cycle. USFDA inspection issues, channel consolidation and high competition were the major concerns. In recent times, Indian pharma companies have been getting various approvals from USFDA for their manufacturing units and drugs. This suggests a positive outlook for the sector. With the current valuations looking attractive, there is enough room for re-rating in the medium to long term. Indian pharma companies seem to be fighting back by improving their R&D and shifting their focus to niche areas like biosimilars derma, injectables and complex generics which faces less competition. Besides the global requirement for cheap medicines provide ample opportunities for a low cost manufacturer like India. General optimism can also be seen with regard to the increasing number of drug releases by Indian companies in the coming years and the same is reflected in the earnings estimates. The tactic to wither off industry pressure by strategic planning done by Indian companies is expected to bring revival in the pharma space.Additionally, the impact of slow growth led by global headwinds is largely factored in the price and investors are gradually changing their view and accumulating to reap the benefit in the long term. Investor’s sentiments towards defensive sectors like IT and Pharma are likely to change from underweight to overweight slowly, owing to attractive performers, tailwinds and slow down in the broad economy and higher valuations in growth oriented sectors.