During a broad market fall, once the intensity of the panic attack fades, the most frequent question is “Is it the right time to buy?” Come to think of it. What exactly is the question? Is it not fair to imagine that for an investor looking to risk his capital, timing the market would be least of the concerns? Rather, he is looking to capitalize on the opportunity, and to that end, the investor actually meant to ask: “I know markets are falling, but I feel this is an investment opportunity, so which are the right stocks to buy now?” So, the question of timing becomes a question of choosing. Now what makes a stock right is always a question of value. Is the stock valued fairly enough to fetch a higher price in the future?

During a broad market fall, once the intensity of the panic attack fades, the most frequent question is “Is it the right time to buy?” Come to think of it. What exactly is the question? Is it not fair to imagine that for an investor looking to risk his capital, timing the market would be least of the concerns? Rather, he is looking to capitalize on the opportunity, and to that end, the investor actually meant to ask: “I know markets are falling, but I feel this is an investment opportunity, so which are the right stocks to buy now?” So, the question of timing becomes a question of choosing. Now what makes a stock right is always a question of value. Is the stock valued fairly enough to fetch a higher price in the future?

Finding value:

How do we define value? Fishing for value in a falling market is different from value picking in a stable or rising market. Let us see, why some stocks are deemed undervalued.

- Untouchables: Bad things can happen to people. Same applies to stocks as well. And once they do, by way of regulatory changes, scams etc., it usually requires a lot of convincing for the investor to develop an appetite for such stocks, even as they trade at attractive valuations.

- Unpredictability: When rallies become unsustainable, crashes unfold, which invariably attracts panic and a tendency to ignore and doubt even good news. This would mean that the unpredictability of future trend of broader market may prompt investors to be risk averse, refusing to pick up stocks, which may be trading at fair valuations.

- Under appreciated: Just as in real life, some sectors just do not get the attention they deserve, either because they have not been touted as the next big thing or perhaps because they had gone out of favour in the past. It may require more than a smart mind to spot value in such stocks.

- Under researched: The question of valuation cannot be fully addressed without commenting on the extent of quality research that goes into stocks. It is quite possible that quality stocks continue to stay below par valuations, and under bought, because, the best minds have not yet researched on them for one reason or the other.

Undervalued or Oversold?

Being undervalued is always a relative term; you compare with its own history, key fundamentals, or that of its peers, or industry. You may still not get it right, if broader market sentiments do not turn in favour. But yet, comparing price and earnings is often the starting point of all such searches.

In 1992, in his Chairman’s Letter to the shareholders of Berkshire Hathaway Inc., ace investor Warren Buffet wrote …

“Whether appropriate or not, the term “value investing” is widely used. Typically, it connotes the purchase of stocks having attributes such as a low ratio of price to book value, a low price-earnings ratio, or a high dividend yield. Unfortunately, such characteristics, even if they appear in combination, are far from determinative as to whether an investor is indeed buying something for what it is worth and is therefore truly operating on the principle of obtaining value in his investments.”

Yet, we know that most of these seemingly sensible parameters give erroneous signals especially in a bear phase, similar to what was witnessed in the September month. For example, what to make of HLL which has always commanded hefty valuations, and has fallen steeply in the last couple of months? It still commands a premium, albeit at a discount from August month’s multiples. A practical approach is to look for consensus as to how much of a premium the market is willing to give, without deeming it expensive.

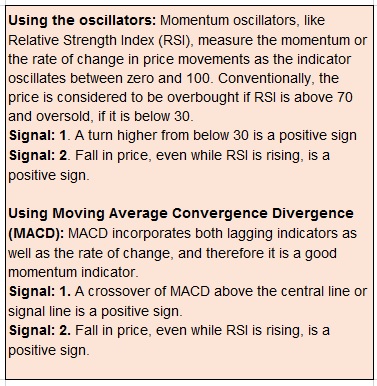

Figuring out the consensus

When broad market sentiments continue to be iffy and when stock valuation methods appear shaky, a consensus approach strikes a middle ground between speculative bottom fishing, and missing the entry outright. It first involves shortlisting stocks based on fundamental parameters like, Price-Earnings (PE), Price By Volume (PBV), Earnings Yield, Management quality etc. A trigger event would now help to have a rallying point to generate consensus amongst a larger pool of investors. If it is earnings, then, and look for strengthening of earning cycle, or positive divergence across quarters, etc. Now, the tricky part would be to study the reaction of stock price to the trigger event. This can be attempted by using a mix of momentum oscillators and lagging indicators. Where this assumes importance is how they help in ignoring a false negative reaction to the event, or how they help in bolstering a positive bias. In other words, the search of the right valuation sometimes becomes less about price, and more about consensus regarding future gain. So, the question that we started off with: “Is it the right time to buy”, can be rephrased as this: “I feel there is a buying opportunity now; are we all in agreement?”