The economy is apparently slowing down and not accelerating. Here is a long list of indicators that suggest so.

The economy is apparently slowing down and not accelerating. Here is a long list of indicators that suggest so.

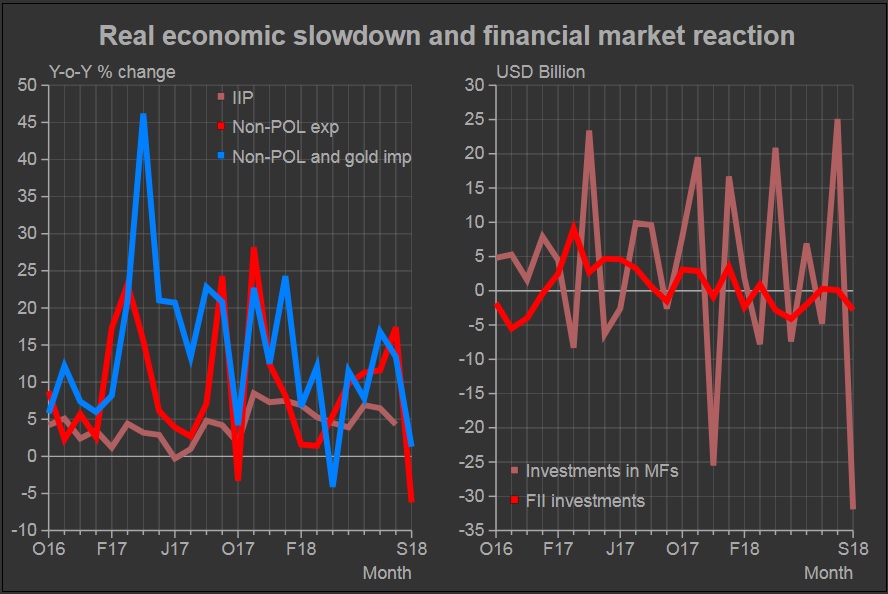

The Index of Industrial Production growth slowed down to 4.6 per cent, y-o-y, in August 2018 after having clocked 6.9 and 6.5 per cent in the preceding two months. This fall in the growth rate of the IIP reflects a similar fall in the manufacturing sector and an absolute fall in the mining index. Performance of the capital goods segment that had lost momentum in July did not bounce back, thereby suggesting that the acceleration seen in early 2018 could not be consolidated.

RBI’s OBICUS showed a fall in capacity utilisation to 73.8 per cent in the quarter ended June 2018 compared to 74-75 per cent in the preceding two quarters. Plant load factor of thermal power plants is still just 61 per cent. The industrial outlook for production and capacity utilisation is tempered compared to the recent past. New orders received by companies in September 2018 scaled back to Rs.456 billion compared to the record Rs.824 billion in August.

The double-digit y-o-y growth in exports seen from May through August 2018 could not be sustained. Exports in September 2018 were 2.2 per cent lower than they were a year ago. The real stress on the exports front though is reflected exports of non-petroleum which were down 6.2 per cent.

Poor domestic demand is reflected in imports of non-petroleum and non-gold and silver products which grew by a mere 1.3 per cent in September 2018.

Growth in consumption of petroleum products was down to 0.9 per cent in August and 1.1 per cent in September from 5-12 per cent in the several months preceding these. Similarly, there are signs of a slowdown in the y-o-y growth of railway freight traffic – from a peak of 8.3 per cent in April to 3.7 per cent in September 2018.

Year-on-year growth in production of finished steel reverted to 2.1 per cent in September after rising to 6.7 per cent in August. The industry seems to be alternating between robust and weak growth every month since April this year.

Passenger car production was down 3.5 per cent in September 2018 over a fall of 3.2 per cent in the September 2017.

Rainfall in September 2018 turned out to be the worst of the season. It was 23.6 per cent below the long period average. June, July and August had seen deficiencies of 5.1, 5.8 and 7.6 per cent, respectively. As a result, the 2018 monsoon precipitation was 9.4 per cent below the long period average. India Meteorological Department declared that 239 of the 662 districts had large deficiency in rains. Kharif sowing is likely to have declined and we expect yields to suffer as well. To make matters worse, prices of kharif crops continue to remain low and so possibly, farmers could face a situation of low production and low prices.

Bank credit to industry in August 2018 was 2 per cent higher than the year-ago level. Growth is anemic but, at least positive after a long spell of contraction. Banks had seen robust growth in loans extended to NBFCs. In August, these were 44 per cent higher than a year ago. Post ILF&S, this is likely to decline. Commercial bank loans to NBFCs are more than the loans to micro, small and medium industries.

Stress related to NPAs and governance in banks spread to NBFCs in September and even led to redemption pressures in mutual funds. G-sec yields are high and the fiscal deficit is likely to overshoot its target substantially.

Net portfolio investments into India have been negative through most of 2018 save for some negligible positive inflows in March, July and August 2018. On a net basis, FIIs have pulled out USD 11 billion from equity and debt markets during April-September this year. And, another USD 3.6 billion were drawn out in the first two weeks of October.

Tourist arrivals in September 2018 were 0.12 per cent lower than they were a year ago although the rupee has been depreciating rapidly.

Besides, CMIE’s surveys show that new investments continue to remain muted and unemployment increased in September. In such circumstances it does not help that crude oil prices averaged USD 78 per barrel in September. At this level it is 43.4 per cent higher than a year ago and exerts substantial pressure on the current account balance, the fiscal balance and also inflation.