There are plethora of mutual fund schemes and various asset classes available in the industry. It is confusing for a layman to pick a fund that is suitable for his/her profile. Before investing in mutual fund, a novice investor must keep in mind the following important points:

There are plethora of mutual fund schemes and various asset classes available in the industry. It is confusing for a layman to pick a fund that is suitable for his/her profile. Before investing in mutual fund, a novice investor must keep in mind the following important points:

- Identify your financial goals: Every individual has different life goals. Before investing, one has to identify his/her life goals, the amount required for this goal and the investment horizon or time you have to achieve this goal. This financial goal may be children’s higher education, marriage, buying a house, car or even buying an iPhone. Monthly investments required could be calculated and invested accordingly.

- To know the risk taking capacity/risk appetite: After setting the financial goal and its investment horizon, one should assess his/her risk taking capacity in terms of investing money. The risk taking capacity or the willingness to take risk varies with age, investible surplus, time horizon and the investment objective. Since income or existing wealth alone cannot help to assess risk tolerance level, assessment of risk profile is inevitable exercise.

- Asset Allocation matters: After ascertaining the financial goal and risk profile, one has to allocate the amount to each asset class according to his/her risk profile. The investment horizon to achieve this financial goal also will ascertain the type of asset class to be invested in.

- Selection of fund that suits your risk profile: There are different category of mutual funds that we already discussed in earlier volumes. Every equity mutual fund carries risk and a pure equity fund is suitable for aggressive investor having long term financial goals. Also important is the right asset allocation of funds. As per the risk appetite one may diverse his investments into equity, debt, gold or real estate. We can have different types of investment strategies such as Lump sum investments and Systematic Investment Plans according to the existing asset position and investment period he has for achieving the goals.

According to the risk tolerance capacity, investors are mainly categorized as Aggressive, Moderate and Conservative Investors.

- Aggressive investors are experienced investors and will be ready to take high risk with their significant portion of their assets understanding that this is crucial for generating long term returns

- Moderate investors may have some experience of investment and are those having moderately high risk tolerance in order to meet their long term goals. Usually they take this risk with a part of their available assets

- Conservative investors are those having low risk tolerance and having a short to medium term investment horizon.

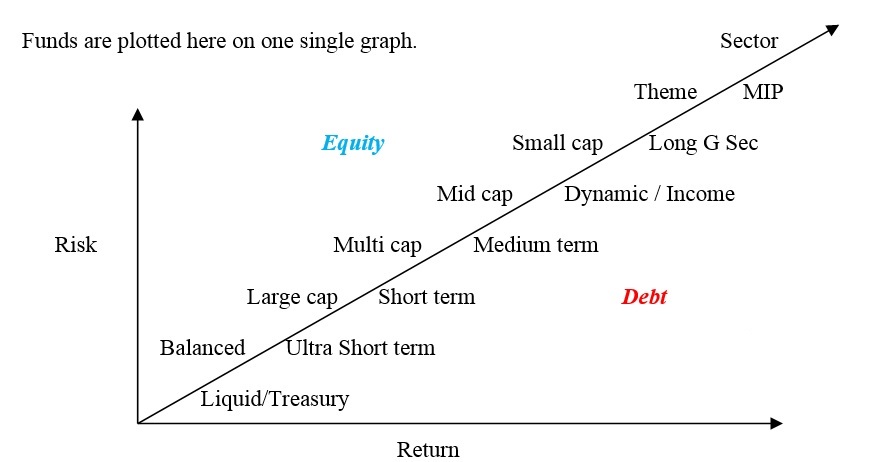

5.Diversification within an asset class: After the diversification through various asset classes one has also to diversify the investments among different categories of equity and debt as well. In the equity category there are large cap, mid cap and small cap funds. In debt category there are long term and short term category of funds as per the instruments they carry in the portfolio. So considering the risk capacity and investment horizon one has to allocate amount to each of these categories. The figure plots the risk reward relationship of various category of schemes. On one side of the graph we can see equity funds and their risk profile. Balanced is the least risk one and sector is the most risk fund. In debt, liquid fund is the least risk and MIP is the most risk one. As the risk increases, the return also increases. Hence select your fund composition accordingly.

To start investing download Geojit’s Mutual Fund App Funds Genie. The desktop version can be accessed from www.fundsgenie.in

Posted: February 2018

Madam

I had invested in Franklin India Smaller Companies Fund-GROWTH – through GEOJIT 5 months ago with Rs. 3000 deposit every month. I am planning continue this up to 3 years.

Kindly let me know what amount I would get after three years SIP income is calculated. if any formula is there please let me know.

please which is more beneficial from the following two methods

1. if I continue depositing 2 more years (total 5 years) with Rs.3000 monthly

2. if I deposit total income what i will get after 3 years is deposited for two years as fixed deposit.

