By Vinod T.P.

By Vinod T.P.

Soybean is one of the largest oil seed crop grown in the world. It is the most versatile and economically viable source of protein. Apart from human consumption as a whole seed and oil, a large portion is utilized for poultry, dairy, and aquaculture business by way of animal feed. This makes soybean the most valuable commodity in the world.

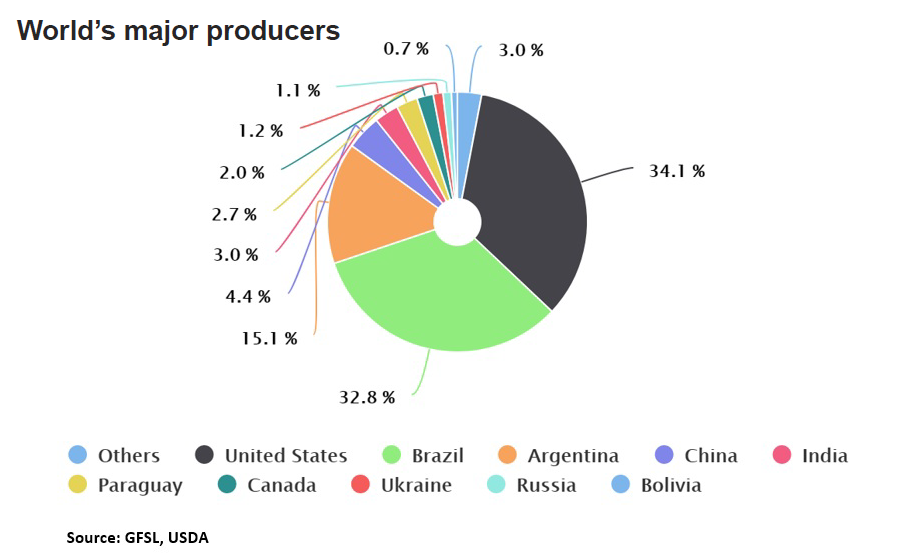

According to the U.S Department of Agriculture, almost two-thirds of the world’s soybean come from the Americas. U.S produces 125.18 million MT per year followed by 122 MT grown in Brazil and 55.5 MT in Argentina. China and India are the fourth and fifth largest producers of soybean with an annual production of 16 MT and 11 MT respectively. Though China is the largest producer in Asia, its consumption is about 129.54 MT which is far higher than its total production. This is because China is the leading value-added exporter of soya products. The deficit in supply is met by imports and periodic building up of stocks.

China’s hunger for soybean

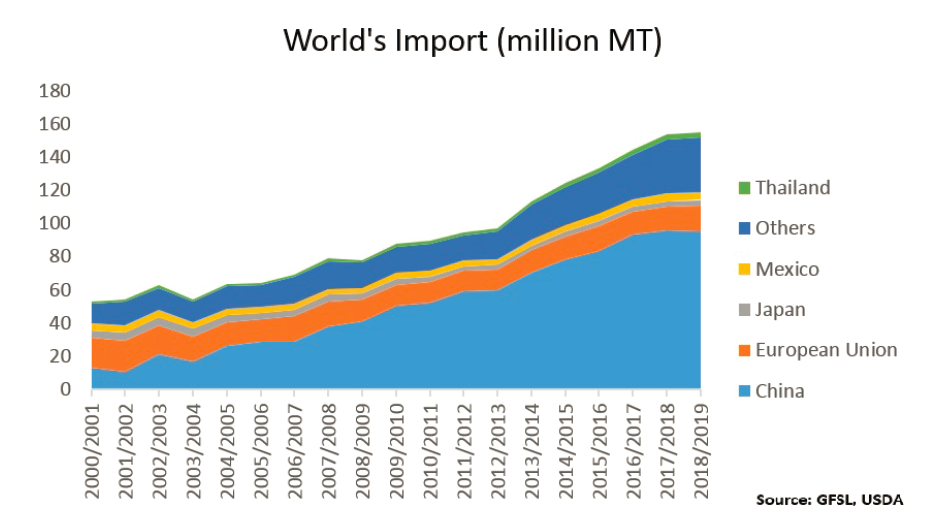

Following the rapid pace of liberalization in China, its appetite for soybean grew significantly due to a rise in per capita income and changing domestic consumption patterns.

