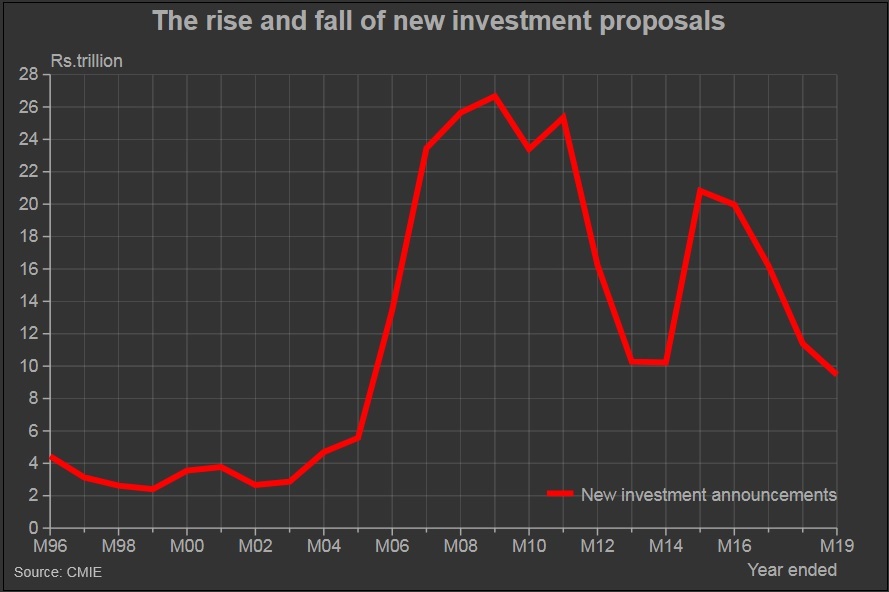

Fiscal 2018-19 ended with new investment proposals adding up to a dismal Rs.9.5 trillion. This is the lowest investment proposal recorded in a year since 2004-05, i.e. in 14 years.

The estimate of Rs.9.5 trillion will be revised upwards in the coming weeks. But, this is unlikely to change the fact that 2018-19 would be the year of very poor investment interest in India.

2018-19 would be the fourth consecutive year of decline in new investment proposals. The decline began in 2015-16.

New investment proposals were robust during the five years from 2006-07 through 2010-11 when they averaged Rs.25 trillion a year. The decline thereafter was steep and rapid as new investment proposals dropped to just Rs.10 trillion by 2013-14.

A new and promising government in 2014-15 reversed this decline. Investment proposals shot up smartly in 2014-15 to Rs.21 trillion. 2015-16 was comparable with new investment proposal announcements worth Rs.20 trillion. But, this pick-up was short-lived and short of the earlier boom in terms of the total size of investments. India never regained the investments exuberance of the earlier boom period.

A noteworthy difference between the investments boom of 2006-11 and 2014-16 is the role of the private sector in driving investment intentions in the two periods. In the earlier period, the average share of the private sector in total new investment proposals was 62 percent. In comparison, the share of the private sector in new investment proposals during 2014-16 was much lower at 47 percent.

Apparently, the private sector did not really get enthused with the new government’s spirited show of new energy or even passion.

The share of private proposals shot up to an all-time high of 67.5 percent in 2018-19. But, there is a somewhat bizarre twist to this record. One-fifth of the private sector’s investment proposals made in 2018-19 are already stalled. These are the two proposals made by the beleaguered Jet Airways to buy 150 units of the doomed Boeing 737 Max 8 aircraft for Rs.1.31 trillion.

If we adjust the new proposals of 2018-19 for these mis-fired investment proposals then the total new investment announcements drop even further and the share of the private sector also falls.

The private sector has not been very enthusiastic in investing since the end of the last investments boom in 2011-12.

While the public sector’s share in investment proposals has been greater than that of the private sector, its low value of new investment proposals in 2018-19 is noticeable. Government driven project announcements add up to only Rs.3 trillion in 2018-19. This is much lower than the Rs.5.3 trillion worth of projects proposed by the government in 2017-18. In fact, the sharp fall in investments since 2015-16 is largely attributable to the fall in the interest of the public sector.

In 2015-16, both public and private sectors had proposed new investments worth Rs.10 trillion each. Since then, the public sector’s contribution has dropped to Rs.3 trillion while the private sector’s contribution is more than twice that at Rs.6.4 trillion in 2018-19. Ideally, the government’s strategy should have been to counter the fall in private sector investments.

This fall in government proposals has hit infrastructure sectors, which, as we see below, have been hit particularly badly.

The industry-wise distribution of new project investment proposals seems less concentrated in 2018-19 compared to earlier years. The share of manufacturing has risen to 33 percent from 26 percent in the preceding two years. Correspondingly, the share of services has declined from 51 percent two years ago to 39 percent.

In the manufacturing sector, investment proposals have increased in chemicals and in metals industry. In the chemicals sector it is largely because of two large investment proposals made by Haldia Petrochemicals to expand its capacities in Kakinada and Balasore. In metals, it is RashtriyaIspat Nigam’s high end steel manufacturing unit in Visakhapatnam that contributes to the increase in new investments.

The decline in the services sectors reflects a sharp drop in new investment proposals in the roads sector. New investment proposals peaked in 2015-16 at Rs.2.6 trillion and remained at similar levels during 2016-17. Then they fell to Rs.2 trillion in 2017-18 and then more sharply to less than a trillion in 2018-19. This fall in roads projects alone account for half the fall in total new investment proposals in 2018-19.

The story in railways is similar. Investment proposals peaked in 2014-15 at Rs.2.8 trillion, then declined a bit initially and then went down a steep gradient to a mere 0.2 trillion in 2018-19. Shipping and logistics are small variants of the story seen in roads and railways – a pick-up and then a steep fall.

The decline in new investment proposals in roads, railways, shipping and logistics together exceed the total fall in new investments in 2018-19.

Air transport services which have been flying high as flights are full although airlines are stressed have their own tragedy. Some of their proposals to buy aircraft have been stalled even before they took off because of mishaps.

Perhaps, the new government may correct this fall in investments by first increasing its own contribution to new projects.