Edible oils are one of the major necessities for household cooking around the world. In India, due to diverse taste preferences, culture and the flora across the regions, we prefer to use various types of edible oils for consumption. This makes India the fourth largest edible oil market in the world after US, China and Brazil. India accounts for around five percent of global vegetable oil production and 12 percent of global consumption. According to the US Department of Agriculture (USDA), India produced around 7.4 million tons of edible oils against the total requirement of 24.4 million tons during 2018-19. Among these, mustard oil, soy oil, groundnut oil, sunflower oil, sesame oil, safflower oil and niger oil are major oils that are produced domestically. The difference in supplies of about 17 million tons is filled by imports.Palm oil, soy oil and sunflower oil are major culinary oils which are imported to India among which, palm oil constitutes the major chunk. It is mainly imported from Malaysia and Indonesia and is the cheapest of all types of cooking oils. Soy oil is the next major cooking oil imported either in the form of oil or bean from Brazil and Argentina, while sunflower oil is mainly supplied by Ukraine.

According to a study conducted by Rabobank, India’s demand for vegetable oil is likely to grow annually by three percent to 34 million tons by 2030. Growth in population, solid economy and rise in disposable income, rapid urbanization and changing food habits are the main factors that led to a skewed increase in oil consumption in India. Moreover, rise in oilseed production is not in sync with rising domestic oil demand, which will further push India’s dependence on imported edible oils in coming years.

Recent Trend in Prices

Recent swing in vegetable oil prices were propelled mainly by rise in Crude palm oil products. Amid higher global edible oil stocks, slowdown in global economy, and US-China trade tensions, crude palm oil witnessed an electrifying rally in the start of last quarter of 2019. BMD Malaysian crude palm oil prices rose a whopping 47 percent in the last six months. Similarly, in the case of domestic futures market, MCX CPO prices rallied more than 50 percent during this period and touched a record high of Rs.844 per 10kg earlier this year.

