Which is right for you — Exchange Traded Funds [ETFs] or index funds? The truth is they appear more similar than different from each other. Click here to read how to decide when considering between the two.

As an investor looking for diversification, mutual funds give you a ready-made and broad exposure to a wide range of asset classes without having to buy individual stocks. But when it comes to narrowing down your options, you may wonder which is better – Exchange Traded Funds [ETFs] or index funds? Both have a lot in common — they are passive investment vehicles that pool money from investors in a basket of securities that follow a specific market index.

So when to comes to index fund vs mutual fund, they may appear to have a similar structure, but that’s where the similarities end. To allow you to make an intelligent investment decision, let’s understand the difference between ETF and mutual fund individually to know how to buy index funds and ETFs.

What is an index fund?

Index funds are mutual funds. These passive funds track a specific market index like the Sensex or Nifty, which includes stock holdings from companies in that index. Index funds provide you broad exposure to a particular market and do not deviate from the benchmark index as the weights of the securities in the portfolio match the index.

The index fund price is based on the Net Asset Value [NAV] just like other mutual funds offered by Asset Management Companies [AMC]. You can invest in index funds through the lump-sum and Systematic Investment Plan [SIP) approach. Besides, to buy index funds, you do not require a demat account.

The passive funds in India are regarded as ideal investment options for investors looking for stable returns and grow their wealth in the long run.

What are ETFs?

ETFs consist of several investments such as stocks, bonds, commodities or a mix of securities but are primarily passive investments. They attempt to replicate the performance of a specific index like the NSE Nifty 50 or the BSE Sensex. As a flexible investment vehicle, ETFs can also be an alternative to futures. Since they trade in stocks, it is mandatory to hold a demat account to transact in ETFs. You can trade in ETFs during trading hours, just like stocks. They also carry a market-traded price as well as NAV.

Typically, ETF prices fluctuate during trading hours, whereas the NAV is generated only once every day. You can buy a minimum of one ETF through your demat account, but you cannot make use of a SIP for ETFs.

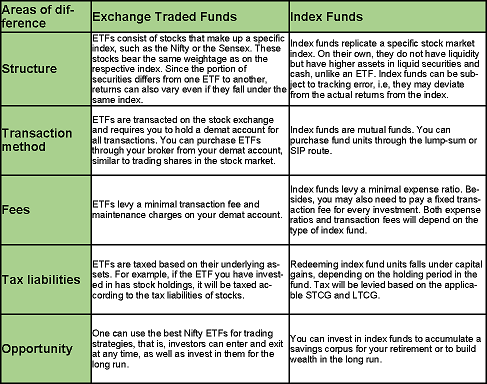

So, then which one is better, ETF or mutual fund? While both ETFs and index funds mirror the index, their risks and returns also follow their respective index. The main differences, however, lie in their structure, transaction method, fees and tax liabilities. So, let’s look at the distinctions between exchange-traded funds vs mutual funds in the table below.

How to choose between ETFs and index funds

ETFs can be an ideal option to consider if you’re looking to gain from intraday trading and market liquidity. But in the long run, both ETFs and low-cost index funds offer good returns and can be suitable to diversify your investment portfolio.

When deciding to invest in either index funds or the best ETF in India, look into the index scheme’s or ETF expense ratio to know how much it will cost you in annual percentage cost to manage your investment. Also, look into the tracking differences that will allow you to see effective ETF returns or how the index fund is replicating its underlying benchmark index.

With regards to how to invest in ETF in India, study the Impact Cost. That means, look into the difference between the actual trading price and the cost you are buying the units on the stock exchange—also, factor in the brokerage costs or demat account charges associated with buying ETFs. Since you can purchase index funds directly from the ANC, they do not come with an impact cost, and you get to buy the units at the actual NAV.

Investing index funds also provide you with the convenience of investing via SIPs, which is not an option with ETFs, as you need to depend on your broker each time you wish to purchase new ETF units.

When looking into how to invest in index funds and the best ETFs to buy, consider structure and pricing. While ETFs have low expense ratios and give you the potential to be an active trader, it also comes with commissions. On the other hand, index funds don’t require you to buy and sell frequently as individual securities.

Regardless of the investment approach you take, passive index funds and ETFs are both effective in helping you achieve a diverse portfolio without getting into individual stock selection. If you find it challenging to decide the best approach, reach out to a financial advisor who will guide you on how to invest in ETF, find the best ETF funds and the best way to invest in index funds. Based on your financial goals, time horizon and risk appetite, your financial will help you to see which is the best index fund in India and the best performing ETFs as well.