By Anu V Pai

The commodity market is on a stronger footing in the year 2021, rebounding from the Covid-19 pandemic induced shock. Prices of many commodities have surged, and some have rallied to record highs. Energy prices have soared, with crude oil breaching $80 a barrel after plunging to sub-zero levels last year, while natural gas prices have touched multi year highs. According to the World Bank’s Commodity Market Outlook, metal prices are forecast to rise by 48 percent in the year 2021, while that of agriculture commodities is expected to rise about 22 percent.

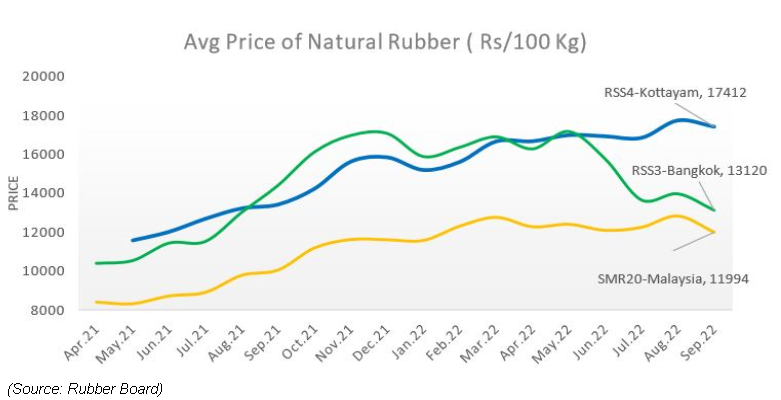

Natural rubber is one such commodity that has been in recovery mode from a long bear phase. Natural rubber prices have risen more or less steadily since April 2020, when they plunged to decade lows. In the major overseas futures and spot markets, natural rubber prices climbed to their highest level since 2017 during the last quarter of 2020 and the first quarter of 2021 before easing to one year low in the third quarter of this year. However, the commodity showed more resilience in the Indian market.

Natural rubber in the domestic market is currently being quoted at the highest level in more than eight years. The RSS4 grade rubber in the major Kottayam spot market has breached Rs.180/kg mark, its highest level since September 2013.

