RBI statistics show that India attracted USD 62 billion of foreign direct investments in 2017-18. This was nearly 3 per cent higher than the USD 60.2 billion FDI attracted in 2016-17.

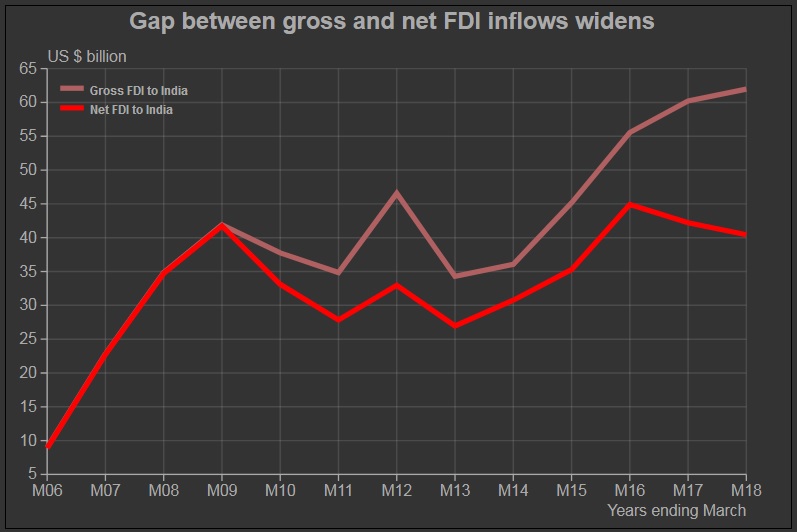

FDI inflows rose smartly after 2013-14 when they were at USD 36 billion. They shot up to USD 45 billion in 2014-15, then USD 55 billion and USD 60 billion in the following two years before slowing down a bit in 2017-18.

Between 2013-14 and 2017-18, the equity component of FDI led the increase as it scaled up from USD 25 billion to USD 45.6 billion. Reinvested earnings grew relatively modestly from USD 10 billion to USD 12.4 billion and the rest was “others”. The share of reinvested earnings dropped from 25 per cent to 20 per cent while that of equity investments increased from 70 per cent to nearly 74 per cent.

Repatriation or disinvestments by foreign entities that were invested into India has been rising. In 2017-18, these amounted to USD 21.5 billion. These therefore, offset nearly 35 per cent of the new investments that came into the country. In 2013-14, they offset a much smaller, 15 per cent of the inflow.

The sharp slowdown in reinvested earnings and the steep rise in disinvestments by foreign entities possibly indicates a disenchantment with the experience of investing into India. While reinvested earnings have grown tepidly in recent years, dividends repatriated have increased. The balance of payments data show that in the past few years there was a sharp increase in dividends taken out by foreign companies. These increased from USD 10.5 billion in 2013-14 to USD 15.5 billion in 2017-18.

Because of the large repatriation of investments, the actual foreign direct investments into the country have declined in the last two years. Foreign direct investments net of repatriations peaked at USD 45 billion in 2015-16. Then, it fell to USD 42 billion in 2016-17 and finally to USD 40 billion in 2017-18.

According to the UNCTAD’s World Investment Report, 2018, FDI into India dropped from USD 44 billion in 2016 to USD 40 billion in 2017.

The UNCTAD report makes a pretty grim reading on global FDI flows. Global FDI flows fell by 23 per cent to USD 1.43 trillion in 2017. This, while the world saw accelerated growth in GDP and trade. There was a sharp fall in cross-border mergers and acquisitions and also in greenfield investments. However, FDI flows into Asia were stable. The report remains cautious on future prospects although it suggests a 10 per cent growth in global flows. Trade tensions could negatively impact investments in cross-border value chains but, a decrease in returns on investments seems to be the key contributor to lower investments. Global average returns on foreign investment were down to 6.7 per cent compared to 8.1 per cent in 2012, according to the report.

The report seems to suggest that we cannot assume that foreign capital would be as keen to invest into India as it may have been in recent times.

Foreign direct investments by Indian entities, which have been falling since 2008-09 have picked up in recent years. FDI by Indians had risen sharply between 2004-05 and 2008-09, from USD 2.3 billion to USD 19.4 billion. Then, it fell to USD 4 billion in 2014-15. Since then it increased to 9.3 billion in 2017-18. India registered a large disinvestment of its FDI overseas in 2016-17. It disinvested USD 10.6 billion during the year.

Net of FDI disinvestments and net of FDI by Indians abroad, India finally received net FDI worth USD 31.1 billion during 2017-18. This is much lower than the USD 35.6 billion of net FDI received in 2016-17 and the USD 36 billion received in 2015-16.

Sector-wise break-up of FDI inflows is available for equity investments and these are available only upto the quarter ended December 2017. The top six industry groups accounted for over 62 per cent of all FDI flows during the first three quarters of 2017-18. These were – telecommunications (17 per cent), computer software and hardware (14 per cent), services (13 per cent), infrastructure construction infrastructure (7 per cent), trading (6 per cent) and automobiles (5 per cent).

Evidently, the manufacturing sector does not seem to figure prominently in foreign direct investments in India.

In January 2018, the government liberalized FDI in single brand retail trading, civil aviation, construction and, power exchanges. The move did not improve the FDI inflows for the quarter of March 2018 but, such changes take time to show results.