By Vinod Nair

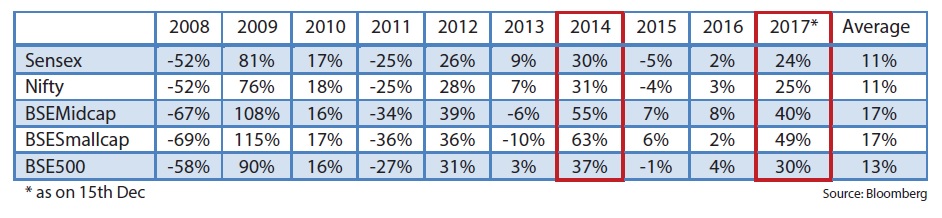

Against all odds during the start of the year, the equity market rallied throughout to new record high, ignited by the new era of transformations. Initially, these transformative ideas provided a hiccup to the market, but changes from the old system to the new converted the mood and outlook of the market. Excluding the bounce back we had post the 2008 crisis in 2009, 2017 will be recorded the second best year, over the last 10 years.

Performance of the last 10 years

The fact that this year’s rally has been a widespread one, across most sectors in the market, made it very attractive indeed! Also, the market found new segments of performers like realty, consumer durables and discretionary, metals, NBFCs and private banks.

The fact that this year’s rally has been a widespread one, across most sectors in the market, made it very attractive indeed! Also, the market found new segments of performers like realty, consumer durables and discretionary, metals, NBFCs and private banks.

Some fundamental crux of the year were:

Market likes transformative ideas

Demonetization was hugely disruptive and the GST made it a double whammy. Initially market assumed that this may be a disaster to the economy and political stability. Consequently the market corrected following demonetization. But as the market slowly understood the positive implications of the new policies, it started rallying. Globally, even though the politics of the Trump administration has been controversial, the economic initiatives like tax reforms and infra spending have been well received. Also, the Fed policies and commentary were supportive of markets. Similarly the domestic market reversed in spite of the double whammy of demonetisation and GST, giving a vote of confidence to the reform initiatives and their potential long-term benefits. This explains the spike in valuations in spite of lack of earnings growth. This ‘hope trade’ expects upgrades in future profitability and reduction in systematic risk.

Liquidity is a central part to the market…

We had started this year wondering about the risk of US rate hike, which did happen thrice, raising the Fed Funds rate by a total of 75bps to 1.5%. But this did not impact the market since the liquidity in the market has been maintained and supplemented by other central banks like ECB and the central banks of Japan and China. Also, the Federal Reserve’s (assets) was not brought down but maintained at the same level as last year. Additionally, as world economy improved the money-multiplier and return on investments surged and the confidence and ability of the financial market to absorb interest rate hike improved. This helped in maintaining the market momentum. Net FII inflows increased to ~Rs52,000cr in CY17 from ~Rs19,000cr in CY16.

Political stance and stability

Since the national election, the market has been enthusiastic about the government’s reform measures and intention to upgrade India’s business environment towards global standards. Market has been optimistic about measures like Make in India, defence policy, demonetisation, GST, NPS restructuring, bankruptcy code and bank recapitalisation. Even though the initial impact has been a bit negative, market had rallied by re-rating with the hope for long-term benefit and political stability. As the NDA’s strength grew in the Rajya Sabha, the market extended the rally.

Domestic investors to the fore

MF investment in the equity market has been improving steadily since 2014. But this year has been a bonanza with MF inflows exceeding Rs 1,07,000cr (by 15th Dec) which is almost equal to the amount invested in 2015 and 2016 put together. Retail inflows to MF schemes has increased to an all-time high at ~ Rs 160,000 cr. This trend had expanded post demonetisation and the shift in funds from physical to financial assets. This trend is likely to be maintained unless the confidence of the retail investor is impacted due to some domestic or global triggers.

Other essential factors

We had a good budget doing the right things with focus on the rural economy, infrastructure spending and poverty eradication. The government gave a strong push to public spending even while maintaining the fiscal target at 3.2%. Domestic market was also benefited by low crude prices and good monsoon.

Our view at the begining of the year

We had suggested that the best time to have entered the market was the month of November 2016 when the disruptive measure of demonetisation was announced. Post this, as the market rallied in November and December, we anticipated that the first quarter of 2017 may be volatile since the outcome of double whammy of demonetisation and GST was unknown in the near-term. At the same time the global markets were wondering about the fallout of Trumponomics and the risk of US rate hike. But we had maintained our positive outlook expressing the long-term benefit of these transformative ideas and its benefit to the listed well managed companies.

As on 31st Dec 2016 when Sensex was at 26,626, we had a target of 29,500 for March-2018. This target was continuously upgraded after every quarter reaching to a high of 32,000. This was largely led by increase in valuation multiplier P/E from 16x to 17.5x and increase in long-term profitability due to reforms and stabilisation in the economy. We have been continuously sharing with you numerous sets of stocks and sectors to invest for which the performance had been good.

