The market is hoping for continuity of reforms and measures implemented during the tenure of the Modi government. There are fears of a fractured election verdict, which could be a big risk for the market impacting the premium valuation of India compared to other emerging markets. A fractured verdict can impact government’s policy, decision-making ability and reform initiatives. Government spending can get delayed impacting the earnings growth expectation of the market. But market is hoping for the best outcome based on the distinct advantage to the ruling party shown by pre-poll election surveys.

The market is hoping for continuity of reforms and measures implemented during the tenure of the Modi government. There are fears of a fractured election verdict, which could be a big risk for the market impacting the premium valuation of India compared to other emerging markets. A fractured verdict can impact government’s policy, decision-making ability and reform initiatives. Government spending can get delayed impacting the earnings growth expectation of the market. But market is hoping for the best outcome based on the distinct advantage to the ruling party shown by pre-poll election surveys.

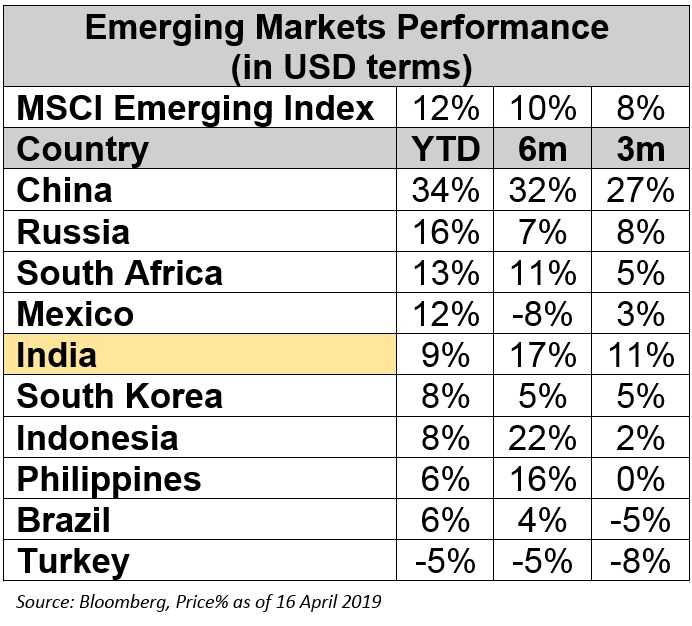

FII’s net-inflows in the cash segment have increased from Rs13, 500cr in February to Rs 32,000cr in March. This increased exposure to India is also motivated by the risk-on strategy adopted in emerging markets by FIIs. Global bond yields reduced while liquidity increased supported by central banks due to slowdown in world economy. This has provided an arbitrage opportunity for FIIs to play in EMs in which India is a key beneficiary being a major economy growing at the fastest pace. India is expected to turnaround its growth from FY20.

Performance of EMs in dollar terms

Recession is an important risk in the global market today. Global bond-yields, oil prices and economy data show a slowdown in the world economy. The financial market has turned cautious over viewing such data, a situation which the world market had not seen in the last ten years. IMF in its latest update, has cut the world economy’s forecast further, third time in six months, to 3.3% in 2019 from 3.6% in 2018 due to trade tensions and probable chaotic Brexit. IMF expects growth to improve in 2020 to 3.6%. The forecast does not foresee a recession, only a slowdown. This is also well accepted by the leading central banks and is supported by reduction in interest rate and increase in liquidity. This is unlikely to be a dire state of affairs for emerging markets, particularly for India, which is likely to improve its economy from H2FY20. But we need to keep a close watch on the upcoming poll results, NPA issues, fiscal slippages, effect of El Niño, and crude prices. The NPA level in the domestic economy has reduced from 11.5% in March 2018 to 10.8% in September 2018, and it is expected to decline to 10.3% in March 2019. This is an ongoing process and will provide the needed push to the humongous size of projects stuck in India, which will help in restarting the private spending in the coming years. However, there can be a temporary delay in the resolution process given the recent Supreme Court order regarding February 12 RBI circular.

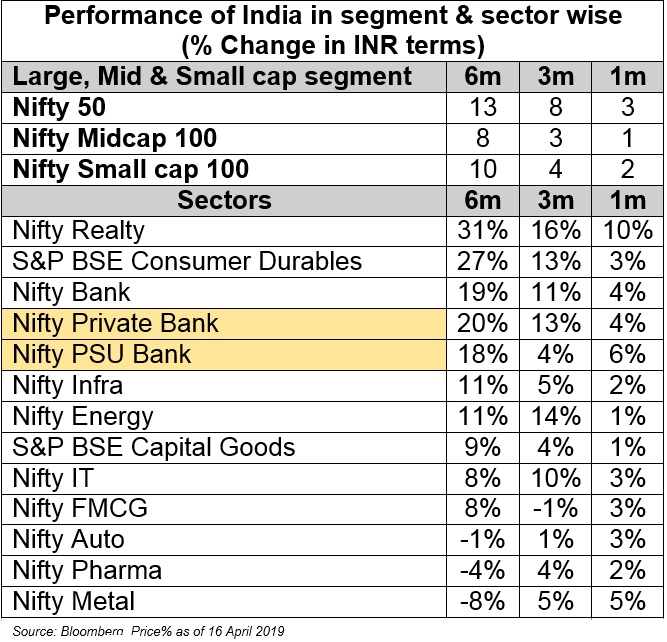

Better Q4 numbers led by banking sector

Net profit of Nifty50 companies is expected to grow by 20% YoY for Q4FY19. The growth would be mainly driven by the banking sector due to low base in Q4FY18. The low base in the banking sector was mainly due to losses of SBI and Axis bank and the heightened NPA issue in the economy leading to higher provisions. Today, improved asset quality, credit growth and reduction in slippages are expected to drive profit growth for banks.

