By Anand James

Sixes in cricket are a routine feature today, and exhilarating last over finishes are just as common as well. However, the epic six hit by MS Dhoni in the final of 2011 World Cup at the Wankhede Stadium will forever remain in the minds of the Indian cricket fans. As the ball sailed into the sky that was about to be decorated by firecrackers, Dhoni held the poise for a few seconds, embellishing his legend as a finisher, and also etching a delightful imagery into the mind of Indian cricket lovers, that they would ruminate for years to come.

Ideally, but, not quite forever, because, today, just a few years since that historic day of winning the world cup, commentators and a good section of public alike are interested in when the man would retire. Not that his team is doing badly. India, in fact, is number two in ICC men’s one day rankings just seven points below the topper as of October 2017. And it is also not his fault that he appears to be among the fitter and faster than most in the team, and his magic behind the stumps is still mesmerizing. And his captain is also not shy to be public about the value he brings to the table as a senior member. Why, he even has the presence on the field, like few in world cricket today have and his wisecracks in post-match press conferences have only sweetened. But retire, he must, say the mob, because, the yardstick for success is in terms of the number of games he finishes, because that was that defined him. This is interesting, if not more educating. Cricket as a sport does not have an official position called “finisher”, though it has openers, wicket keepers, and even bowlers who are informally tagged “tail enders” because, they do not bat as well as the top order. Football has forwards, midfielders, but do not have finishers, as anybody can net a goal; why, even a goal keeper can, and finish a game. So could the openers, in cricket, and so could the middle order, but it all came stuck with Dhoni.

In recent literature, cultural historian Leo Braudy observed that those who succeed in youth sometimes become symbolic before they become real. In Dhoni’s case, the world did not know Dhonisque success, until Dhoni did what he did. And the world is not interested in what else Dhoni could do, he must repeat what he did earlier, every single time, and if possible, better. The type of success which earlier emerged as a symbol is now a real yardstick with which any wicket keeper batsman will be measured upon.

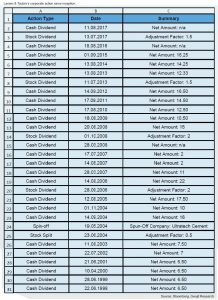

This raises one question. How rational are our expectations when it comes to stocks? Look at three stocks namely, Phillips Carbon, Graphite and HEG, all in the graphite and allied sector, which are now trading at 5, 8 and 13 times respectively from the levels since the start of this year. Obviously, an investor who buys them today would be interested in either the same rate of returns, or may be willing to accept moderated returns, allowing for some cool down in the vertical rise. However, both approaches assume the continuation of the present price trajectory at least to some degrees. Such an expectation ignores what happens when businesses mature, and the corporate actions that usually follow. When business matures, rate of price rise of the stock may be softer but once that is appreciated, there could still be more bonuses on the way, like split, bonuses, dividends, rights issues, value unlocking, M&As etc. all of which give a different meaning for the stock in the portfolio, but usually, only the patient investor ends up benefiting from them.

Now, spare a thought on how we usually build our portfolio. For an average investor, the portfolio building process is mostly about having as many multibaggers as possible. If this was always successful, the portfolio returns could be in the region of 500 percent or so like what was seen with the stocks discussed above. In reality this is usually below 20 percent, if you look at the average performance of most MFs this year, because some of the candidates for multibaggers end up as non-performers.

Which is where the idea of diversification comes in. We diversify our stock portfolio by having variety in industries, leadership styles, size, forex exposure, global foot print versus domestic penetration, etc. but rarely from a stability point of view. Put differently, while the noble reason for diversification is lowering risk, it mostly ends up as picking non-performers. Essentially, understanding diversification is about rationalising return expectations.