Understand that the 2017 rally was a global trend…

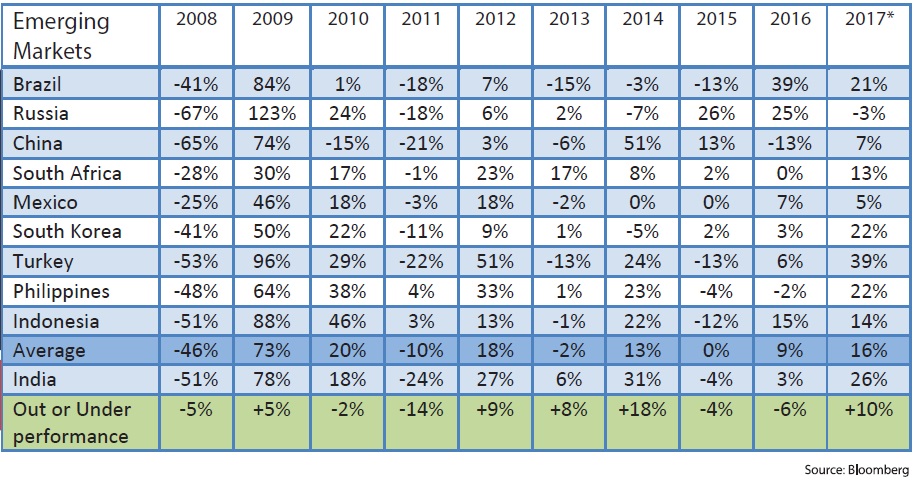

Performance of India compared to the rest of the world

India has been a strong outperformer in the long-term. But it was under threat given the disruptive measures and the good performance of soft and hard commodity exporter. Excluding the bounce back by Turkey led by political stability, India has performed the best. We are bound to have much better performance in the future (not in term of absolute return for 2018 but on relative basis) as earnings start improving from now on.

India has been a strong outperformer in the long-term. But it was under threat given the disruptive measures and the good performance of soft and hard commodity exporter. Excluding the bounce back by Turkey led by political stability, India has performed the best. We are bound to have much better performance in the future (not in term of absolute return for 2018 but on relative basis) as earnings start improving from now on.

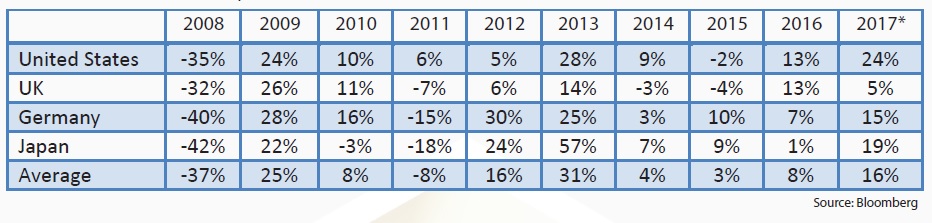

Performance of Developed Market

The Bull Run this year has been a global phenomena. The US was the best performer increasing the Mcap of S&P 500 by $3.7trn to $23.7trn; (India’s total Mcap is $2.3trn currently) followed by Japan; Germany and UK which were impacted by European geopolitical issues and BREXIT. We can conclude that India has benefited at large from the global rally in spite of the setbacks in domestic earnings growth.

The Bull Run this year has been a global phenomena. The US was the best performer increasing the Mcap of S&P 500 by $3.7trn to $23.7trn; (India’s total Mcap is $2.3trn currently) followed by Japan; Germany and UK which were impacted by European geopolitical issues and BREXIT. We can conclude that India has benefited at large from the global rally in spite of the setbacks in domestic earnings growth.

Our outlook for 2018…Stay On

Our one year forward target for Sensex is 34,500 and 11,000 for Nifty. This is based on earnings CAGR of 14% and 15% between FY17 to FY20 for Sensex and Nifty respectively. This is compared to the market forecast of ~20% CAGR. We are valuing Sensex at a P/E of 17.6x and Nifty at 17x, based on historical valuation band. This is about 10% to 15% above the long-term P/E of 15.5x. We are comfortable to value at a premium because this time the earnings growth is likely to be much better than that of the last 2-3 years.The main factors which will help to grow the earnings are the base effect, uptick in domestic and global economy, government spending and reform oriented benefits.

Based on the current level of December 15th 2017, this target expects a return of 6 to 8 percentage. We have a moderate expectation on the equity class this year in spite of an uptick in earnings growth. Some important factors for this expectation are:

- We are already under premium valuation, which is about 15 percentage above the long-term base.

- A portion of the uptick in earnings may be factored in the market.

- Liquidity in the global market is likely to reduce over the next 1 to 3 years, impacting the valuation.

- Though sceptical, there is a risk of populist agenda before the election of 2019.

- Hawkish RBI stance.

- Global tightening, Trump politics and increase in global interest rates and underperformance of emerging markets due to a better outlook for developed economies.

We feel that though the outlook on main indexes is moderate in the short to medium-term, the broad market will maintain its vibrancy as businesses flourish during which mid and small cap segments will have more to offer. Stock specific picks may be the routine of the year to outperform the market. Some stocks and sectors in mid and small caps which can provide a leeway are; those under NCLT resolution, chemicals, textiles, PSUBs, metals, home building segments, infra and capital goods. We are also positive on defence and cement sectors. Long-term investors can also chip into defensive sectors like IT, pharma and telecom as contrarian bets. We suggest churning your equity portfolio with higher exposure to the above mentioned sectors.