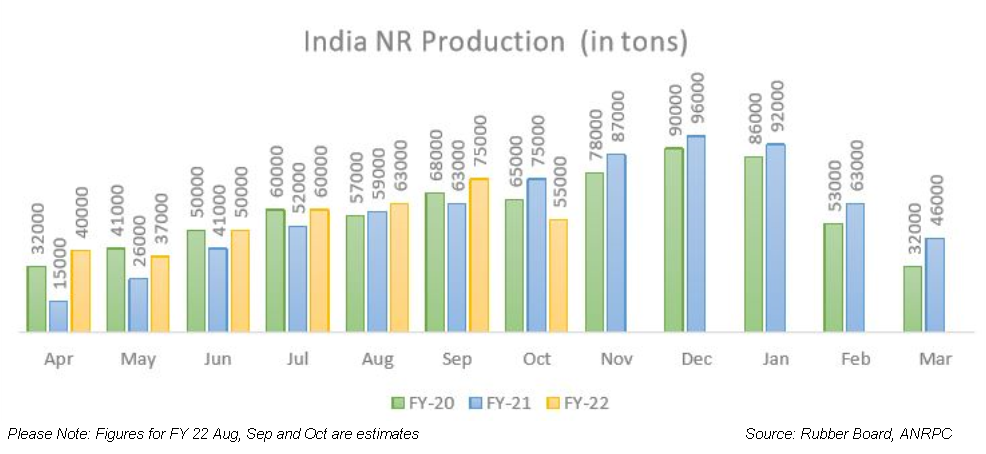

Even as the underlying market sentiments are mixed, presently supply-side constraints are seen pushing natural rubber prices to a higher trajectory. Domestic natural rubber production has been falling short of consumption for the past many years and the difference has been more glaring since FY 2013-14. Natural rubber production in India began to rise in FY 2019-20 after ranging between six to seven lakh tons for a period of five years. A rise of 9.4 percent was recorded in FY 2019-20 to 712000 tons. However, in the FY 2020-21, only a marginal growth was seen, by 0.4 percent to 715000 tons. According to the Rubber Board, the growth in production even in the midst of COVID-19 pandemic in the country is attributed to several factors such as measures taken by the Board to increase production and productivity, favourable climate, supply of inputs, especially rain guarding materials through Board promoted companies, a continuation of Rubber Production Incentive Scheme, relatively higher price of rubber, promoting self-tapping so as to reduce the cost involved and thereby increasing the profit, adoption of untapped area into tapping. Natural rubber output for FY 2021-22 is forecast higher at 790000 tons under normal scenario and it has started on a positive note. A rise of 39.6 percent was seen for April-July period of 2021-22 compared to the same period last year, data by Rubber Board showed. Yet, unfavorable weather in the major natural rubber producing state of Kerala is affecting production related activities. The peak production phase began in October, but excessive rainfall is hindering tapping activities. According to the Association of Natural Rubber Producing Countries (ANRPC), natural rubber production fell to 55000 tons in October from 75000 tons produced in September.

Kerala accounts for more than 70 percent of total natural rubber production in the country. While the Southwest monsoon this year was normal for the state, the Northeast monsoon was in excess according to the Indian Meteorological Department’s Meteorological Center at Thiruvananthapuram. For the period 1 October 2021 to 18 November 2021, the state received 874.8 mm rainfall, a departure of 107% from the normal. Except for Alappuzha, all other districts received rainfall that was largely in excess. Heavy rainfall severely affected tapping activities across the major growing regions in the state. Adding to the woes were landslides and flash floods in the districts like Idukki, Kottayam, Pathanamthitta, etc. leading to crop damage in certain places. As per a first information report on crop loss filed by the Kerala state’s farm department, so far 1,468.6 ha under rubber (tapped and untapped) have been damaged.

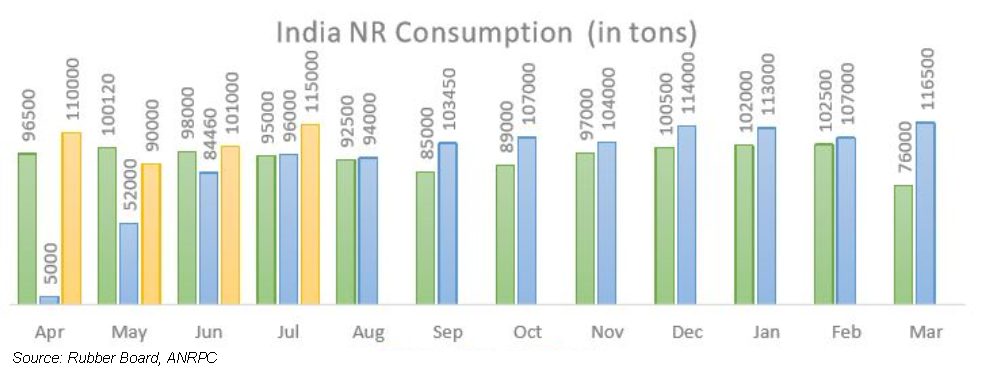

On the consumption side, natural rubber offtake peaked in FY 2018-19 before declining. The decline in FY 2019-20 was mainly due to a fall in offtake from the auto-tyre manufacturing sector, which accounts for about 67 percent of the total natural rubber consumed in the country, while in 2020-21 the decline was due to the sudden halt in socio-economic activities due to the spread of Covid-19 and related measure to contain the pandemic. However, easing of restrictions later that year and gradual resumption of economic activities saw demand gathering pace and the fall was much lower than anticipated earlier. According to the Rubber Board, the domestic consumption of natural rubber in 2020-21 was 1,096,410 tonnes, down 3.3% from the quantity of 1,134,120 tonnes consumed during 2019-20. The auto tyre sector recorded a growth of 3.2% during 2020-21 as against a high negative growth of 12.5% recorded during 2019-20. At the same time, the general rubber goods sector registered a negative growth of 16.4% during 2020-21 compared to a growth of 8.6% during 2019-20. Amendment of import policy by Government of India in New Pneumatic tyres from “free” to “restricted” aided higher demand from the auto-tyre sector.