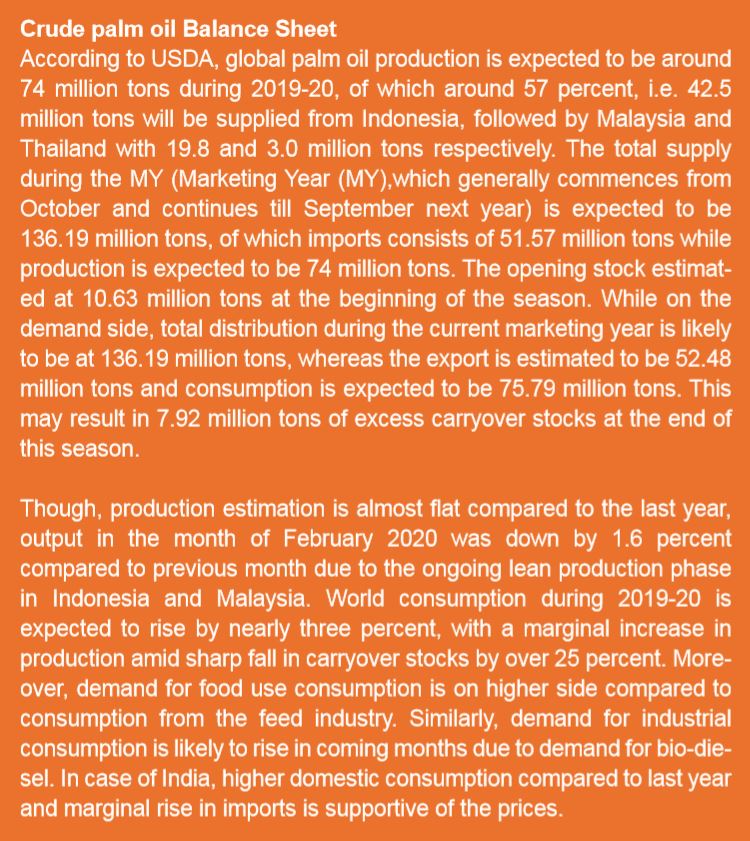

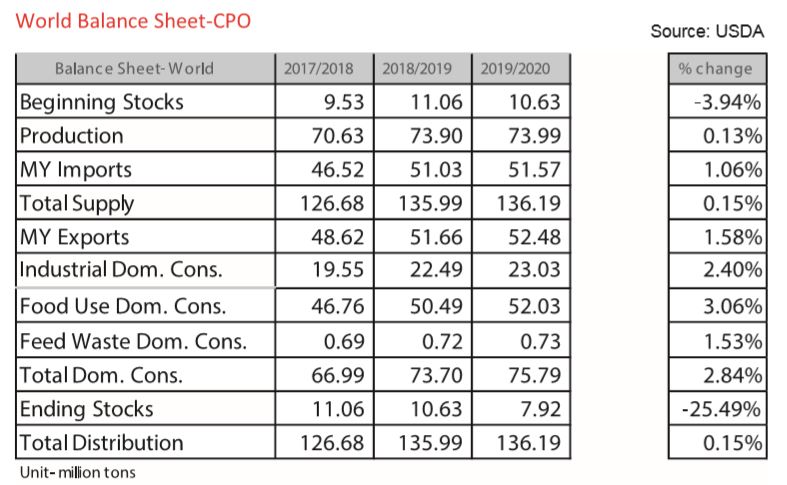

The rally triggered in palm oil prices were initially due to the demand that emerged ahead of festival season in India. Following the bump up in prices, reports of a fall in output in Malaysia, the 2nd largest producer, due to the latent stage of palm oil trees resulting in declining output after a year long high production cycle during 2018-19, fanned the uptrend.According to the USDA, Malaysian palm oil production is likely to see a dip during 2019-20 to 19.8 million tons from 20.8 million tons in the previous year. But, in Indonesia, world’s largest producer, the production is expected to be a bit higher, a marginal increase of one million ton to 42.5 million tons. Moreover, sharp decline in global edible oil stocks in Indonesia and Malaysia also propped up the prices. Again, the USDA reported a 25 percent fall in stocks during 2019-20 (till February) compared to same period the last year.

In the meantime, the Indonesian government’s plan to implement B30 mandate for its bio fuel in the year 2020 accelerated the rise in prices on fears over further tightening in supply in the global market. Additionally, optimism over phase one of the U.S-China trade deal boosted the sentiments of the palm oil. Back home, concerns over decline in soybean output due to floods in key growing areas and resultant anticipation of a fall in soybean oil supported the domestic palm oil prices as well.

However, it was seen trimming gains by mid of January this year primarily due to the restrictions posed by India and scare of coronavirus outbreak. MCX CPO prices fell nearly 15 percent from the peak of Rs. 844/10 kg while, international crude palm oil prices slipped by 20 percent in January. India’s moves on banning refined palm oil imports along with hike in import duties to protect the domestic refiners triggered fresh selloffs in the counter. Meanwhile, India imposing special restrictions and asking the importers to avoid purchase of crude palm oil from Malaysia following the diplomatic dispute between the two countries also hammered down prices. Apart from this, sudden outbreak of coronavirus in China and fears over the spread of the disease across the globe, increasing death toll and restricted travel across these regions resulted in fall in demand in all the major commodities including crude palm oil.

Increased market uncertainty regarding China’s ability to buy US agricultural produce as part of the phase-one trade deal in the wake of the deadly Wuhan virus is also influencing the market sentiments.

Going forward, despite signs of green shoots in the global economy and sharp decline in global palm oil stocks and production, the fears over spreading of the lethal Covid-19 virus across the continents are likely to undermine the export market of Malaysia. Moreover, Indian government has banned the imports of refined palm oil due to the ongoing tussle between India and Malaysia are likely to limit any major upward moves in palm oil prices in the short term.

However, the current downside correction being witnessed in crude palm oil prices may be short lived. The current stagnant Malaysian palm oil exports may pick up once the threat from the deadly virus ends and India negotiates a better deal with Malaysia, reopening the Indian market. This could brighten up the prospects for palm oil exports. Also, the progress of phase one trade deal between the US-China has to be closely monitored as well for fresh trends in coming days.