Excluding banking stocks, Nifty50 is expected to de-grow by 2% on a YoY basis. Apart from the banking sector, growth is expected in cement, FMCG and IT sectors. Better profitability in cement sector is due to robust growth in cement production owing to higher demand from road construction, affordable housing and some revival in real estate leading to higher cement prices. The auto, metal and telecom sectors are estimated to see negative growth this quarter. Weak prices of industrial metals like steel, copper, and aluminum and lower demand from China is expected to put pressure on metal stocks while intense competition will continue to plague the telecom sector earnings.

Auto sector is expected to post weak earnings due to inventory build-up and lower demand. In the last two quarters, auto sector is witnessing sluggish demand and we expect this trend to continue till H1 FY20. After this we expect pre-buying before shifting from BS-IV to BS-VI platform in FY21. During FY19 the Indian OEMs registered a growth of 10%, led by 5% in private vehicles, 11% in two or three wheelers and 15% in commercial vehicles, which is below our expectation. This has led to production cut by major original equipment manufacturer (OEMs) due to higher inventory and lower liquidity. This muted trend can continue in the short-term, however we remain positive over the long-term owing to lower valuation, increase in rural income and higher infra spending. Currently the Nifty Auto Index is trading at 16.5x on a one-year forward basis, which is reasonable compared to its three-year historical average at 16x.

Market was impacted when Skymet came with a subdued outlook on India monsoon relating it with El Nino effect. Agriculture is only about 15% of the GDP and a weak monsoon would impact more if it were for a consecutive period. Increased percentage of irrigation has reduced the effectiveness of weak monsoon in the economy. But it does impact the sentiment, growth of the rural economy and allied ancillaries. And given the higher weightage of primary items in the inflation index it impacts CPI, interest cycle and NPA issue in agriculture credit having a dire effect on the respective segments of the economy. These concerns dimmed as India Meteorological Department (IMD) came out with its normal monsoon forecast for 2019. The rainfall is likely to be 96 per cent of the Long Period Average (LPA) with a model error of +/- 5 per cent. A near normal rainfall range is given as 96-104 of the LPA. LPA is the average of rainfall between 1951 and 2000, which is 89 cm. IMD stated that neutral Indian Ocean Dipole (IOD) conditions are prevailing over the Indian Ocean, indicating positive IOD conditions during the monsoon season.

We expect FY20 to be better than last year

Market has been good in the last one and half months. We expect FY20 to be better than FY19 in which mid and small caps are likely to outperform supported by revamp in business and improved liquidity from FIIs and DIIs. India has been at a premium valuation for a long-time which is likely to be maintained supported by higher inflows from FIIs, reduction in cost of equity and India being the fastest growing large economy in the world. Volatility will emerge in-between the finalization of US-China trade deal and national election outcome, since this will define the final effect in FY20.

Having said that forecasting the main indexes has been a tricky business in the last two to three years. The market has not been showing the true trend of the broad market. Rather, it has been showcasing a skewed picture led by a set of blue-chip stocks as liquidity continued strong in these stocks. We had started this year with a one-year target of 11,750 for Nifty50, which has marginally increased to 12,000 today. This is in spite of downgrade in earnings growth post the mixed result of Q3FY19. The increase in target reflects the increase in PE valuation from 16.5x to 17x on FY21 EPS due to improvement in outlook. Nifty EPS for FY19 is expected at Rs523 and Rs615 for FY20. On a one year forward basis, Nifty is trading at a premium valuation of 19x; a similar trend of skewed performance may prevail.

Mid and small caps have managed well during the previous period of slowdown in business with tight liquidity and SEBI norms which impacted their valuation and growth. Post this underperformance, valuations have turned attractive being below the averages while outlook has improved. Instances like stability in domestic economy, possible gain from last reforms, post-election normalization, reduction in domestic interest rate, pick-up in credit growth and reduction in global bond yield leading to higher inflows from foreign investors are likely to deeply benefit India, in which mid and small caps will outperform.

Performance of India’s varied sectors

We are more positive on domestic oriented businesses. In-terms of sectors we are positive on banks, cement, infra, chemicals and consumption. Banks will perform better due to normalization in NPA issue, capital infusion, start of credit growth and reduction in interest rates in the coming year. Cement and infrastructure will perform well because of capital expenditure post-election, reduction in the cost of operation and funding and attractive valuations. Chemicals will do well due to disruptions in China generating opportunity for Indian exports while consumption as a long-lasting story for India given the aspirational class of urban and rural market. Having said that valuations are not attractive across the consumption sector. Stock specific approach will be the key to making money, beating the market.