Natural rubber consumption is expected to rise, and the Rubber Board data shows a jump of over 75 percent during April-July 2021 compared to the same period last year. According to the reports, both domestic and export demand for tyre is seen rising this fiscal as the lifting of restrictions imposed to contain the spread of Covid-19 pandemic, increased preference of personal mobility, etc. is seen boosting demand for tyres, which could boost demand for rubber. However, automobile production and sales are being affected in India due to a severe shortage of semi-conductors and high commodity prices. According to the latest report from the Society of Automobile Manufacturers (SIAM), total automobile production fell by 22 percent to 2.21mn vehicles in October, while total auto sales dropped by 25 percent to 1.8mn from the previous year.

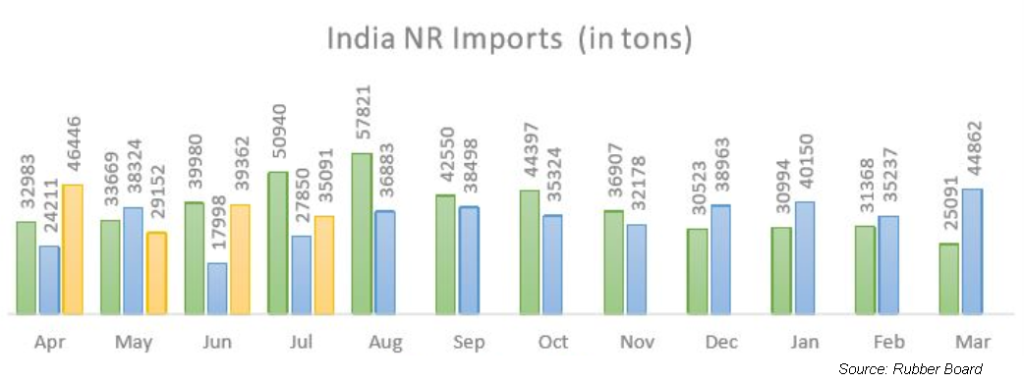

With domestic production falling short to meet the rising consumption, India is relying heavily on imports. After reaching a record high of 582351 tons in FY 2018-19, natural rubber imports have been declining in tandem with consumption and hitting a six-year low in FY 2020-21. For FY 2021-22, natural rubber imports are seen falling to 350000 tons from 410478 tons in the previous fiscal. However, imports may rise this fiscal to more than the forecast due to pick up in demand from the tyre sector, easing of lockdown restrictions and production shortfall. Moreover, the gap between natural rubber prices in the Indian and overseas market has widened, with domestic produce being quoted higher, making imports more attractive. But, the disrupted global logistics, container shortages and the abnormally high ocean freight cost is impacting imports.

Imports of natural rubber for the period April to July 2021 have increased to 150051 tons, a rise of 38 percent compared to the same period last year according to the Rubber Board data.

Sharp rise in crude oil prices, global cues, lifting of Covid-19 restrictions in many leading economies and resultant surge in demand are auguring the sentiments as well. According to ANRPC’s latest report, global natural rubber consumption is set to increase by 8.3% to 14.0 million tonnes in 2021, slightly higher than the expected world’s supply of 13.8 million tonnes. It added that though the shortage is expected to be only to the tune of 200000 tons, its impact may be reflected in the physical markets in the last two months of this year. Also, the Association sees that the natural rubber market is on the verge of a deficit for a long period that could extend up to 2031 due to a widening gap between supply and demand.