You can use our SIP Return Calculator to find out how your SIP investments will fare. SIPs help you in accumulating wealth over long term. SO it is always ideal to invest in SIPs over a 5 year horizon.

yes i would like to know about the ROI with the period etc

can you sugest the type of mutual fund

and you may please clear that we can individually invest the mutual fund like share trading demat account

For Return On investment , you may refer the Geojit Insights page on the performance of schemes in various category of mutual funds.

provide me two top class small cap fund

Thank you for writing to us. You may view Geojit’s recommended list of funds given in pages 31, 35 and 41 by downloading Geojit Insights from the blog.

To invest in a few easy steps download Funds Genie from App Store or click here to access our web platform.

Want to invest in medium term SBI debt fund. Any advice ?

Looking at the current economic situation it is wise to stay away from medium-long duration papers. You may choose short term schemes. SBI has its short term scheme named SBI Short term Debt fund. But as per our internal analysis, the scheme is not performing well. The Yield to Maturity at this point is 7.64%.

Need to invest Rs 1 lakh in ELSS for 2018 19, through STP to SIP, Pl suggest TWO suitable schemes WHERE 50% amount will be shared for each scheme. I am a Geojit stack holder since long time.

Thank you for writing to us. You may view Geojit’s recommended list of funds given in pages 30 – 32 by downloading Geojit Insights from the blog.

To invest in a few easy steps download Funds Genie from App Store or click here to access our web platform.

easy to understand iwant to know about available liquid/treasury scheme

Liquid schemes invest in papers with less than 91 days maturity. Since their rates are not marked to market, NAV seldom faces risk of fluctuation. Please refer Geojit Insight recommended scheme list of Liquid fund to pick the top performing funds with good portfolios.

To invest in a few easy steps download Funds Genie from App Store or click here to access our web platform.

The tax advantages of investing in mutual funds, incidence of dividend distribution tax and similar benefits could have also been covered. But, compliments for a comprehensive coverage. The graph could also have been elaborated, stating debt funds post higher returns in falling interest rate regimes and how an investor can take a view on interest rate. On equity investment, when you do a theme fund, you are running a sector concentration risk. Similar elucidation would have made it more informative to a naive investor. Looking forward to more write ups. Good wishes

Dr. V. K. Vijayakumar’s article Investment in stocks and MFs: Impact of budget 2018 will help you understand tax implications on investment in stocks and mutual funds.

What is the average expected income

The expected return from various kinds of mutual fund schemes vary. For more information please refer the performance of schemes in Geojit Insights.

Can you give me details which mutual fund is better .Presently i am holding SBI blu chip

Hi, Thank you for writing to us. Request you to please view Geojit’s recommended fund list by downloading Geojit Insights from the blog.

To invest in a few easy steps download Funds Genie from App Store or click here to access our web platform.

I am a Geojit member

Age 67, retired, no job

Family man. Want to invest in best mutual funds for 5 years. Please advise 4 mutual funds that best suit to me. Thanks

Since you are retired and do not have alternate income arrangements, we advise you not to invest in risk bearing assets. Even debt mutual funds with higher durations bear risk. Gold though does not earn you regular income, can hedge the risk against any unwarranted economic challenges. Hence we recommend a portfolio with 80% in short to Ultra short term schemes and rest into GOLD ETFs.

The gold portfolio will hedge risks such as a war, market fall, rupee appreciation etc. You may choose two ultra short term and two shot term schemes from Geojit Insight recommended list. Gold ETF could be bought Geojit Selfie trading platform.

The expense ratio of M.F. varies between different M.F.’s .

The Honest & Ethical managed Fund House has the least .

When it started the expense ratio was between 1.9. to 2.5 % for AUM of 50 odd crores, today with all the multiple schemes in every Fund House & AUM totaling 50,000 Crores, the expense ratio continues to be around 2.5 %. With even the best of International Auditors , the SCAM continues

SEBI’s recent decision to reduce the additional expense ratio that can be charged to a scheme from 20 Bps (0.2%) to 5 bps(0.05%) for open ended mutual funds will definitely impact the total return of the scheme.

I will be retiring from service towards end of 2018 with a plan to live on monthly return from investments. Approx cash requirement for out living will be Rs 20,000 p.m. Request you to suggest best investment option with monthly pay our facility.

Since there are 8 more months left for retirement, it won’t be wise to suggest a suitable portfolio at this point of time because the interest rate, inflation, taxation and economic conditions are subject to change and any investment decision should be suitably taken in the first week of January 2019. Not only returns, but many other factors also go into finalizing the investment vehicles. On a general note, we advise a 70:20:10 portfolio for retirement investment. 70 in debt, 20 in equity and 10 in gold or other commodities.