During the initial years of the century, the Chinese share of global soybean consumption was about 15 percent and its imports were approximately 22 percent. But now, the country’s consumption quadrupled and imports rose exponentially to 617 percent of world production. This massive growth in soybean demand is largely contributed by mounting demand from livestock and animal feed industry.

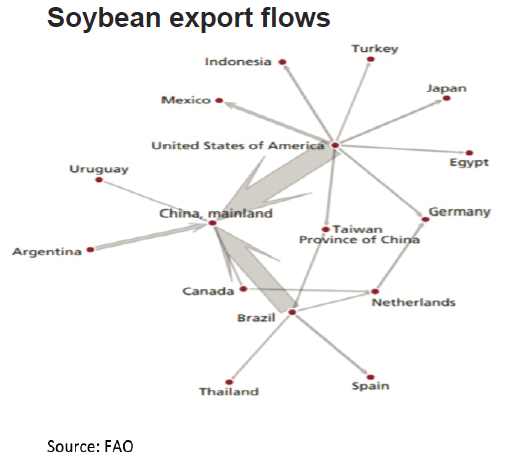

China’s growing appetite for the golden bean is being largely satisfied by Brazil and the U.S. The U.S Department of Agriculture reported that during 2017 China imported around 94 million tons of soybeans from different countries. The largest soybean supplier to China was Brazil with 54 million MT followed by the U.S exporting about 32 million MT. Both countries together account more than 90 percent of the total Chinese imports.

China’s growing appetite for the golden bean is being largely satisfied by Brazil and the U.S. The U.S Department of Agriculture reported that during 2017 China imported around 94 million tons of soybeans from different countries. The largest soybean supplier to China was Brazil with 54 million MT followed by the U.S exporting about 32 million MT. Both countries together account more than 90 percent of the total Chinese imports.

Soybean export flows

Trade tariff

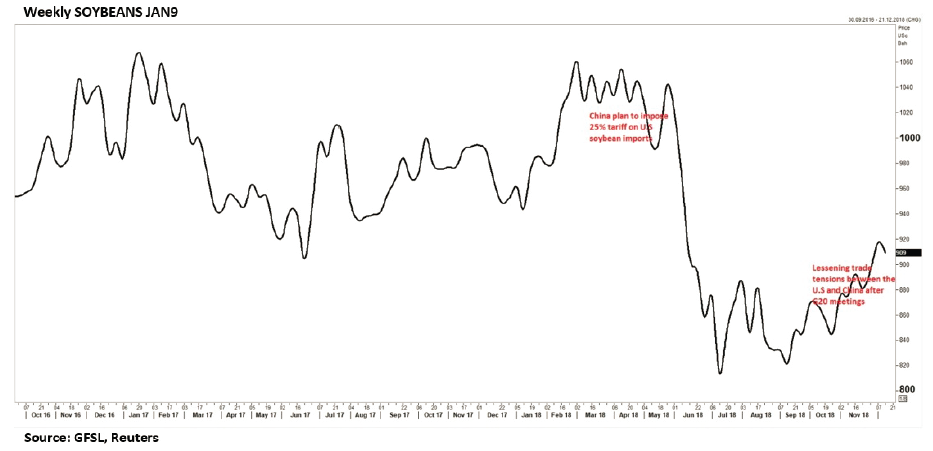

Imposition of trade tariff by the U.S government on Chinese products ignited a spat between the two largest economies. In a tit for tat move, China too countered this stance and levied tariffs against a slew of U.S farm products.

