Harish Krishnan is the Sr. Vice President and Fund Manager – Equity at Kotak Mahindra Asset Management Company. He currently manages large cap and thematic equity funds at Kotak including Kotak 50, Kotak India Growth Fund and Kotak Infrastructure & Economic Reform Fund. Harish Krishnan has more than a decade of experience spread over Equity Research and Fund Management.

KOTAK 50 is a popular and performing large cap fund and recommended by Geojit Research team for many years.

How do you see Indian financial market on 2018? As per your analysis which are the sectors that investors should concentrate on this year?

CY2018 can best be summarised as MICRO over MACRO. Over the last 3 years, macro environment was very positive, falling energy prices, benign commodities, falling inflation and falling interest rates. As we move in 2018, the best of these macro benefits are fully behind us. However, in the last 3 years – the

micro – which is corporate earnings – was lackluster with impacts from NPA, impacts from demonetisation, GST, weak private capex cycle etc. We expect earnings aggregate to improve significantly from hereon, thereby indicating an improving micro, partly led by a weak base as well as likely resolution of asset quality of corporate banks and market share moving from unorganised businesses to organised businesses (which are listed) in a post GST shift. While valuations are not cheap, and in many cases are building in this earnings recovery, we still are reasonably positive on Indian equities from a medium term perspective.

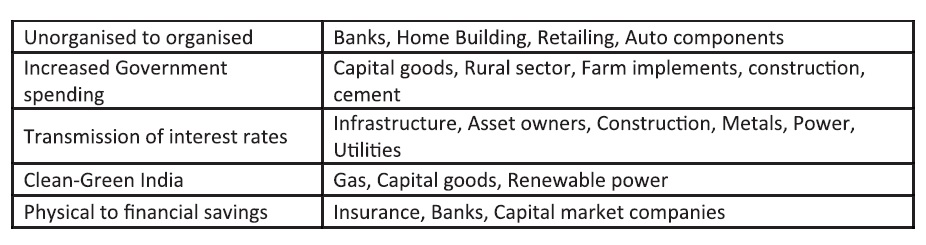

We favour sectors aligned to domestic cycle as against exporters. We expect the following themes to do well.

While looking at the portfolio of Kotak 50, the fund holds more than 20% in private banks throughout the year. Looking further stock wise, we can clearly see a sales momentum from Aug 2017 in almost all stocks except ICICI bank. Is this a part of asset rebalancing or an investment strategy? What is your outlook on Private Banks for the year 2018-19?

While looking at the portfolio of Kotak 50, the fund holds more than 20% in private banks throughout the year. Looking further stock wise, we can clearly see a sales momentum from Aug 2017 in almost all stocks except ICICI bank. Is this a part of asset rebalancing or an investment strategy? What is your outlook on Private Banks for the year 2018-19?

We continue to be positive on retail oriented banks (which are predominantly in private space), as we expect improvement in credit growth and continued shift of market share from PSU Banks.

We have gradually increased our exposure to corporate banks (both private sector and PSU banks) as we expect few large cases of NPA to resolve, which have been admitted to NCLT. The PSUB recapitalisation plan of government looks credible and will aid in banks making large provisions as they take haircuts, when these NPA companies move to new buyers in the NCLT auctions. We are underweight NBFC on account of recent increase in bond yields and rich valuations.

The Kotak 50 fund holds Refinery as one of the top five sectors. Considering the expansion plans of refineries like BPCL and RIL for the next five years and the Government’s initiative on renewable energy and green environment by 2040, what is your long-term outlook on the Refineries?

Energy sector is one of the key investment bets of Kotak50. Within that, our key investment theme is gas space, as we expect it to be a large beneficiary of “green” push of government. Gas sector is also likely to benefit from likely inclusion in GST basket, likely tariff increase approved by regulators etc. On our exposure to other companies in this sector, we are more enthused by finishing of large capacity expansion plans which are likely to add to earnings growth hereon.

The fund has a P/E ratio just below the P/E of the benchmark, the difference is a mere 7 basis points. Does this imply that the fund is expecting future returns which will be almost equal to its benchmark return?

The focus of the fund is to have earnings growth profile higher than benchmark, with valuation similar to benchmark, thus aiding performance ahead of the benchmark in the medium term.

What are the stock specific traits that you look into while adding a new stock to your portfolio?

Many factors are evaluated while considering adding a new company into the portfolio – ranging from business scalability (making the most in an up cycle), sustainability (ensuring the business survives and grows in the down cycle), management track record and treatment to minority investors and lastly the valuation parameters. New businesses are also considered when they bring a new dimension/factor of business opportunity to portfolio, which helps diversify the portfolio.

When we look at the past performance of Kotak 50, the fund has outperformed its bench mark in almost all the periods. But when we look at the peer comparison, the last one year performance of the fund is slightly lower than its peers when the market was on a positive move. What is your future outlook on the fund?

Focus of this fund is to provide consistent outperformance and better risk adjusted returns compared to its benchmark while investing in India’s blue chips. While investing in our portfolio companies, we evaluate them on the medium term basis (3-5 years) and not a near-term basis, as obsession to near-term performance can mean missing out on big opportunities which can benefit investors over the medium term. On a 3 year basis, our key bets of cement, auto, capital goods, and retail banks have significantly aided performance. Our underweight calls on technology and pharma have also aided performance. We have been negative on commodities, telecom, and real estate from a 3 year perspective which have seen material underperformance in these businesses from a 3 year perspective. However from a near-term perspective of 1 year, these sectors have done very well from their lows, which have impacted near-term performance. Thus, we urge investors to look from a 3-5 year perspective while evaluating performance.

As the 2018 budget is on the door steps, what may be the cues in this budget that can influence the performance of the market in FY 2018-19?

Markets will keenly look at fiscal deficit figures, revenues and expenditure announcements of the government. Besides, the focus of the market will be if government will tax equities by either increasing period of long-term or introducing capital gains tax. As we are likely to move into general elections by early 2019, this budget is likely to be last major policy, hence the focus will be if government will focus on populist schemes or reining in the fiscal deficit.

With the Government proposing major reforms in the infrastructure space through Real Estate Regulation Act, Affordable housing, PSU bank recapitalisation, ”Bharat Mala” etc., what is your long term outlook on the infra sector?

We are enthused by recent initiatives in the infrastructure space. While government spending had improved significantly from FY16, there are initial signs of private capex revival as well. Recent initiatives of PSUB recap also help flow of credit to infrastructure space. Besides, as we approach elections in 2019, we are likely to see faster execution in this space.

According to you, how are the recent reform initiatives in the mutual fund industry likely to influence the future performance of the funds?

Streamlining of fund mandates is a welcome step and will help alignment of investor expectations with fund mandates, and thus help in improved financial planning. While there may be some changes in portfolios, as funds completely adhere to the mandates, longer term fund performance will continue to remain in favour of process oriented fund houses backed by sound fundamental research, as has been the case in the past.