by Vinod Nair

Markets had a downfall during February and March, leading to an average fall of 10 percent in large-caps, 15 percent in mid-caps and 20 percent in small-caps. The key hindrance was the increased global risk leading to a jump in global bond yields. Premium valuations and concerns on the domestic fiscal front impacted the market for two months. Then, global markets settled and prices started reacting positively as they became more attractive and redemption led by LTCG stopped in March-2018 while the supportive action of RBI normalised the domestic bond yield. Market’s performance since the month of April has been good; rejuvenating under the hope that earnings growth will firm-up in India. But till date the performance of Q4 result is much below expectation, undergoing a downgrade in FY19 forecast, still the estimate for next year is very euphoric. Market has made a good flight to reverse in which large caps have come back about 3/4th of the fall, but mid and small caps are underperforming heavily. Today we are in a situation similar to one we had in Jan-2018, i.e. in between positive sentiments and caution, but may not be as frightening since valuation is not very expensive.

The positive side of the face…

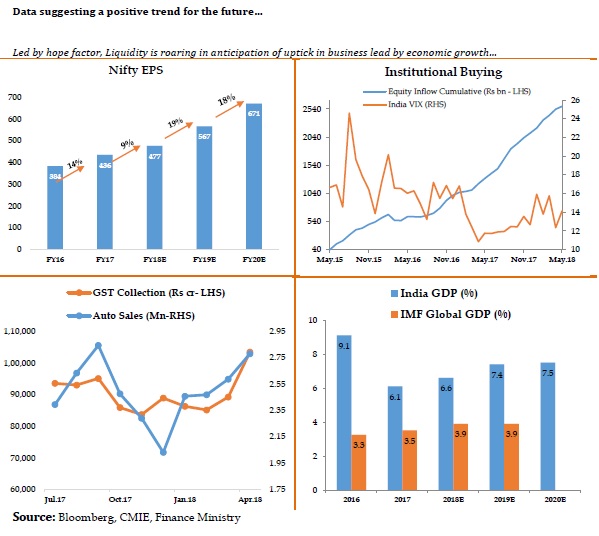

The positive wires are normal monsoon and high expectation of a strong reversal in earnings growth from FY19 onwards. Domestic leading indicators are providing signs of improvement in the economy, like auto has posted robust sales in April and GST collection for the first time has crossed Rs1 lakh crore versus monthly average of Rs90,000 crore, as an indicator for stability in the new tax structure. Additionally, improvement in global economy will provide a push to the saga. IMF has upgraded its global growth forecast to 3.9% for CY2018 and CY2019. Nifty50 EPS is anticipated to grow at 19% for FY19 compared to 9% in FY18.

Market is betting on improvement in business confidence led by the organised sector, forecasting strong pick up in earnings growth in the future. If this is likely to happen then India’s premium valuation will prolong. At the same time, liquidity is pouring in led by finalisation of savings.

The conservative side of the market…

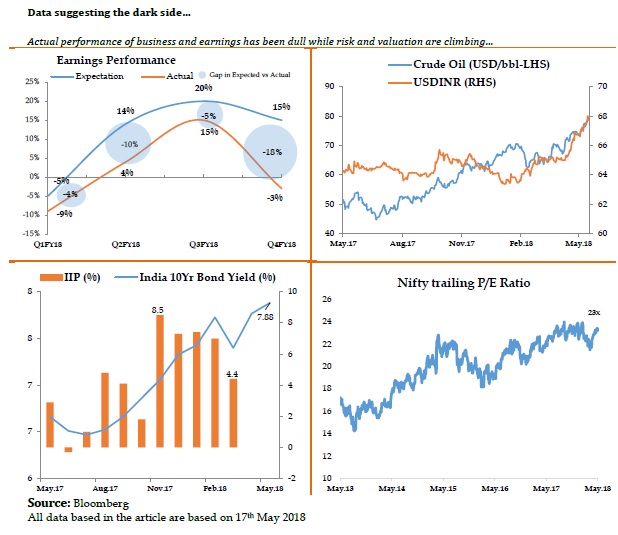

A quick reversal in the market has taken us near to the situation we challenged about a quarter back. The truth till date is that the actual earnings growth has been much lower than anticipated during FY18. The gap in estimate and actual growth has expanded heavily. Many important risk indicators are creeping up, like crude prices have elevated to $80 which is a 4 year high. Government 10 year bond yield has inched to 7.9%, a 3year high while free fall in INR to a 16 month low @ 68, and widened Current Account Deficit @ 2% of GDP are risk factors. Inflation has inched to RBI target of 4.5% in H1FY18 while core inflation has increased to 44month high in spite of slow industrial activities. RBI has a hawkish outlook on the monetary policy and situation of bad loans have not yet improved; performance of the banking sector is at the worst with subdued credit growth.

For mid-caps, valuation on a trailing basis are very high about 70 percent premium to large-caps. On a one year forward basis it may come around 25 percent as distortion in financial performance reduces due to high expectation in the future. To maintain this premium the economy and industry growth has to improve a lot from hereon.

Have the right choice in your portfolio…

Nifty has recovered about 10% from the last low. Earnings growth had fallen in FY18 due to demonetization and GST implementation. But since the economy has stabilized, growth is likely to bounce back. Sentiment and future forecast are very buoyant. While at the same time, watchful leading indicators are also highlighting the risk profile of the market. We are unlikely to witness a very healthy return compared to the supernormal performance of the last two to three years. We need to be more careful and get more stock and sector specific to outperform the market.

Investors were also enthused hoping for a positive development to the ruling party in the Karnataka election. On the day of the election result market had a good start led by positive impression. But it lost the aura as lack of clear majority emerged by the end of the day. Whatsoever be the final outcome, this will give more depth to the market as concern over the performance of BJP in the next general election of 2019 reduces, since incrementally their performance has been good in the last set of state elections. But as per history, state and national elections do not meaningfully change the trend of the equity market, but rather a weekly or a monthly volatility (positive or negative). As this event is over, market will focus back on the macro and micro economic parameters which have been unpleasant in the recent times.