Among these, soybean is the top agri-commodity that was hit worst as China imports significant quantity of the U.S produce. However, this situation directly benefits Brazil, Argentina, and India, which are likely to compensate for the U.S shortfall. As per studies, an imposition of 25 percent duty would lead to a drop of at least $4.5 billion U.S shipments. On the price front, the global benchmark U.S Chicago Board of Trade (CBOT) soybean has also shed by more than 25% during this period.

China or US

Since the initiation of US trade dispute with its allies, U.S soybean exports fell to 51 million MT in November, the lowest level since 2014, against 62 million MT in April. The market share of U.S originated soybean in China dropped to 29 percent from 39 percent compared to the last year as well. Thedrop inexports coupled with a rise in output led to bulging inventories, which damaged the prospects of many soybean growers in U.S. To protect the farmers, the U.S government announced to deliver $12 billion in aid during this year. The aid will not extend to next year.

While in China, to offset the shortfall of U.S soybean imports, the government is looking for various alternatives of soybean and reduction in consumption. China has a plan to increase the use of palm kernel, sunflower, mustard seed, cottonseed and maize which are used as an alternative for soymeal. In addition, the government has a proposal for using a low protein diet formula for animal feeds.This will directly slash the soybean imports to the country by more than 10 million tons per year. The country is now importing largely from other major soybean producers such as Brazil and Argentina which also helps to reduce the dependency of U.S bean. Anyhow,imports from these countries and existing higher domestic stockpiles could fixonly sixty percent of their total demand. The rest of the demand has to be satisfied with other countries such as India which is minuscule.It seems that China has to re-depend on U.S bean again as imports from Brazil and Argentina are insufficient to meet the whole Chinese demand. Almost 54 percent of the total production in Brazil and Argentina is being consumed domestically.

Does India benefit from it?

Indian mustard and soybean meal have been banned by China since 2012 due to detection of contamination. In the wake of worsening trade tiff between the U.S and China, the Indian government was proactive to boostup export of Indian soybean to the Chinese market. Still, diplomatic efforts are being underway between India and China, but at a slower pace to clear the trade hurdles like quality and quarantine measures imposed by China. In case if the ban is lifted off, India will get a good opportunity to exportnon-genetically modified soybean to China. Earlier, China had lifted a six-year-old ban on mustard meal imports from India, and similar stance is expected for soybean as well.

Declining domestic soybean prices coupled with the weakening of Indian Rupee has bolstered the export prospects of Indian yellow bean. Soybean has corrected more than 16 percent from the recent high of Rs 3895 per kg, made in April 2018 in the domestic futures market. In the meantime, the currency has depreciated by more than 16.6 percent from the start of 2018 against the U.S dollar, which is seen augmenting export competitiveness.

The seasonality of soybean in India is also likely to support Indian bean. China is stocking soybean by importing from Brazil, the second top producer in the world generally till October after that it becomes sluggish once the planting season starts there. This will benefit to India as harvesting has already been started and Chinese importers prefer to buy Indian bean during this period. This may also be supported with the cost of shipment which is lower due to demographic advantage.

As the arrivals started to flood the market, factors like deteriorating trade relationship between the two largest economies, hopes of higher output and weak Indian Rupee are likely to uplift the Indian soybean industry in the near future. The domestic exporters have already started to work to make the natural advantage of the existing situation, which would probably benefit farmers and traders during the current cropping season. However, the total domestic consumption is higher than total production and leftover demand is met by imports. So, exports are presently questionable.

The trade war that set in early this year has created a change in the existing value chain of oilseed complex notably in soybean. This may need time to set a new supply-demand pattern to reach the market equilibrium.The current trade disputes may be short-lived as it results in harm to both economies in the long run. Hence, the trade negotiations between the U.S. and China are likely to resolve the current haphazard market situation. If the disputes settle amicably, the global market is likely to see a glut which may adversely affect the soybean prices.